Presented by:

Editor's note: This article appears in the special OTC edition of the E&P newsletter. Subscribe here.

A full room of delegates gathered Aug. 17 during the Offshore Technology Conference (OTC) to talk digitalization in the oil and gas industry. A hot topic these days, the digital transformation and the utilization of data wisely have perplexed many in the sector. All three speakers at the OTC session, which looked at the evolution of digitalization in the industry of the next decade, agreed that most players in the sector are still a long way away from realizing the true value proposition of digitalization.

“The pace of digitalization in the industry is relatively slow,” said Satyam Priyadarshy, chief data scientist and technology fellow with Halliburton International Inc.

“It’s not going to happen overnight,” agreed Hani Elshawi, managing director with NoviDigiTech LLC.

Most of the oil and gas industry is still engaged in the process acquiring digital means.

While the pace of adoption has been slow, interest has grown rapidly. That’s because digitalization has the potential to accomplish two tasks at the top of the minds of executives these days—transforming the core business of today while simultaneously building out the future of the industry.

Digitalization offers “the ability to do previously unimaginable and unthinkable things,” said Arno van den Haak, head of worldwide business development, energy, with Amazon Web Services.

He pointed out, like the others, that digital transformation is about generating value.

“It is generating $1.5 trillion in opportunity,” he said.

That’s why, according to van den Haak, who joined the hybrid session virtually, 905 companies are engaging in some form of digitalization. However, he said, only 16% of companies feel they are responding to digital disruption with a bold strategy of scale.

Creating a viable strategy, all three panelists said, is about finding the value in the data and turning it into actionable uses. This is where many companies, energy especially, have fallen short.

It might be because traditional business models operate on proving a concept before implementation. However, when it comes to data, proof of concept is a hard task and shouldn’t be the main driver of strategic thinking, Priyadarshy said.

“We can’t do digitalization by proof of concept; we must do proof of value,” he said. “There is a significant amount of value in our data.”

Acquiring data is only the beginning of digitalization efforts. That’s simply the automation stage, he said.

“We need to automate, optimize and innovate, and that will lead the digital transformation,” Priyadarshy said.

Data are “really the raw material of digital transformation," Elshawi added. "You have to create value by transforming raw material just like any raw material. You transform it to information, then knowledge and, ultimately, action."

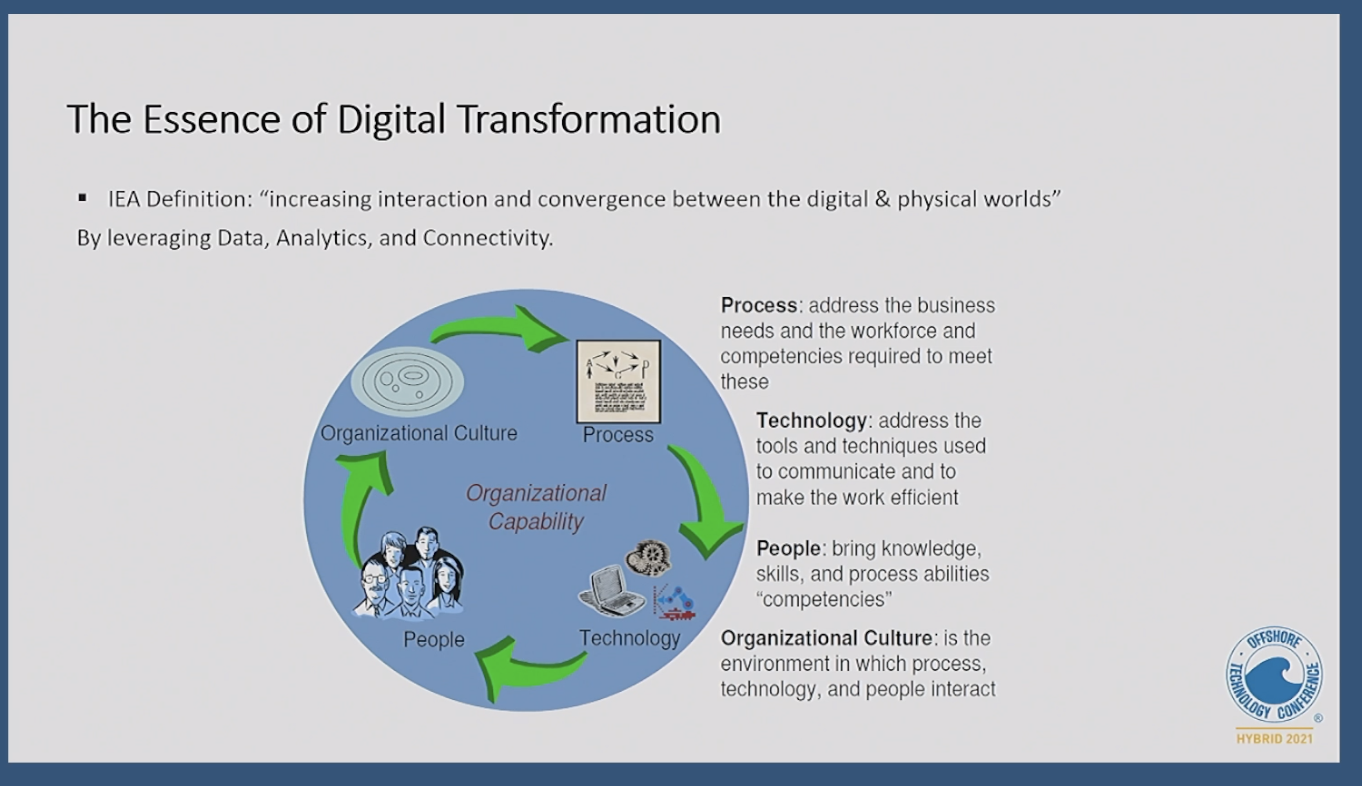

To get there, Elshawi likened the process of digital transformation to a “staircase of increase process capability.” He referred to four key elements of digitalization strategy in any company: process, technology, people and organizational culture. Defining those elements, he said:

- Process addresses the business need and the workforce competencies required to meet those needs;

- Technology addresses the tools and techniques used to communicate and to make the work efficient;

- People bring knowledge, skills and process abilities; and,

- Organizational culture is the environment in which process, technology and people interact.

While there is still a long way for the industry to go in digitalizing its future, all three speakers said they were confident that the industry is moving in the right direction regardless of the pace.

Recommended Reading

US Raises Crude Production Growth Forecast for 2024

2024-03-12 - U.S. crude oil production will rise by 260,000 bbl/d to 13.19 MMbbl/d this year, the EIA said in its Short-Term Energy Outlook.

Iraq to Seek Bids for Oil, Gas Contracts April 27

2024-04-18 - Iraq will auction 30 new oil and gas projects in two licensing rounds distributed across the country.

Tech Trends: Halliburton’s Carbon Capturing Cement Solution

2024-02-20 - Halliburton’s new CorrosaLock cement solution provides chemical resistance to CO2 and minimizes the impact of cyclic loading on the cement barrier.

To Dawson: EOG, SM Energy, More Aim to Push Midland Heat Map North

2024-02-22 - SM Energy joined Birch Operations, EOG Resources and Callon Petroleum in applying the newest D&C intel to areas north of Midland and Martin counties.

Range Resources Expecting Production Increase in 4Q Production Results

2024-02-08 - Range Resources reports settlement gains from 2020 North Louisiana asset sale.