In upstream oil and gas the only certainty is uncertainty; this applies to produced water (PW) as much as anything else in the oil field. Water production occurs throughout the life of a well, mostly consisting of formation water once the initially injected completions fluid flows back to the surface. Both the production and quality of the water varies significantly from region to region and from well to well. Conventional PW disposal occurs via Class II injection wells, either by saltwater disposal wells (SWDs) or enhanced recovery injectors. However, the disposal well status quo is changing as more producers look to treatment and reuse as a disposal alternative.

Evaluating produced water economics

To address economic uncertainties related to various water management strategies, the Upstream Water tool was developed by researchers David Burnett and Tyler Hussey at Texas A&M University. The tool provides an unbiased evaluation of PW economics from an operator’s perspective. The model considers an operator’s costs, including sourcing, storage, logistics, treatment and disposal costs. The economic value of water is realized either through a source water cost savings or a treated water revenue. These costs, coupled with production and demand data, are used to project various scenarios throughout the lifetime of a field. GHD, an engineering consulting firm, exclusively licensed the model. The firm is commercially implementing the model and furthering its development.

Uncertainties in PW arise from both the price of oil and the inherent microclimates that exist region to region. The current low-price environment for oil and gas has underscored the necessity of cost reduction across oilfield expenses. This is in contrast with the pre-2014 oil price peak of more than $100/bbl, when massive margins overshadowed the importance of minimizing expenses. Although oil is hovering at $50/bbl, many tight oil and gas companies are surviving due to lower breakeven costs for drilling and completions and reductions in lease operating expenses, of which water management is often a significant portion. As the price of oil is projected to remain low for the next few years, reducing expenses through proper water management is essential.

Furthermore, basins, plays and fields across geographic locations tend to vary in a multitude of ways; the realities in each of these regions—ostensibly upstream oil and gas microclimates— exacerbates economic risk and uncertainty. Water production and quality varies in each of these regions. Each state governs its surface and ground water differently, and each operator has different water needs and supporting infrastructure. Each cost associated with sourcing, trucking, disposal and treatment, and the overall water management strategy varies across organizations and is also dependent on the price of oil.

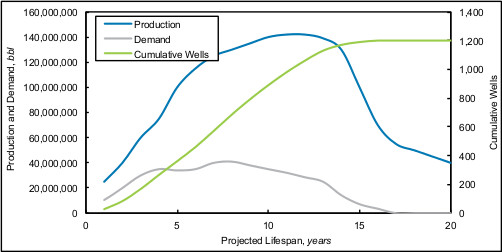

With these uncertainties, there is no one-size-fits-all solution to PW management. The most economical strategy for one field is likely different from the next. The following example case study modeled with the Upstream Water tool is presented to illustrate the advantage of properly leveraging data to optimize a water management plan. The study was based in the Permian Basin. All costs, production and demand data are estimated based on experience and represent typical conditions seen in the region. Figure 1 displays the drilling schedule, water production and water demand curves for the field. The demand, assuming completions accounts for the majority, is calculated based on the drilling schedule.

Balancing capex and opex

There is significant debate over the relative advantages of capex- vs. opex-intensive management strategies. For example, is it more cost-effective to utilize in-house SWDs or commercial SWDs? Is there a greater advantage to using pipelines to convey water in a given field or haul water via trucking? In-house SWDs and pipeline infrastructure require significant capital investment but demand low opex over the long term. Operationally, commercial SWDs and trucking require significant annual opex. The deciding economic factor as to which option is most advantageous comes down to project duration.

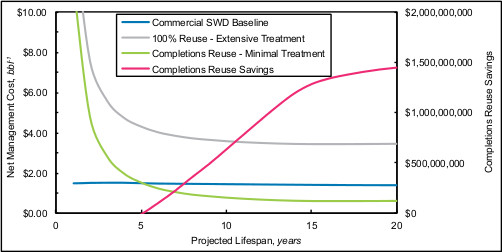

Figure 2 plots the net management cost per barrel for three scenarios: commercial SWD baseline, 100% reuse (extensive treatment for resale) and completions reuse (minimal treatment for demand, additional PW disposed). The first represents the net cost per barrel for sourcing the water at $0.50/bbl, disposing of the water at $0.40/bbl and transporting the water from the well to the SWD by trucking. Both treatment and reuse cases use in-house SWDs and pipeline conveyance. The 100% reuse case assumes desalination at $3.50/bbl for reuse in operations and resale for beneficial reuse (agriculture, irrigation, municipal process water) at $1/ bbl—the waste generated by treatment is disposed of by in-house SWDs. The completions reuse case assumes minimal treatment at $0.25/bbl, and additional water outside of the completions demand is disposed of via in-house SWDs. For this case minimal treatment for completions reuse with pipelines and in-house SWDs was the most economical scenario, and the savings plotted in Figure 2 illustrates the long-term economics of this option.

The result of this example case study is typical of that seen in the field: Minimal treatment for PW reuse in completions operations is the most economical form of treatment and reuse. With salt-tolerant completions chemicals only minimal treatment is required to reuse water in operations. In Figure 1 the demand was significantly less than PW production. Therefore, excluding the required completions demand, the majority of PW will be disposed. Most desire to be both environmental and economical, yet surface discharge or beneficial reuse requires such extensive treatment that the net cost is too high for operators to justify.

Similar to its quality, quantity and associated costs, the PW industry is constantly changing. The trends of today are much different than the trends of five years ago, and everyone is talking about PW. While the desalination required for beneficial reuse is too expensive in the current market, the future is a different story. As water continues to gain attention, an operator that leverages data to optimize its water management strategy will have a competitive edge. The day is coming where water will be a commodity rather than a waste.

Recommended Reading

Wayangankar: Golden Era for US Natural Gas Storage – Version 2.0

2024-04-19 - While the current resurgence in gas storage is reminiscent of the 2000s —an era that saw ~400 Bcf of storage capacity additions — the market drivers providing the tailwinds today are drastically different from that cycle.

Biden Administration Criticized for Limits to Arctic Oil, Gas Drilling

2024-04-19 - The Bureau of Land Management is limiting new oil and gas leasing in the Arctic and also shut down a road proposal for industrial mining purposes.

PHX Minerals’ Borrowing Base Reaffirmed

2024-04-19 - PHX Minerals said the company’s credit facility was extended through Sept. 1, 2028.

SLB’s ChampionX Acquisition Key to Production Recovery Market

2024-04-19 - During a quarterly earnings call, SLB CEO Olivier Le Peuch highlighted the production recovery market as a key part of the company’s growth strategy.

Exclusive: The Politics, Realities and Benefits of Natural Gas

2024-04-19 - Replacing just 5% of coal-fired power plants with U.S. LNG — even at average methane and greenhouse-gas emissions intensity — could reduce energy sector emissions by 30% globally, says Chris Treanor, PAGE Coalition executive director.