Paraffin deposition is a major industrywide problem costing the petroleum industry billions of dollars per year. The extra cost is a result of many economic factors including increased chemical usage, reduced production, well shut-ins, abandonment of reserves and increased power and maintenance requirements. Paraffin is also a major contributor of underdeposit corrosion, which can lead to losses of hundreds of thousands of dollars in lost production and equipment repair or replacement costs. An array of remediation options are available, but until recently none of them offered a solution that was both cost-effective and did not cause skin damage.

Traditional paraffin removal methods

Conventional paraffin deposition control programs include chemical, thermal and mechanical methods. In many cases, excellent results can be achieved with these methods. However, these programs add significantly to the cost of oil production. The chemicals used to treat paraffin problems generally fall into two groups: inhibitors and dispersants.

The more expensive inhibitors are polymeric molecules added to the crude oil in the well at a constant, low dose above the wax appearance temperature. When dissolved in the crude, these inhibitors decrease the wax appearance temperature so that wax formation is reduced or eliminated during the production process.

In contrast, cheaper wax dispersants break up existing paraffin deposits into small fragments that can be mobilized in the produced fluids stream. Two of the most common dispersants are surfactants and solvents. Surfactants are typically used to disperse and potentially solubilize the paraffin wax into crude oil but can pose environmental and health concerns.

Solvents are used to solubilize and disperse existing wax deposits. In many cases, however, solvent treatments can damage the formation near the wellbore by making it more oil-wet. These solvents are also highly toxic.

Thermal well treatments are another common practice for removing paraffin deposits. These treatments involve adding hot oil or hot water through the well tubulars and flowlines on a regular basis. However, these types of treatments often result in long-term formation damage by forcing the heavier fractions of the paraffin back into the reservoir rock.

Attempts to develop alternative solutions

Biologically and microbial-derived products have been investigated for oilfield use for several decades as an alternative to traditional treatments. In theory, these formulations offer superior environmental performance and higher energy efficiency compared to the conventional paraffin treatment methods. However, many have exhibited reduced effectiveness in the field as a result of a one-size-fits-all approach, as well as lower comparative potency, or are cost-prohibitive (such as D-Limonene and other terpenes). One science-backed company created a cost-effective product with proven efficacy and safety as well as protection against skin damage, which could accelerate production declines.

Multidimensional dispersal treatment

A newly developed approach using a nonbacterial, microbial-derived, biochemical-based paraffin wax treatment has been successfully commercialized in the Appalachian and Permian basins. It is quickly exhibiting results that are considerably better than traditional equivalents as well as being cost-effective and consistent—driving quick adoption and high demand throughout the country’s top oil basins.

In the field these treatments are performed in the same manner as solvent treatments. The product is pumped through the backside through the annulus with no shut-in required. The new treatments have several advantages compared to existing options. There are no toxicity or HSE issues such as those resulting from the use of toxic benzene, toluene, ethylbenzene and xylene solvents. Also, being aqueous-based, the product maintains a water-wet state in the near-wellbore region—preventing formation skin damage.

