(Source: Zula Albab / Shutterstock.com)

2022 saw oil prices and activity levels recover from COVID pandemic-related drops, and 2023 looks set to continue that trend.

Enverus Intelligence Research projects Brent oil price will surge over $100/bbl again in 2023 but that gas prices will likely fall to $3.50/MMBtu. Westwood Global Energy Group puts floating production system (FPS) engineering, procurement and construction award value for 2022 at around $16.4 billion, driven by 15 units, with 2023 expected to see 16 units sanctioned.

Josephine Mills, an associate on Enverus Intelligence Research’s macroeconomics team, said the firm’s most recent Macro Forecaster, with an outlook on 2023, has oil poised to rise due to low reserves and high demand, while gas prices are expected to drop due to the expectation that supply will outstrip demand.

“There are quite a few factors that are keeping everything tight” on the oil side, she said.

Some of those factors in the tight oil supply, including EU sanctions on Russian exports due to the ongoing Russia-Ukraine war, demand volatility in China and expectations for modest US supply growth. The Russian exports didn’t vanish from the market, she noted, but rather were diverted to China, India and Turkey.

“On the back of all of this is just super low OECD crude and product inventories,” Mills said.

OECD crude stocks are about 300 MMbbl below normal, and the U.S. Strategic Petroleum Reserves is about 200 MMbbl below normal, she said.

“These main factors are what is pushing that price to $100/bbl despite any demand weakness.” – Josephine Mills, Enverus

“Those are way below normal,” she said. “These main factors are what is pushing that price to $100/bbl despite any demand weakness.”

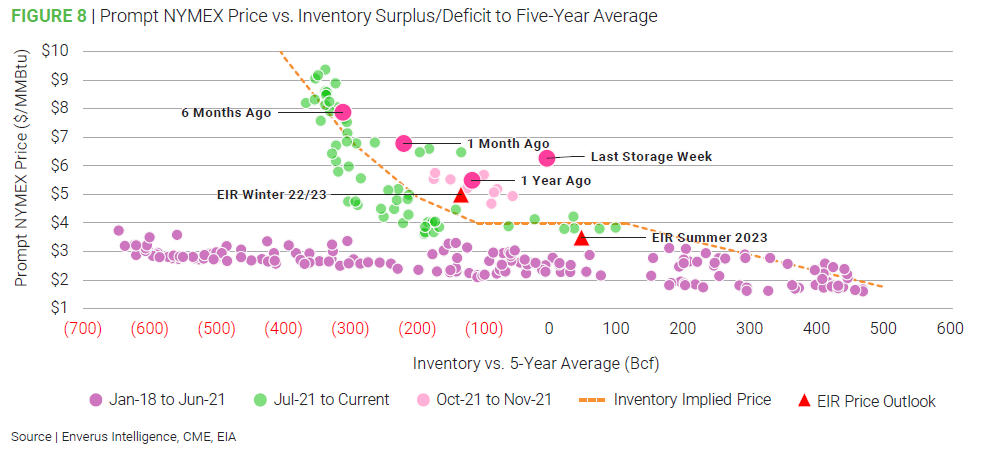

On the gas side, she said, NYMEX prices have been higher in 2022 because of lower inventories and a tighter market, she said.

“Those higher prices are just due to global supply issues. Obviously, the war is not something we had predicted,” Mills said.

As a result, Dutch TTF, which is the base price for European gas, shot up due to the war, she said. Even so, Europe was able to fill their stocks ahead of winter. If the winter is colder than normal, she noted that more gas will be drawn from inventories, but even so, the expectation is that “we’re going to see supply outpace demand.”

Those factors contribute to Enverus’ projection that the NYMEX gas price will fall from a winter price of $5 to about $3.50 by the summer.

Offshore production systems

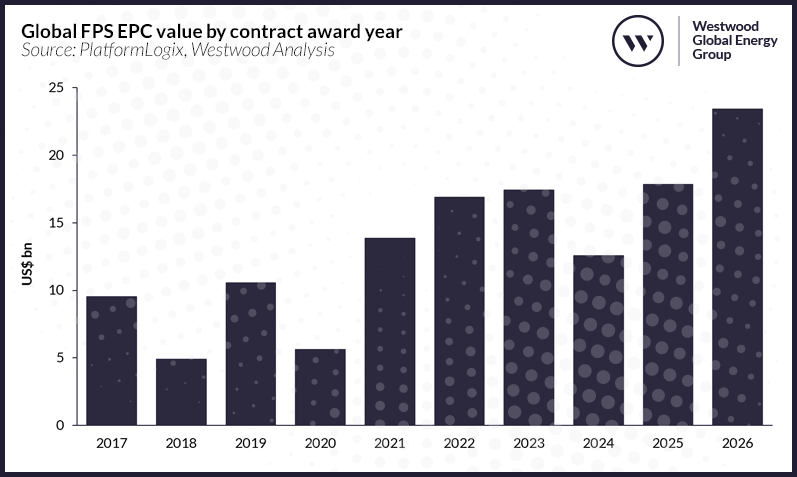

Westwood analysis of the global FPS market indicated boldness on the part of E&P companies, who are investing in floating units to produce offshore oil and gas reserves. Despite major project delays, 2022 will have the highest FPS throughput capacity sanctioned since 2010.

