Petrobras' Rafael Chaves shared the company's investment planning in its Petrobras Day webcast briefing on Dec. 1. (Source: Petrobras)

Petrobras has hiked its planned 2023-2027 investments by about 15% to $78 billion over the company’s 2022-2026 projected spending.

During Petrobras Day webcast investor briefings on Dec. 1, top Petrobras executives outlined the company’s strategic plan for the five-year period 2023-2027.

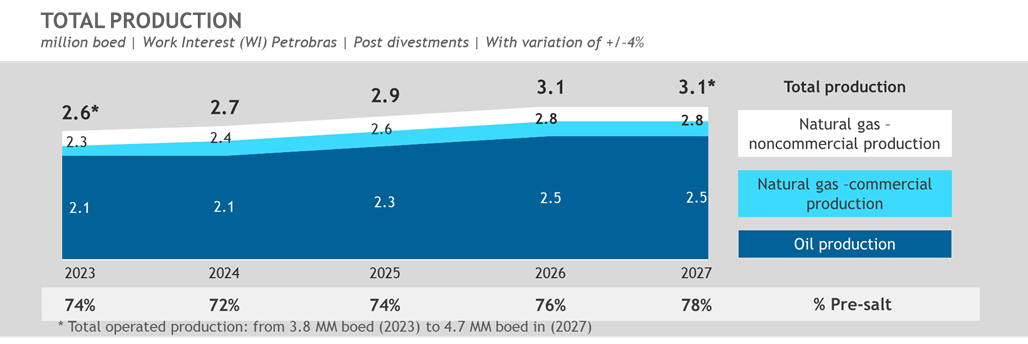

Of the $78 billion planned for capex, $64 billion - or 83% - is earmarked for E&P activities. About 67% of the E&P capex budget will go to pre-salt activities, which are expected to account for 78% of Petrobras’ total production by the end of 2027.

The remainder of the overall capex includes 12% set aside for refining, gas and power, 3% for corporate - which includes funding for digital transformation projects - and 2% for trading and logistics. Petrobras said that in addition to the US$78 billion planned for capex, the company will also invest about $20 billion in chartering new platforms.

Rodrigo Araujo Alves, chief financial and investor relations officer at Petrobras, said the operator had already committed to a certain level of capex spending for the next three years, with these investments intended to ensure projects can be delivered on time. Petrobras has already committed to 95% of the 2023 capex budget, 90% of the 2024 capex budget and 80% of the 2025 capex budget, he said.

“It’s a responsible capex plan that is self-financeable and resilient to stress scenarios,” he said.

Petrobras defines its base case scenario as oil at $55/bbl, while it considers oil at $35/bbl to be a stress case.

Fernando Borges, chief exploration and production officer at Petrobras, said the company’s breakeven price for its projects remains around $20/bbl.

Joao Henrique Rittershaussen, chief production development officer at Petrobras, said the company plans to bring on 18 new FPSOs in the next five years.

“18 FPSOs is half the total number of vessels that will be built in the world in the next five years,” he said. “We are very confident we will be very successful in this journey. It’s very challenging construction, but we are very confident with the results that we are planning for the near future for these units.”

Pre-salt exploration

Of the 18 FPSOs planned from 2023 to 2027, most are pre-salt with four being for post-salt projects; 11 will be chartered, six owned by Petrobras and one is for a project not operated by Petrobras.

The majority of Petrobras’ E&P efforts moving forward will be in pre-salt, and the company expects 70% or more of its production to come from pre-salt reserves.

Petrobras is also looking for new oil and gas frontiers and has tagged about $6 billion for that type of exploration capex. Of that, about $3 billion will be spent in the Equatorial Margin.

“Assets in the Equatorial Margin are in the exploration phase and show excellent potential as demonstrated by the projects in Suriname and Guyana,” Borges said. “However, we cannot anticipate investment or production or development phase prior to execution of our exploration program.”

The company plans to drill 16 exploratory wells in the Equatorial Margin, he said, and the first is expected this month, once the environmental permit for the deepwater Amapa prospect is received.

Joao Henrique Rittershaussen, chief production development officer at Petrobras, noted Petrobras had allocated $1.5 billion for decommissioning activities in the new 5-year plan, up from $1 billion in the 2022-2026 plan.

He attributed part of that to an increase in the number of platforms, lines and wells that needed to be decommissioned as part of the 2023-2027 plan compared to the previous plan.

“Decommissioning is part of our business. We discover the oil, produce the oil field and then in the end we need to decommission,” he said.

Recommended Reading

Comstock Continues Wildcatting, Drops Two Legacy Haynesville Rigs

2024-02-15 - The operator is dropping two of five rigs in its legacy East Texas and northwestern Louisiana play and continuing two north of Houston.

TPH: Lower 48 to Shed Rigs Through 3Q Before Gas Plays Rebound

2024-03-13 - TPH&Co. analysis shows the Permian Basin will lose rigs near term, but as activity in gassy plays ticks up later this year, the Permian may be headed towards muted activity into 2025.

Rystad: More Deepwater Wells to be Drilled in 2024

2024-02-29 - Upstream majors dive into deeper and frontier waters while exploration budgets for 2024 remain flat.

Ohio Utica’s Ascent Resources Credit Rep Rises on Production, Cash Flow

2024-04-23 - Ascent Resources received a positive outlook from Fitch Ratings as the company has grown into Ohio’s No. 1 gas and No. 2 Utica oil producer, according to state data.

Less Heisenberg Uncertainty with Appraisal Wells

2024-03-21 - Equinor proves Heisenberg in the North Sea holds 25 MMboe to 56 MMboe, and studies are underway for a potential fast-track tieback development.