Following offshore oil and gas activities in the U.K. is like watching a rollercoaster.

Offshore U.K. activity was finally on the uptick after the latest lower-for-longer crash, only to run right into a COVID-related downturn. Combined with the fact that much of Europe is pushing for higher investments in renewables, fewer are focusing as heavily on oil and gas, but with the Russia-Ukraine war ongoing, the U.K.’s need for energy security has never been higher.

Yvonne Telford, Westwood Global Energy Group’s senior analyst for northwest Europe, said the level of activity off the U.K. coast in the aftermath of the lower-for-longer crash could be described as cautious optimism. And activity levels seemed to be increasing until COVID hit, she said. The result was a reduction in capex and personnel, she said.

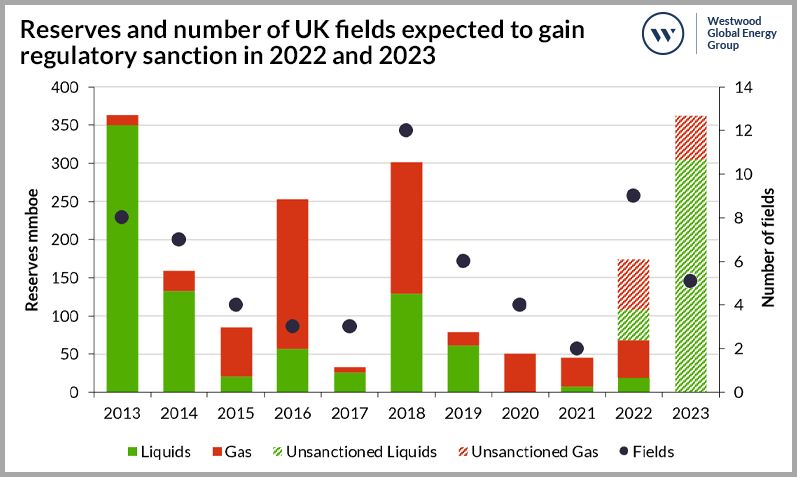

“What we've had was kind of a step down in terms of the development activity and investment activity that was going on at that time” in relation to exploration, appraisal and development wells as well as infill drilling, Telford said. “In terms of new field developments, many were put on pause” and deferred for two to three years.

And during Covid, there was a “sense of pessimism” about investment the UK sector would receive from the wider investment community as the region – and investors – focused more on renewables and a more diverse energy supply than just oil and gas, she said.

That meant at the start of 2022 some of the expected oil and gas investment was stepped down and optimism for recovery was “somewhat deflated,” Telford added.

Now, however, it seems the dynamic is finally shifting again, she said.

One of the drivers is Russia’s war with Ukraine, which has severely constrained gas flow to western Europe.

Gas prices have “exponentially increased in Europe since last year, and energy security is important in Europe,” Telford said.

These higher prices are stimulating oil and gas investment.

“New developments are being progressed with the inclusion of low-carbon power sources,” she said.

One such project is Equinor’s Rosebank, west of Shetland, where the operator plans to electrify operations rather than using fossil fuels. That project is expected to reach final investment decision next year.

“We’re seeing a progression of projects. We’re seeing more activity, but it is fair to say that the work is being carried out hand in hand with a low carbon emissions strategy from the majority of companies,” Telford said.

Rig demand

Teresa Wilkie, Westwood’s research director for RigLogix Offshore Drilling, said demand for offshore rigs for the U.K. has also been up and down.

In 2015, there were 22 semisubmersibles in the U.K. market, with 18 working. Now, there are 11 available in the region, only seven of them working.

Average prices also dropped from around $220,000/day for these U.K.-capable semis to $140,000/day, she added.

“The fleet has basically been cut in half,” Wilkie said, citing a “severe lack” of demand in the region for semi drilling rigs.

Some U.K.-capable semis are working in other places, like Mexico, China, Canada and Norway, she said.

However, in the last year, there has been an uptick in tenders for U.K.-capable semis, she said.

“A lot of that is plug and abandonment campaigns,” she said, but some are for development projects, such as the Rosebank field.

As a result, day rates are starting to increase, she said. At the same time, utilization for U.K.-capable semis is currently around 65%, but that number goes up to about 75% when future work is factored in, Wilkie said.

On the jackup side of the market, she expects the coming months to be interesting given the expected merger of Noble and Maersk. To clear regulatory requirements, Noble is selling five high-spec jackups to Shelf Drilling.

But overall, she said, trends in the U.K. jackup market pretty much mirror those of the semi market. In 2015, there were 18 active jackups working offshore the U.K., but now there are 12. Some of the rigs aged out of the market, she said, but others left for the Middle East, West Africa and Mexico.

Utilization is below 80% for U.K. jackups, she said, but taking into account future contracts, it reaches 95% due to the lower number of available rigs, she said.

“It’s stronger than it first looks,” Wilkie said.

Recommended Reading

Deep Well Services, CNX Launch JV AutoSep Technologies

2024-04-25 - AutoSep Technologies, a joint venture between Deep Well Services and CNX Resources, will provide automated conventional flowback operations to the oil and gas industry.

EQT Sees Clear Path to $5B in Potential Divestments

2024-04-24 - EQT Corp. executives said that an April deal with Equinor has been a catalyst for talks with potential buyers as the company looks to shed debt for its Equitrans Midstream acquisition.

Matador Hoards Dry Powder for Potential M&A, Adds Delaware Acreage

2024-04-24 - Delaware-focused E&P Matador Resources is growing oil production, expanding midstream capacity, keeping debt low and hunting for M&A opportunities.

TotalEnergies, Vanguard Renewables Form RNG JV in US

2024-04-24 - Total Energies and Vanguard Renewable’s equally owned joint venture initially aims to advance 10 RNG projects into construction during the next 12 months.

Ithaca Energy to Buy Eni's UK Assets in $938MM North Sea Deal

2024-04-23 - Eni, one of Italy's biggest energy companies, will transfer its U.K. business in exchange for 38.5% of Ithaca's share capital, while the existing Ithaca Energy shareholders will own the remaining 61.5% of the combined group.