Testing results

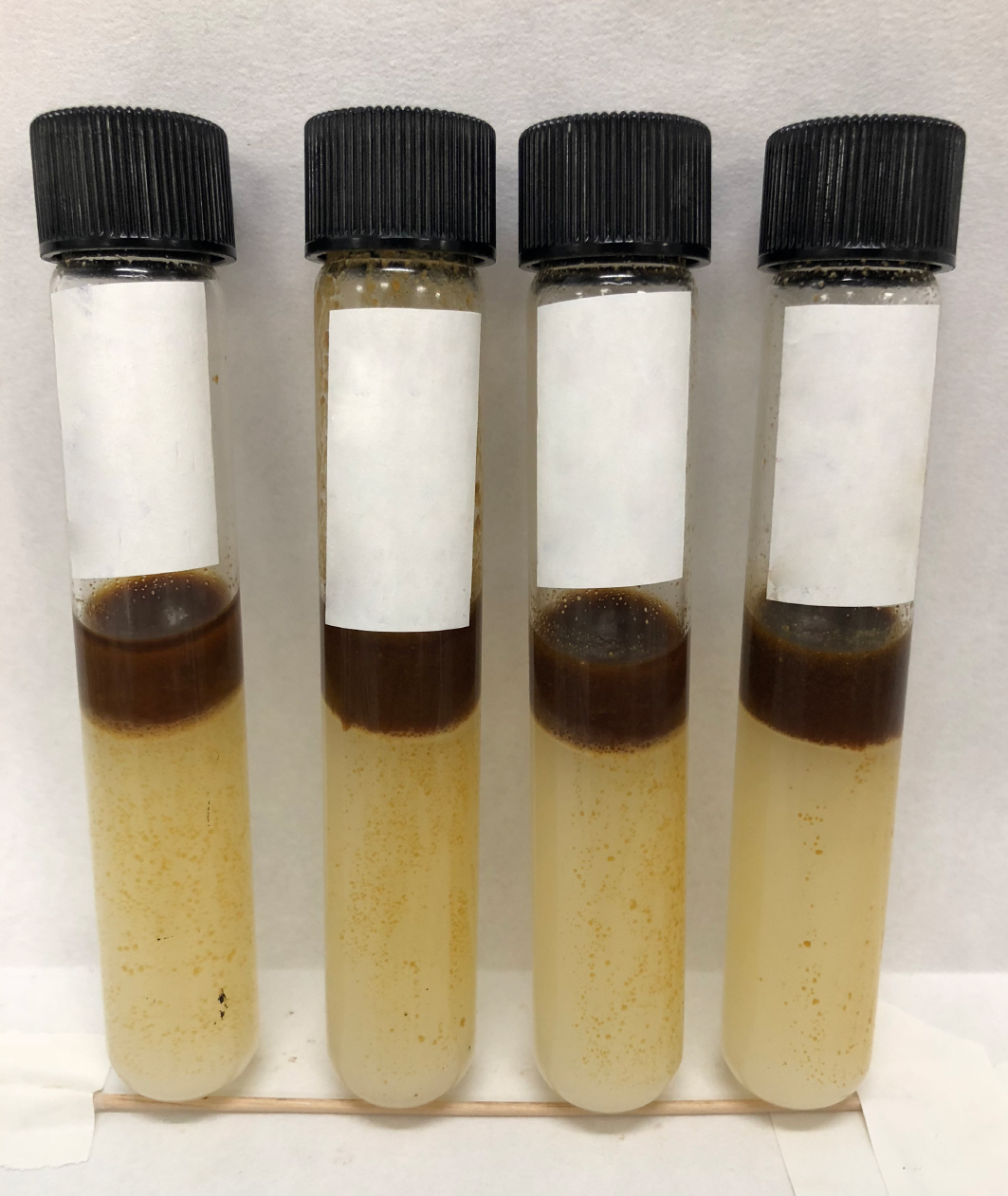

Figure 1 shows laboratory screening results indicating rapid liquefaction and dispersion of 2 g of solid paraffin samples obtained from the Permian Basin in 30 ml of the formulation. Quick separation of the paraffin into a liquid oil layer with a sharp interface was observed, with dispersing performance comparing favorably to that of toluene.

The treatments are customized specifically to each client and formation. As a first step, the carbon chain lengths of a representative sample of the well’s paraffin deposits are studied as well as the amount of inorganic matter such as solid iron sulfide scale embedded within the paraffin.

This analysis provides clues to formulation design to maximize penetration into the paraffin, while accounting for the scale. The dispersal effect is achieved as a result of a combination of mechanisms—one using enzymes and biosurfactants for increased penetration into the paraffin, and another using proprietary nongenetically modified organism cell proteins and biosolvents for rapid dispersal of the paraffin into the oil. Adjusting the ratios of the different contributing ingredients to match the hydrocarbon profile maximizes effectiveness; this is a rapid laboratory process typically completed within a day.

The treatment has been found to be effective, and treated rods and pumps exhibited almost no paraffin when pulled from a well (Figure 2). Upon visual inspection, clients uniformly agreed that pulled rods and tubing had never looked better. Clean metal surfaces are essential to prevent underdeposit corrosion.

