Editor's note: This article first appeared in Hart Energy's Shale 2022 report. For more information and insights, view the Shale 2022 report here.

In the aftermath of the industry upheavals in 2020 and 2021, some experts have proclaimed the death of shale. Many of those prognostications came before oil broke the $80/bbl ceiling not seen since 2014. But doubters persist.

In fact, many of the major service companies have left the U.S. market, concentrating instead on more stable and less competitive international markets. Depending on the company, these markets include South America, the Middle East and Russia, among others.

Companies active in shale plays realize that its future is in the balance, relying on greater efficiencies in drilling and completions as well as improving production. The heady days of the early shale boom, when oil grazed $100/bbl and capex budgets knew no limits, died quickly in the downturns of 2015 and 2020. Service companies and the manufacturers that provide much of their equipment are now combining Big Data with human ingenuity to make shale viable at any price level.

Efficiencies in simul-fracs

One of those equipment suppliers is SPM Oil & Gas. They specialize in well service and stimulation pumps, flow control products, replacement expendable parts and supporting engineered repair services. Bryan Wagner, the company’s director of engineering for pressure pumping, confirmed that boosting efficiency is what’s driving the market—and their R&D.

“The oil and gas industry is continuing to get squeezed for margin, not only in the major E&P companies, but also down to the oilfield service providers and, ultimately, down to us in the equipment provider perspectives,” he said.

Perhaps the most basic shift is toward replacing diesel on site with produced natural gas. This has opened up new opportunities for equipment providers to go bigger, running equipment with gas turbines. Using electricity, either from site generation or through the grid, is also opening new options.

Power demands from simul-fracs—pumping frac fluid into two wells at a time—have energized equipment updates as well. Standard fracs requiring 40,000 hp need 20 pumps on location. Wagner noted that a simul-frac doubling that amount of power and putting 40 pumps on site would create major space challenges.

“But you’re doing that to drive toward efficiency,” Wagner said. “You’re hoping that, with efficiency, you can do more work in a year and, ultimately, your cost will come down.”

Onsite electricity has “broken the ceiling” of diesel engines because “those engines can only be so large and still be driven over the road,” he added.

Engines hit this ceiling at about 3,000 hp.

In comparison, a gas turbine with a capacity of 5,000 hp “is smaller than a refrigerator,” Wagner said. Turbines are less flexible, speed-wise, than reciprocating engines, which somewhat limits their use in directdrive applications. However, converting that power into electricity offers more diverse power options. This reduces the equipment footprint on site, and it opens options for larger pumps.

Previously, pumps were limited to the same 3,000 hp as their prime movers. With new power options, SPM has introduced 5,000 hp continuous duty pumps.

“With the combination of the increase in capability and in duty cycle, customers may be able to reduce the number of pumps on location by about 60%,” according to the company.

Originally, simul-fracs also required doubling much of the peripheral equipment such as manifolds and trailers—and people to operate all that. So providers like SPM are working on how to develop a truly optimized system. The design of prime movers, electric motors, turbines, gear reduction, trailers, pumps and down to flow iron must work together to maximize efficiency while reducing the site footprint. Half of the SPM’s 5000- hp e-frac pumps in operation are e-frac and half are turbine direct drive, all operating at capacity.

Early simul-fracs also pumped the two wells at about 50% of flow instead of the standard 120 bbl/min, but with the development of more powerful equipment, flows may soon increase.

E-fracs currently make up about 10% of frac activity, Wagner said, quoting figures from Rystad Energy Research.

With the intense drive toward greater efficiency, interest in simul-frac operations is likely to grow. Some may actually be turbine-driven, but they will fall under the idea of alternative fracs.

As operators continue to enhance their operations, simplifying natural gas delivery to the frac site through conditioning and LNG conversion or pursuing grid power options will be top of mind. Deciding who owns the power will become another issue, whether it’s the third-party equipment provider, the service provider or the E&P company.

Taking advantage in a downcycle

While the 2020 pandemic and oil price crash were painful for the entire industry, many companies like NOV used this time to concentrate on innovation.