As of mid-December, 14 FPS units had been greenlit and a final one was expected to receive the go-ahead before year’s end, Adeosun said. On the other hand, a number of projects expected to move forward during 2022 have been delayed or canceled, he said.

At the outset of 2022, the firm had anticipated 25 projects to reach sanction. Shell’s Gato do Mato in Brazil and Linnorm in Norway have both been delayed, and TotalEnergies walked away from its plans to develop the deepwater North Platte project in the Gulf of Mexico. In August, Santos pushed back final investment decision on its Dorado project and in November, Equinor similarly delayed decision on its Wisting project.

“Overall, when you look at the proportion of EPC expenditure in 2022, and you look at the throughput capacity that was sanctioned this year, it's been positive,” he said.

Highlights include the sanction

Westwood now anticipates 2022 FPS EPC award value will be $16.4 billion. The 15 units moving forward include eight newbuilds, two conversions and five upgrades or redeployments.

Of the units awarded to date, 11 are FPSOs and three are production semi-submersibles. No spars or tension leg platforms were awarded in 2022. A final production semi is expected to reach sanction by year’s end.

Those numbers are well above 2021 and represent a 22% increase in capex over 2021 commitments.

“In 2021, only nine units were approved or sanctioned,” Adeosun said. “In terms of cost, that came down to about $13.8 billion. So that's where we are, a 22% increase.”

Of those nine units, eight were newbuilds and one was a conversion.

Westwood predicts a 3% increase in spend for 2023 over 2022, with $17.3 billion going toward a total of 16 FPS units expected to reach sanction.

Adeosun said he expects only four of those units to be newbuilds, with six expected to be conversions and the remaining six to be upgraded or redeployed.

“Overall, as expected, activities will be dominated by Brazil. We currently expect that six FPS units will be sanctioned in Brazil in 2023,” he said.

Angola is likely to sanction three floaters, with two expected in the U.K. Guyana, China, Ivory Coast, Mexico, Vietnam and Nigeria are each expected to have one floater sanctioned in 2023. No floating units are expected to achieve sanction in the U.S. Gulf of Mexico in 2023, Adeosun noted.

“What we anticipate is over the next four to five years, investments are going to be relatively stable,” Adeosun said.

2022 reached a record level of sanctioned capacity since 2010, and from 2022 through 2026, the firm projects $88 billion of offshore EPC spend.

“That significantly trumps what we’ve seen” over the last two five-year periods, he said.

Considering five-year contracting periods between 2012 and 2026, forecast FPS throughput capacity sanctioned over the 2022-2026 period represents a 36% increase compared to the preceding five-year period, and an 87% growth on the 2012-2016 period, according to Westwood.

“What we anticipate is over the next four to five years, investments are going to be relatively stable.” – Mark Adeosun, Westwood

One driver for that activity is the fact that operators in many regions are developing reservoirs further away from shore, which means floating solutions are needed if a tieback to a nearby floater is not possible.

“When you're looking at traditional basins, for example, Brazil, West Africa, or relatively new entrants into the market like Guyana or Suriname, or even old producers like Canada – all of those reservoirs are far from shore. They are and they will be requiring floating production facilities,” he said.

Looking beyond 2023, Adeosun believes the future mix of FPS orders will include some that are all-electric or include carbon capture, storage and utilization solutions (CCUS) onboard.

“Despite the fact that they're still exploiting traditional oil and gas, they're looking at doing it in a much more environmentally friendly manner and reducing emissions, either by going all electric or including CCUS capabilities on those FPSOs,” Adeosun said.

Recommended Reading

President: Financial Debt for Mexico's Pemex Totaled $106.8B End of 2023

2024-02-21 - President Andres Manuel Lopez Obrador revealed the debt data in a chart from a presentation on Pemex at a government press conference.

Some Payne, But Mostly Gain for H&P in Q4 2023

2024-01-31 - Helmerich & Payne’s revenue grew internationally and in North America but declined in the Gulf of Mexico compared to the previous quarter.

Uinta Basin: 50% More Oil for Twice the Proppant

2024-03-06 - The higher-intensity completions are costing an average of 35% fewer dollars spent per barrel of oil equivalent of output, Crescent Energy told investors and analysts on March 5.

In Shooting for the Stars, Kosmos’ Production Soars

2024-02-28 - Kosmos Energy’s fourth quarter continued the operational success seen in its third quarter earnings 2023 report.

M4E Lithium Closes Funding for Brazilian Lithium Exploration

2024-03-15 - M4E’s financing package includes an equity investment, a royalty purchase and an option for a strategic offtake agreement.