It’s time that the oil and gas industry caught up with other global industries and automated its financial supply chain.

The oil and gas industry continues to harness new technologies to drive E&P, including sophisticated seismic modeling, data mining and even harnessing Big Data to make E&P more efficient and increase production. So why are oil and gas producers still using paper invoices?

When it comes to the financial supply chain, paper processes and lack of a common financial ecosystem continue to slow things down. Just as technology is helping speed exploration and the development of new oil and gas projects, e-procurement systems and e-invoicing can eliminate the logjam of paper that prevents producers and suppliers from improving their cash flow and getting a better handle on their financials.

Paperless workflow processes can streamline business. Statistics show that by migrating to e-invoices, invoice approval that previously took 10 days or longer was being completed in hours. PayStream Advisors surveyed companies about their experience and expectations regarding e-invoices. According to the study, going paperless offers real advantages:

• 53.6% said e-invoices mean fewer lost or missing

invoices;

• 50.7% want paperless processes to speed approval cycles;

• 46.4% said paperless processes reduce processing costs;

• 44.9% said e-invoicing increases on-time payments; and

• 42% said paperless processes provide better visibility into the transaction life cycle.

The PayStream Advisors study also highlights other advantages to creating a paperless financial supply chain, including improved vendor satisfaction (31.9%), fewer supplier inquiries (31.9%) and reduction in billing exceptions and discrepancies (21.7%). Most importantly, using paperless financial processes lays the foundation for automated transactions with suppliers.

Implementing a paperless supplier ecosystem can benefit everyone in the value chain. E&P companies need three primary elements for a frictionless financial supply chain.

Create paperless processes

The first step in streamlining financial data flow is to eliminate paper so that data are available to drive financial transactions. Many oil and gas companies are still using paper processes to issue invoices and track payments. These same companies are using manual data entry to capture financial data in enterprise resource planning (ERP) systems. Of course, manual data entry can still be used to update internal financial tracking systems, but this dispels most of the benefits of paperless processes.

Consider the actual cost of doing manual data entry. If a company pays an analyst $60,000 per year and it takes that individual three days to process paper invoices, then that’s three days of unnecessary manual labor cost. If that analyst can manually process 400 invoices over three days, the cost is $720 to process 400 invoices, or $240/d. That averages out to an added cost of $1.80 per invoice for manual invoice processing.

In this example, eliminating the paper and the manual data entry could mean that invoices go out three days sooner, and the company can use the time it has regained more productively. If that company can start with paperless processes, so much the better, but chances are that it will still have to deal with incoming paper invoices and forms in the way of faxes and mailed invoices.

Software and optical-character recognition technology have become very sophisticated and can easily turn paper into data. Intelligent capture systems can map paper documents to structured data fields so that any invoice or bill can be scanned and recorded in the ERP system. Scanning paper documents is more efficient than manual data entry, whether it’s done in-house or is outsourced. More companies are simply bypassing paper and uploading or emailing PDF documents or other files for conversion into the ERP system.

Centralizing financial records in electronic form also makes it easier to keep track of custom contracts, discounts and payment terms. The system can be configured to prioritize invoices and payments based on criteria such as pending discounts, outstanding purchase orders (POs), contract terms and other conditions. The right software customized for the oil and gas industry also can handle three-way PO matching, royalty check stubs, run tickets, joint interest billing (JIB)

and shared billing costs.

Automate workflow

To make the most of paperless processes, companies also have to develop automated workflows that enable digital transactions. Workflow automation streamlines the financial supply chain and provides a more accurate means of tracking transactions. It also can identify unnecessary steps.

In fact, one of Oildex’s oil and gas customers reports that by adopting a paperless workflow it was able to reduce the time required to generate supplier invoices from 30 days to three days. It also was able to optimize the invoicing workflow from 60 steps to only 12 steps. The result is faster invoicing time with the ability to triple the invoicing volume without adding staff or overhead and a faster turnaround on payables to improve cash flow.

Automating financial workflows also can help resolve supplier disputes. For example, consider the complexity of the terms in a JIB or a joint operating agreement. Costs incurred by the operator such as labor, maintenance and repairs have to be billed back to the joint venture partners. With paperless processing and an automated workflow, all of those calculations are automatic, so both indirect and direct costs are included in the invoicing, including distributed revenue. The system is transparent and free from manual errors and can be readily audited.