“We spent a lot of the downturn really focusing on technology and improving our product portfolios,” said Ryan Supak, NOV’s global sales director for pressure pumping and cementing equipment. “We’ve been looking at new, innovative products that would help various niches in the market. It’s the continual high-grading of products that create the most value for customers. That is the driving force behind much of the innovation in today’s oil patch.”

“The Holy Grail,” he added, “is to optimize everything.”

NOV’s innovation in the shale frac arena during this time focused on optimizing fluid handling and extending wear life.

A revamped frac pump valve called Orange Crush is one of those technologies. It is designed for longer life at competitive prices, with the goal of reducing downtime and repair costs due to its optimized valve geometry.

Another challenge is the number of frac iron connections on site to transfer high-pressure fluid from frac pumps to wellheads. While iron and flowline are thought to be only a small part of the overall wellsite equipment, Supak said, there is more to it, including safety, rig-up time and environmental implications.

“When you look at the safety record, it’s one of the major items that has caused leaks and other issues,” he said. “Rigging up takes a lot of time and energy. How many people have been injured over the years in that process? And what can we do to prevent these injuries in the future?”

NOV has developed its FlexConnect, a continuous high-pressure hose that connects to the frac unit on one side and the manifold on the other to mitigate these safety issues and connection speed on site.

“Having a hose that reduces the total number of connections from frac unit to manifold and manifold to manifold via big-bore hoses reduces the opportunities for leaks and greatly speeds the connection process,” Supak said. “The added benefit is in driving efficiency on the well site, including a reduction in the repair and maintenance costs required to inspect and maintain the hoses versus hard iron.”

The FracMaxx articulated flowline is another technology NOV deployed during this time. Supak described it as “an articulated arm that can quickly disconnect, then connect to other nearby wells without using a zipper frac manifold.” The FracMaxx system connects between wellheads without the additional valve maintenance required of zipper manifolds.

It also eliminates the need to spend several days ahead of the frac job rigging up all the iron. The challenge is that the system is limited to use on one well at a time, so it will not be useful in simul-fracs. But Supak pointed out that there are still plenty of traditional single-well fracs in the system, so it should be useful for the foreseeable future. That is the driving force behind much innovation in today’s oil patch.

e-frac trends

As frac jobs grow in size and complexity, they require more energy density than reciprocating diesel engines can supply without adding more units than are practical on a well site. This dilemma has given rise to e-fracs, using electric motors to increase the power density on site.

Into this market, NOV offers the Ideal e-frac fleet. Supak said the Ideal e-frac system includes 5,000-hp pumps and a reimagined process plant with optimized fluid and power distribution. Compared to traditional diesel engines limited to 2,500 hp to 3,000 hp due to size and weight, the Ideal e-frac system reduces the number of frac units on location while increasing equipment reliability.

“This is especially true for simul-fracs, where they have to run up to double the pumps depending on what they’re trying to achieve,” Supak said. “Simulfracs started by just trying to add a few pumps and run half-rate on each well. Now they’re creeping higher and higher to get the full rate on two wells at the same time. That’s a true doubling of equipment and resources on location—double the amount of fluid, double the amount of sand, chemicals, all that has to be incorporated into that fleet as they drive the total rates being pumped downhole at any given time.”

For the future, NOV looks to the Ideal e-frac platform to drive additional technologies as higher horsepower allows for continued equipment efficiencies and longer service life. "e-fracs have more upside to drive increased efficiencies through fewer rotating components and additional data from the equipment and controls," he said.

Simul-frac trends

In the U.S., simul-fracs are a small but growing segment of the completions market as E&Ps look to save money and speed up return on investment of new wells, said Kevin Schey, Liberty Oilfield Services’ area sales manager, Permian Basin. Simul-fracs may account for about 10% of Permian completions over the last few months.

At current horsepower levels, simul-frac just means fracturing two wells at the same time, Schey pointed out. It does not necessarily equate to a doubling of the speed of completions. Usually, in fact, the two wells are pumped at 60 to 90 bbl/min each, less than the number for a single frac.

He recalled that Liberty initiated its first simul-frac in the Denver-Julesburg Basin in 2019, at about 40 to 50 bbl/min per side.

