FracScape AI combines satellite radar and optical imagery with anonymized cellphone pings to identify frac crew locations. (Source: Sourcenergy)

Presented by:

This article appears in the E&P newsletter. Subscribe to the E&P newsletter here.

As WTI approaches $100 per barrel and the U.S. oil and gas industry roars back to life, opportunities—and competition—abound. For mineral investors, oilfield services and operators alike, the key questions in these wild up-markets are always:

1) How do I find new opportunities ahead of my competition; and

2) How do I avoid wasting my limited resources chasing bad deals?

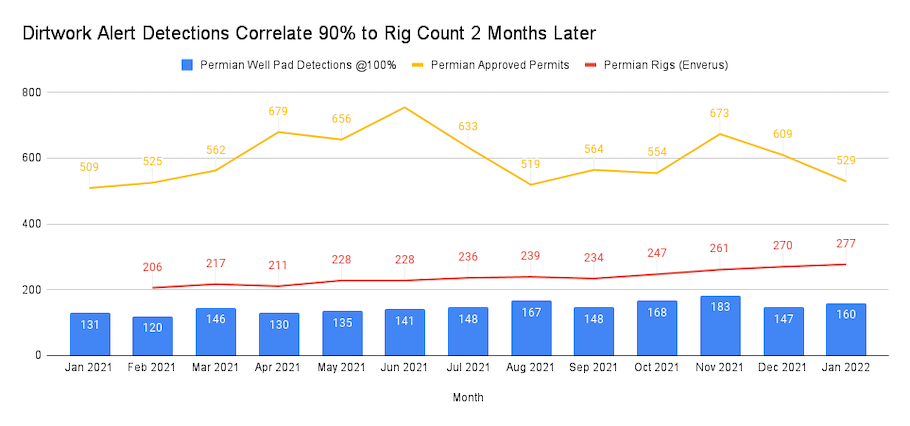

Historically, energy players have relied on drilling permits to predict drilling and rig tracking to predict production and spending. However, both permits and rigs have become a lot less useful over the past decade. Many permits are never drilled or are not drilled for a long time. A new drilling permit only costs about $250 at the Railroad Commission and lasts two years, so permits don’t show skin in the game. In 2021 Permian new drill permits only correlated 29% to the rig count on a one-month lag. Permits tell you very little about the timing of new drilling.

Rigs aren’t much better. In 2021 about nine in 10 new drilling permits were for horizontal wells. For horizontals, the rig doesn’t start production, it just leaves a DUC. It’s the frac that starts production. A long time can pass between a DUC and a frac. Studies have shown that completions spending on a well is more than double the drilling spend. So most of the reasons for tracking rigs in the old days—predicting new production and catching new spending—are obsolete.

Fortunately for those of us still in business in 2022, there are new technologies for detecting and predicting oilfield activity that get earlier, more reliable, more meaningful results. Fresh daily satellite imagery, GPS locations and regulatory data, analyzed with artificial intelligence (AI)—a process called “data fusion”—generate better upstream activity mapping than the old ways, at costs that are now affordable even to the smallest mineral and oilfield service (OFS) shops.

Two of these new data fusion technologies are particularly powerful: well pad detection and daily pinpoint frac tracking.