Unlike thermal treatments, this new approach does not push paraffin farther into the formation, with well failures almost nonexistent in the treatment of hundreds of wells. Tests also have shown the product is not a nutrient source for sulfite-reducing bacteria and has an inhibitory effect on corrosive biofilms.

Natural de-emulsification

Operators using this well treatment have reported the flowlines and storage tanks also are getting de-sludged. This happens because the dispersed paraffin is emulsified into the crude and stays emulsified. Pour point temperatures of the treated paraffin are very low (less than -20 C [-86 F]), limiting the chances of reprecipitation of wax downstream of the treatment. Also, enzymatic action contributes to viscosity reduction which helps reduce energy inputs as the crude passes from the well into downstream equipment. This ensures maximum recovery of the dispersed paraffin with the sales oil—a useful bonus for operators (higher income) and refineries alike (increased utilization).

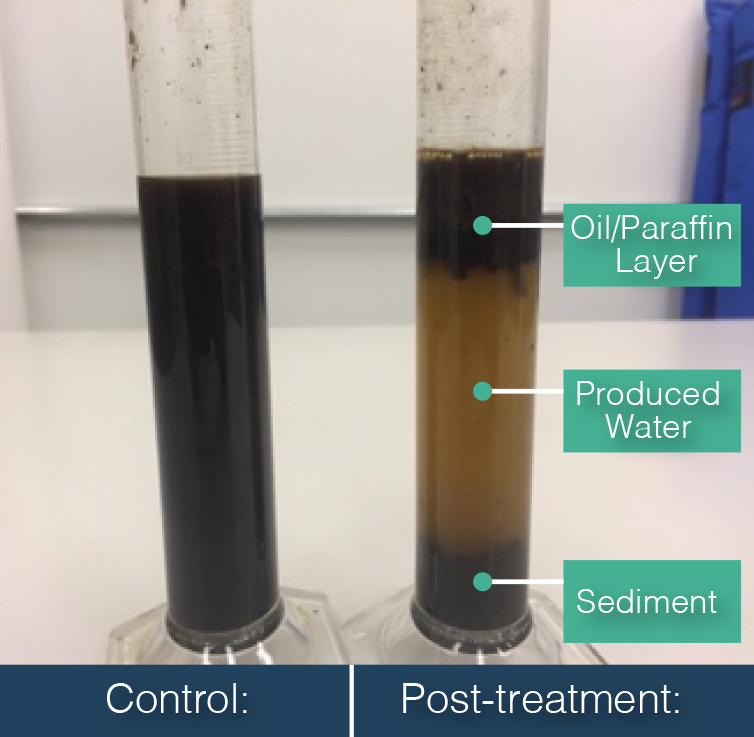

Additionally, produced water, inorganic scale and other solids separate out and stratify naturally (Figure 3). Hardened tank bottoms also release hydrocarbons and naturally soften. This helps reduce costs associated with crude dehydration and tank cleaning operations.

Production advantages

A feature of the new paraffin remediation process is its ability to provide sustained enhancement of oil production rates, an effect seen in both the Permian and Appalachian basins. A 70-well study in the Appalachian Basin yielded no well failures for more than 18 months, and 95% of the wells exhibited an enhanced recovery effect during the entire period. This resulted in an approximate 50% average increase in sustained production rate over baseline. Independent decline curve analyses of the field results forecast a substantial increase in future oil production as well, thereby significantly increasing the operating asset value. The increased recovery rates have transformed the paraffin maintenance program into a documented revenue generator for the operator.

Paraffin dispersal

Although traditional treatments have success in paraffin dispersal, demand is shifting to new, more effective and low-toxicity approaches as E&P companies witness extensive additional benefits from treatments—including increases in daily production and potential qualification for EOR tax credits. This HSE-friendly, multifunctional system mitigates paraffin wax problems and is creating a new industry standard for highly potent, customized products specifically addressing lease-level pain points.

Recommended Reading

BKV CEO Chris Kalnin says ‘Forgotten’ Barnett Ripe for Refracs

2024-04-02 - The Barnett Shale is “ripe for fracs” and offers opportunities to boost natural gas production to historic levels, BKV Corp. CEO and Founder Chris Kalnin said at the DUG GAS+ Conference and Expo.