“The Permian usually does between 120 and 180 (total of the two wells in a simul-frac), and there are some folks trying to go to 200 as the envelope is always being pushed,” he said. “In those scenarios, you’re not talking about your typical frac fleet. You’re bringing in additional horsepower to meet these higher demands.”

Schey said while a simul-frac doesn’t double the speed of completions, at least not yet, it does speed the process with about a 25% increase in equipment but not a corresponding increase in cost.

“The big push right now is the cost savings metric,” he said. “You get a little bit of savings on the frac, and you also get these wells producing sooner, which produces money and pays back the wells sooner.”

This increase in power demand has returned almost all the frac equipment to full use, a situation not seen since pre-COVID-19 days. The downside is the delivery of new equipment is delayed by supply chain issues common to most industries, where lack of a single small part can delay an entire shipment.

Meanwhile, the technology of e-fracs continues to evolve, Schey said. It started with mostly gas-turbine-driven horsepower, with 20-MW to 30-MW turbines powering a frac fleet. There were also smaller, trailer-mounted direct-drive turbines powering a single pump.

But because reciprocating gas-powered engines appear to have lower emissions, companies are beginning to make that change. Schey attributes this interest to ESG-driven net-zero CO₂ goals.

“From the operator’s perspective, if they run a frac operation off a grid, that’s technically net zero, even though there are still emissions further up the power cycle,” he said.

Some have said that a frac job’s power use during the day is equivalent to a city of 30,000, then it drops to 1 MW to 2 MW at night. That much volatility sends ripples all through the grid—volatility it may not be able to handle.

Liberty plans to build two new frac fleets in 2022, assuming resolution of supply chain issues.

International market

All of Baker Hughes’s frac operations are in the international market and offshore Gulf of Mexico. Tom Royce, the company’s director of treatment applications technology for pressure pumping, and Javier Franquet, reservoir techno-commercial manager for pressure pumping services, explained the difference.

Because the international market is dominated by national oil companies, those companies’ strategies are more country-centric, longer term and generally less affected by wide swings in price fluctuations than are those in the U.S.

“International contracts tend to be multiyear and longer term, whereas in the Permian, for example, work is more on a shorter term or call-out basis, and is often focused more on chasing pricing as opposed to including more substantive technologies” Royce said. “That long-term view lets companies like Baker Hughes tie together enhanced products and services that seamlessly take a well from predrilling planning to production and even final remediation. The advantage here is that products, services and technologies are better coordinated, communications enhanced and data information integrated for maximum outcome.”

This strategic planning approach, more tortoise than hare, also means fewer multi-fracs happen overseas. Few international fields are in full factory mode development, so the single well, multistage strategies prevail. Additionally, some of the lower multi-frac and simul-frac count is because “much of the arena also doesn’t have the service infrastructure and logistics that are available in the U.S.,” Royce said.

Proppant, chemicals, water and equipment are often imported and must travel greater distances to arrive at the well, slowing every process. This has become especially true as worldwide shipping and logistics struggle to recover from the recent downturns.

The upside is that drilling fewer wells leaves more time to fully evaluate and integrate technologies for each one. “When you’re only doing 30 unconventional wells per year, you want to make sure that every well is done correctly,” Royce said.

Drilling 30 wells per week in the U.S. “is all about cost,” he added. “However, each strategy optimizes for what brings value for the customer’s business model and for differing customer objectives.”

Not all unconventional wells are the same, and as the rest of the world tries to implement U.S. processes and procedures, they’ve found that those procedures don’t always translate well.

“We see challenges of higher salinity waters, differing tectonics, minerology, stresses and breakdown pressures for unconventional,” Royce said. “We’re treating deeper wells, longer laterals and at higher temperatures, [and] 15,000-psi frac operations are almost becoming standard in operations around the world.”

Big Data applications

In addition to frac technologies, Baker Hughes is a leader in data analysis.

Today the oil industry has access to massive amounts of detailed information about formations, production methods, histories and more. With leaps ahead in artificial intelligence (AI) and other data mining and analysis systems, those data can inform every aspect of planning and execution.