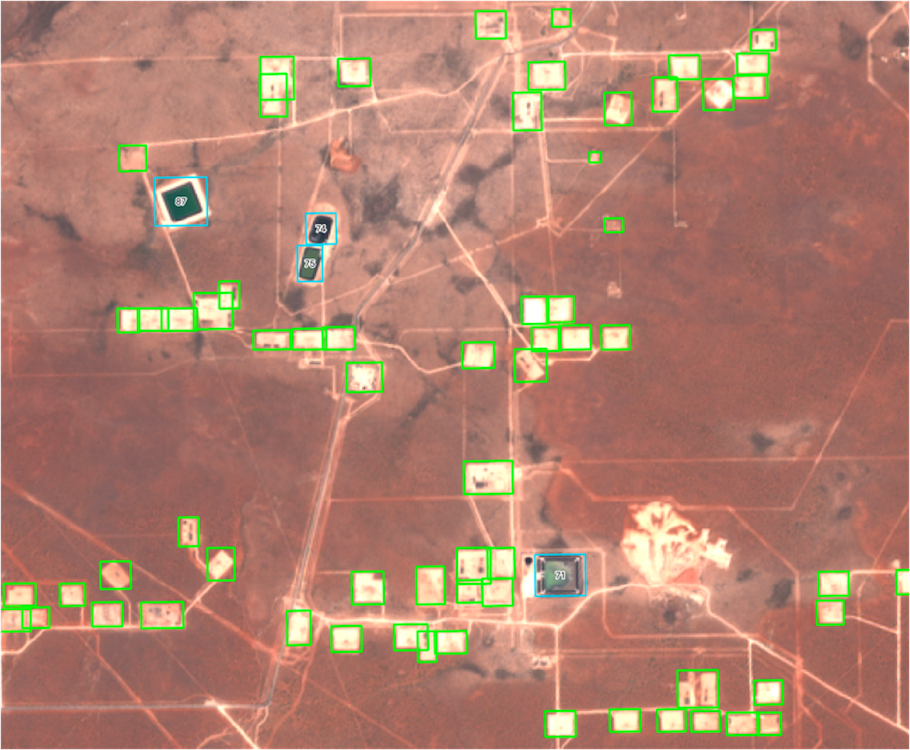

Sourcenergy offers a service called DirtWork Alert that uses AI to detect new well pad construction in near-daily satellite imagery. A well pad costs about 1,000 times more than a drilling permit, so when an operator starts building a well pad, that’s a far better indicator of their intention to drill than a permit alone. In 2021 new well pads in the Permian correlated about 90% to the rig count two months later, compared to less than a 19% correlation between permits and rigs after two months.

It seems obvious that spending $250,000 on a well pad is a much bigger commitment to drill than spending $250 on a permit, and statistics bear this out. But data fusion of satellite imagery and permits not only allows you to see which permits are moving forward for real (you need both a permit and a pad to drill a well), it also detects some drilling plans even before the very first permit submission. From second-quarter 2019 through first-quarter 2021, more than 24% of new well pads in the Texas Permian were detected before the very first drilling permit submission date. The percentage of pads detected before the first permit approval climbs even higher.

Almost all drilling permits in Texas are approved in days, so operators tend to assign dirt work crews on location and availability of contractors, not the permit approval dates. No one can risk a rig showing up without the lease roads and well pads ready. In a tight market for labor and equipment, that means planning and performing site prep early.

Well pad detection also reveals other insights. For example, pad size correlates about 80% to future permits on the pad, which tells a lot about future spending and production even before all those permits have been filed.

The other breakthrough data fusion technology in 2022 is daily pinpoint frac crew tracking. Ever since horizontal wells displaced verticals wells, it is the completion, not the drilling, that determines most spending and most new production onshore.

Yet operators and pressure pumpers keep current frac locations to themselves, and the only semi-official reporting of completions is the Frac Focus database, which can run a year or more late by design. You can’t know where the DUCs remain without knowing where the fracs have been, nor find new unconventional opportunities without seeing where the frac crews are going.

Sourcenergy offers a service called FracScape that combines multiple bands of satellite imagery with anonymized cellphone GPS locations to track every frac crew daily, with the pressure pumpers and operators for each crew identified. That helps operators avoid accidental frac hits, helps mineral owners predict new production on their acreage and helps OFS, water and sand companies win completion business more reliably.

Permits and rigs will always be part of the energy intelligence mix. But just as every energy company had to become more technologically savvy to survive the past two years, this new upcycle will require adopting new intelligence technologies to thrive.

About the author: Josh Adler is the founding CEO of Sourcenergy.

Recommended Reading

Chesapeake Enters into Long-term LNG Offtake Agreement

2024-02-13 - Chesapeake Energy entered into a long-term liquefaction offtake sale and purchase agreement with Delfin LNG and Gunvor Group for a 20-year period.

Heard from the Field: US Needs More Gas Storage

2024-03-21 - The current gas working capacity fits a 60 Bcf/d market — but today, the market exceeds 100 Bcf/d, gas executives said at CERAWeek by S&P Global.

CERAWeek: Gunvor Sees Balanced Oil Market, No Tightness in LNG Supplies

2024-03-18 - The global LNG market is not currently tight, Gunvor Chairman Torbjörn Törnqvist said at CERAWeek, contradicting the view shared earlier in the day by TotalEnergies.

Texas LNG Export Terminal Completes Required Permitting for FID

2024-01-26 - Glenfarne expects the Texas LNG project’s commercialization to be completed in the first half of 2024.

ARC Resources Adds Ex-Chevron Gas Chief to Board, Tallies Divestments

2024-02-11 - Montney Shale producer ARC Resources aims to sign up to 25% of its 1.38 Bcf/d of gas output to long-term LNG contracts for higher-priced sales overseas.