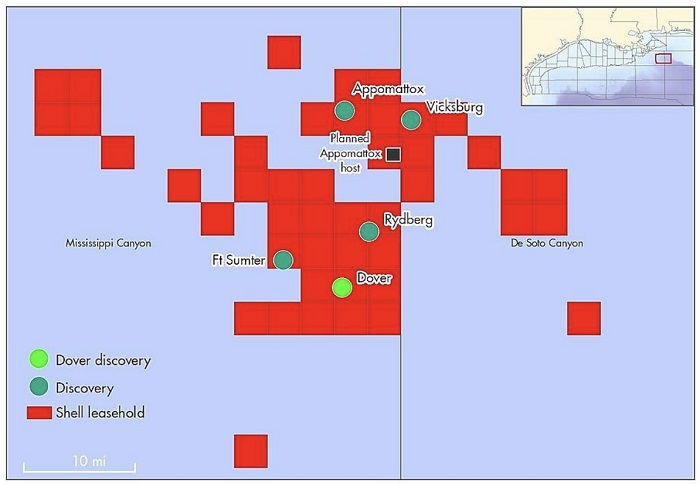

Dover’s subsea development concept calls for two production wells to be produced through a 17.5-mile flowline and riser to the Appomattox production hub. (Source: Shell)

Shell has sanctioned its 2018 deepwater Dover discovery in the U.S. Gulf of Mexico as a subsea tieback to its operated Appomattox production hub.

The supermajor announced on March 15 it had taken a final investment decision (FID) on the project, which is expected to go onstream in late 2024 or early 2025 and produce up to 21,000 boe/d at peak rates.

In 2018, Shell announced the Dover find was the company’s sixth discovery in the Norphlet geologic play. At the time, the operator said Dover was “an attractive potential tieback” to the Appomattox host about 13 miles away. The discovery well in Mississippi Canyon Block 612 was in 7,500 ft water depth and encountered more than 800 net ft of pay.

The subsea development concept calls for two production wells to be produced through a 17.5-mile flowline and riser to the Appomattox production hub.

Last year, Shell took FID on Rydberg, which is another subsea tieback to Appomattox.

"Shell is a pioneer in the Norphlet reservoir with Appomattox, and we are building on our leading position in the reservoir with Dover," Paul Goodfellow, Shell's executive vice president for deepwater, said in a press release.

Shell holds 100% interest in the Dover discovery and 79% interest in the Appomattox production hub.

Recommended Reading

Utah’s Ute Tribe Demands FTC Allow XCL-Altamont Deal

2024-04-24 - More than 90% of the Utah Ute tribe’s income is from energy development on its 4.5-million-acre reservation and the tribe says XCL Resources’ bid to buy Altamont Energy shouldn’t be blocked.

Mexico Presidential Hopeful Sheinbaum Emphasizes Energy Sovereignty

2024-04-24 - Claudia Sheinbaum, vying to becoming Mexico’s next president this summer, says she isn’t in favor of an absolute privatization of the energy sector but she isn’t against private investments either.

Venture Global Gets FERC Nod to Process Gas for LNG

2024-04-23 - Venture Global’s massive export terminal will change natural gas flows across the Gulf of Mexico but its Plaquemines LNG export terminal may still be years away from delivering LNG to long-term customers.

US EPA Expected to Drop Hydrogen from Power Plant Rule, Sources Say

2024-04-22 - The move reflects skepticism within the U.S. government that the technology will develop quickly enough to become a significant tool to decarbonize the electricity industry.