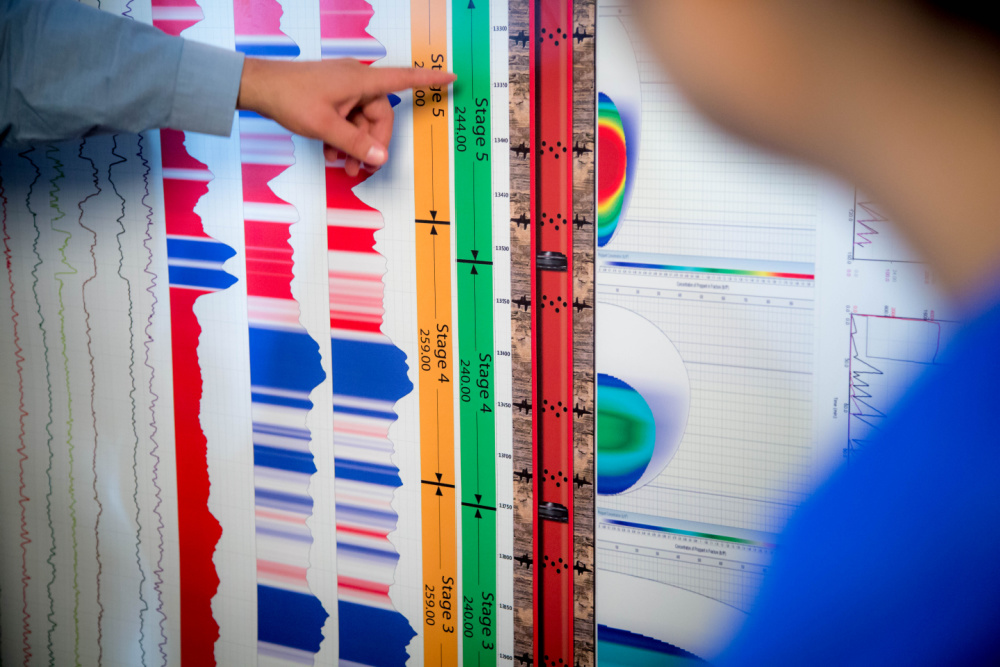

“There is no one single recipe that is good for every shale play,” Franquet said. “It’s almost unique with each shale play when you run AI to find the best cluster separation, number of clusters per stage [and] number of stages.”

He added that AI is more advanced in the U.S. than elsewhere due to the large number of wells and the availability of production data.

Baker Hughes, due to its size, extensive product line and numerous databases, accesses Big Data almost by default, Royce said. “The trick is, with any Big Data, how do you handle that much data?” Royce asked.

Within the company, the emphasis is on coordinating those data so a well’s frac design can seamlessly incorporate reservoir and drilling information to anticipate issues and challenges as well as to optimize engineered fracturing treatment designs.

“Baker Hughes’ Digital Services have key alliances with C3.ai and Microsoft for tackling AI applications in the oil and gas sector,” Franquet said.

Some data are forward-looking and used to analyze formations to find the best well locations and depths. Other data look back to analyze failures of various types and to understand how to minimize the chances of a repeat.

As an energy technology company, Baker Hughes is making a major transition toward smaller carbon footprints and greener solutions. The company was one of the first in the oil and gas industry to make a net-zero carbon commitment, Royce said. Baker Hughes is constantly looking for ways to advance procedures and technology and to partner with customers to keep them at the top of the game into the next century. That includes expanding into other energy options while simultaneously innovating sound technologies for oil and gas. Royce listed hydrogen, geothermal and carbon sequestration as areas of interest for the company.

“Our strategy is simple,” he said, “along with our customers, continue transforming our core business, invest for growth and position for new frontiers.”

South American shale

Weatherford’s focus on the international scene is in tight gas in Russia and South America. In the Southern Hemisphere, their top plays are Argentina’s Vaca Muerta, the Neuquen Basin and conventional Colombia and tight gas Chilean markets.

The company departed the U.S. frac market in 2016 to focus on those international opportunities. At that time an oil price drop coincided with rising operating expenses. The move to finer, locally produced sand (100 mesh as opposed to the previously preferred 40-70) greatly increased maintenance costs, which combined with other factors to shrink profitability, said Francisco Fragachan, Houston-based engineering director for pressure pumping with Weatherford.