Use online exchange

Once a company has a fully automated invoicing and tracking system for financials, it needs to be able to share electronic transactions with partners and suppliers. The best way to streamline the supply chain is to automate the end-to-end transaction process. A company can try to set up individual secure connections or Web portals for each vendor, but a smarter way is to use an online data exchange as a common transaction platform.

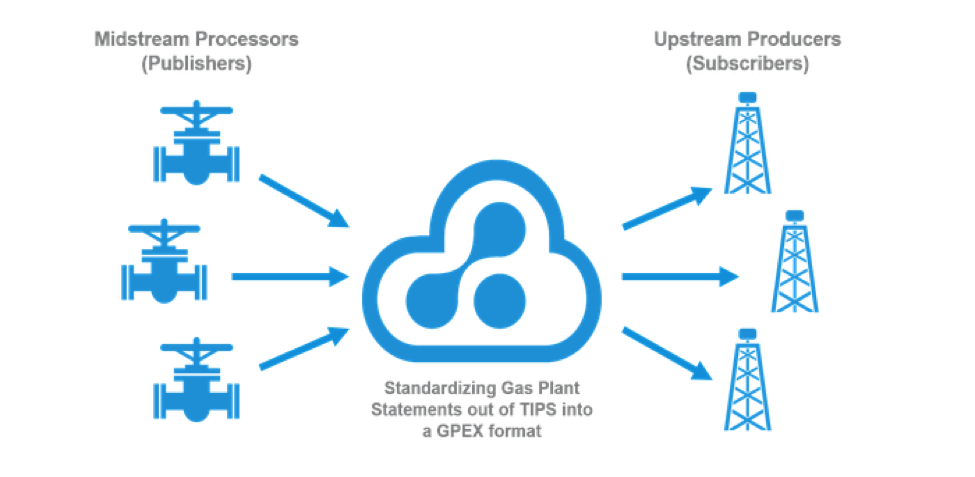

For example, Oildex and Quorum Business Solutions collaborated to launch the Gas Plant Data Exchange (GPEX) earlier this year to allow natural gas processors and producers to share gas plant statements more efficiently. The processors publish gas plant statements, and the producers subscribe to the relevant gas plant statement data. The result is faster turnaround time with greater data accuracy, fewer period adjustments and greater visibility into transaction data.

This subscription model can be extended to as many processors and producers as want to participate. Every GPEX member can exchange data with other GPEX members. There is no internal information technology setup or additional networking technology needed, and providers can leverage their own private and hybrid networks. File format is never an issue because the exchange handles file translation. Since the technology is cloudbased, it is both secure and scalable to handle as many participants and transactions as needed.

When considering the end-to-end benefits of automating the financial supply chain, it’s surprising that more oil and gas producers aren’t working to eliminate the paper logjam. Electronic workflow and market exchanges can improve the speed of transactions and can simplify revenue sharing. More importantly, an electronic workflow can provide a comprehensive portrait of operations. Reports and analytics can highlight problems anywhere in the value chain.

Technology continues to give oil and gas producers a competitive edge in new ways. Those companies that learn to harness technology for financial processes as well as E&P will have an even greater competitive advantage because of the efficiency, flexibility and extensibility it will bring to the financial supply chain.

Recommended Reading

Oil Rises After OPEC+ Extends Output Cuts

2024-03-04 - Rising geopolitical tensions due to the Israel-Hamas conflict and Houthi attacks on Red Sea shipping have supported oil prices in 2024, although concern about economic growth has weighed.

Russia Orders Companies to Cut Oil Output to Meet OPEC+ Target

2024-03-25 - Russia plans to gradually ease the export cuts and focus on only reducing output.

Oil Dips as Demand Outlook Remains Uncertain

2024-02-20 - Oil prices fell on Feb. 20 with an uncertain outlook for global demand knocking value off crude futures contracts.

What's Affecting Oil Prices This Week? (March 11, 2024)

2024-03-11 - Stratas Advisors expects oil prices to move higher in the middle of the year, but for the upcoming week, there is no impetus for prices to raise.

Global Oil Demand to Grow by 1.9 MMbbl/d in 2024, Says Wood Mac

2024-02-29 - Oil prices have found support this year from rising geopolitical tensions including attacks by the Iran-aligned Houthi group on Red Sea shipping.