Exxon Mobil has been reported to sell its assets in the Bakken shale of North Dakota. (Source: Jason Kolenda/Shutterstock.com)

Presented by:

This article appears in the E&P newsletter. Subscribe to the E&P newsletter here.

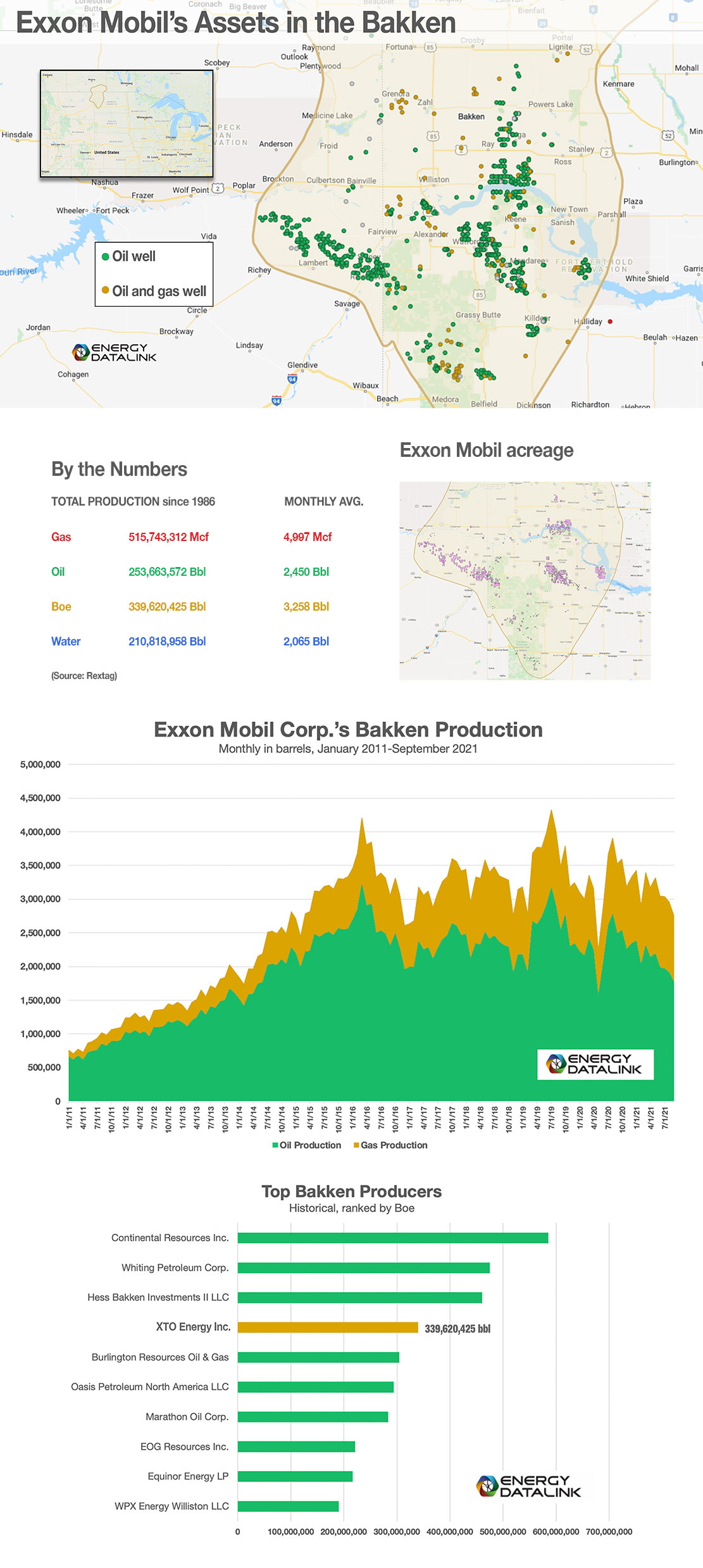

Exxon Mobil Corp. has been reported to be in the process of interviewing bankers to work on the sale of its assets in the Bakken shale play in North Dakota. Bloomberg News reported that insiders believe the sale price could be around $5 billion.

The oil giant has been in the process of cutting costs, generating about $3 billion from divestitures in 2021. In 2018, the company said it planned to generate $15 billion from the divesture of assets. Exxon Mobil launched a sale process for its assets in the Barnett Shale in November, which were expected $400 million-$500 million. In December, the company was reported to be in advanced talks to sell its 5,000 wells in the Fayetteville Shale to Presidio Petroleum LLC.

Rextag data shows that Exxon Mobil’s oil production in the Bakken fell by almost half, from 3.177 MMbbl per month in mid-2019, prior to the pandemic, to 1.763 MMbbl per month in late 2021. If Exxon Mobil does decide to pursue a deal, it would follow the $6 billion “merger of equals” between Whiting Petroleum Corp. and Oasis Petroleum Inc. on May 7.

Recommended Reading

Exclusive: Chevron Balancing Low Carbon Intensity, Global Oil, Gas Needs

2024-03-28 - Colin Parfitt, president of midstream at Chevron, discusses how the company continues to grow its traditional oil and gas business while focusing on growing its new energies production, in this Hart Energy Exclusive interview.

Imperial Expects TMX to Tighten Differentials, Raise Heavy Crude Prices

2024-02-06 - Imperial Oil expects the completion of the Trans Mountain Pipeline expansion to tighten WCS and WTI light and heavy oil differentials and boost its access to more lucrative markets in 2024.

Carlson: $17B Chesapeake, Southwestern Merger Leaves Midstream Hanging

2024-02-09 - East Daley Analytics expects the $17 billion Chesapeake and Southwestern merger to shift the risk and reward outlook for several midstream services providers.

Midstream Builds in a Bearish Market

2024-03-11 - Midstream companies are sticking to long term plans for an expanded customer base, despite low gas prices, high storage levels and an uncertain political LNG future.

Exclusive: Renewables Won't Promise Affordable Security without NatGas

2024-03-25 - Greg Ebel, president and CEO of midstream company Enbridge, says renewables needs backing from natural gas to create a "nice foundation" for affordable and sustainable industrial growth, in this Hart Energy Exclusive interview.