With what the company learned about frac efficiency and technology in the U.S., it is working to implement it abroad. That includes “technologies like friction reducers, efficiencies and stages per day into a tight gas formation where you would need greater proppant concentration, along with how to fight back against the nightmare of settling associated with friction reducers.”

In that vein, Weatherford has worked to develop a fluid system geared toward maintaining good friction reduction while simultaneously keeping the proppant suspended at up to 8 to 10 ppa, without settling, all across the frac zone. The company’s Amplifrac product addresses those issues.

Fragachan added that slicker fluids allow higher injection rates, leading to the completion of more stages per day. It also helps in simul-fracs in the U.S., where pumping two wells at once had previously meant each well’s flow was reduced by half. Higher injection rates could reduce the onsite footprint required for pump horsepower. That brings benefits in logistics and cost savings while reducing the carbon footprint.

In Argentina, last-mile logistics are a major challenge, said Victor Exler, the company’s stimulation technical manager. “Movement of proppant, movement of chemicals, trying to move everything in bulk” are some examples, he said. To Exler, shipping in bulk means getting it by rail instead of trucks.

Shortening the travel distance of those supplies is also on the table.

“One of the biggest changes was to develop local mining for proppants,” he said.

With local mines growing in number, providing 40-70 mesh, this has significantly improved cost efficiencies in that area. Previously, proppant was shipped from worldwide locations such as the U.S. and China.

In Weatherford’s Russian operations, wells are deeper with more stages—a situation that also benefits from reduced friction. Controlling friction for stages at the heel is different from managing it for stages at the toe, and both present challenges because of the different transit times.

Reducing water consumption in fracs is a focus. “Ramping,” or increasing proppant density from the old standard of 1 to 2 ppa or to 8 to 10 ppa, dramatically reduces the water needed for even large frac jobs, Fragachan said. Because of its greater density, ramping also requires less proppant.

Generally, international companies take a longer-term view of fields than E&Ps in the U.S. Costs are still a concern overseas, but Fragachan said they are less willing to cut corners in drilling and completion because that could reduce a well’s productive life. They expect wells to produce for 10 to 15 years.

One way to extend a well’s life is to refrac, which is a major focus for Weatherford.

“How do we go back and selectively frac a zone that was bypassed earlier?” Fragachan asked. “You have 15 stages and you want to refrac stage four, seven or nine without affecting overall production.”

New technologies allow a refrac to straddle zones to achieve this.

Russia is the hotbed of refracs, he noted. Producers there often realize they’ve missed key producing zones the first time around and ask Weatherford how to effectively and safely reenter to capture that production.

Fragachan and Exler see a future where the learnings from today’s frac jobs transfer to the development of geothermal wells.

“It’s going to be that frac industry’s know-how that will optimize and enhance the production of energy from geothermal wells by massively fracking those wells conveying the flow of water to bring the heat to the surface that will be enhanced by fracturing knowhow, with some adaptation,” Fragachan said.

Everyone—from operators to service companies to equipment manufacturers—understands that the future of shale fracturing is in being dollar-efficient on the front end while performing completions (or recompletions) that extend the well’s life on the back end. Perhaps never in history has innovation reached such a frantic pace. Perhaps it’s never been as necessary.

Recommended Reading

US Drillers Add Oil, Gas Rigs for First Time in Five Weeks

2024-04-19 - The oil and gas rig count, an early indicator of future output, rose by two to 619 in the week to April 19.

Strike Energy Updates 3D Seismic Acquisition in Perth Basin

2024-04-19 - Strike Energy completed its 3D seismic acquisition of Ocean Hill on schedule and under budget, the company said.

Santos’ Pikka Phase 1 in Alaska to Deliver First Oil by 2026

2024-04-18 - Australia's Santos expects first oil to flow from the 80,000 bbl/d Pikka Phase 1 project in Alaska by 2026, diversifying Santos' portfolio and reducing geographic concentration risk.

Iraq to Seek Bids for Oil, Gas Contracts April 27

2024-04-18 - Iraq will auction 30 new oil and gas projects in two licensing rounds distributed across the country.

Vår Energi Hits Oil with Ringhorne North

2024-04-17 - Vår Energi’s North Sea discovery de-risks drilling prospects in the area and could be tied back to Balder area infrastructure.