Presented by:

Editor's note: This article appears in the new E&P newsletter. Subscribe to the E&P newsletter here.

Adopting carbon capture technologies won’t be easy and it definitely won’t be cheap. But doing so preserves the possibility of allowing the oil and gas industry to continue to thrive when sometimes it seems the whole world wants it to die.

Pressures from an accelerating energy transition are amped up on multiple fronts. In policy, some of the strategies aimed at combating climate change often seem indistinguishable from those designed to combat the use of fossil fuels altogether. In investing, it has become untenable for some to risk their funds on oil and gas.

But carbon capture offers a way for the industry to clean up after itself, so to speak. Vicki Hollub, president and CEO of Occidental Petroleum Corp., insists the oil and gas business case for carbon capture technologies is a strong one.

“The way it helps our shareholders is it provides a lower cost and sustainable source of CO2 for our enhanced oil recovery [EOR],” Hollub said during a webinar hosted by Columbia University’s Center on Global Energy Policy in March. “Over time, that’s very, very important, because I think one of the things that people don’t realize is that, in oil reservoirs around the world, not a lot of hydrocarbons are recovered through most of the processes that we use today. You have to use enhanced oil recovery to get a majority of the hydrocarbons out of the reservoir.”

EOR economics work like this: using CO2 provided by carbon capture, oil recovery in some wells can be boosted from a range of 25% to 30% to above 70%. The more oil recovered from existing reservoirs, the less expensive it is, which lowers the cost for consumers and helps the economy.

“And,” Hollub said, “it prevents us from needing to go into places to develop new sources of oil and gas that possibly exist in sensitive areas.”

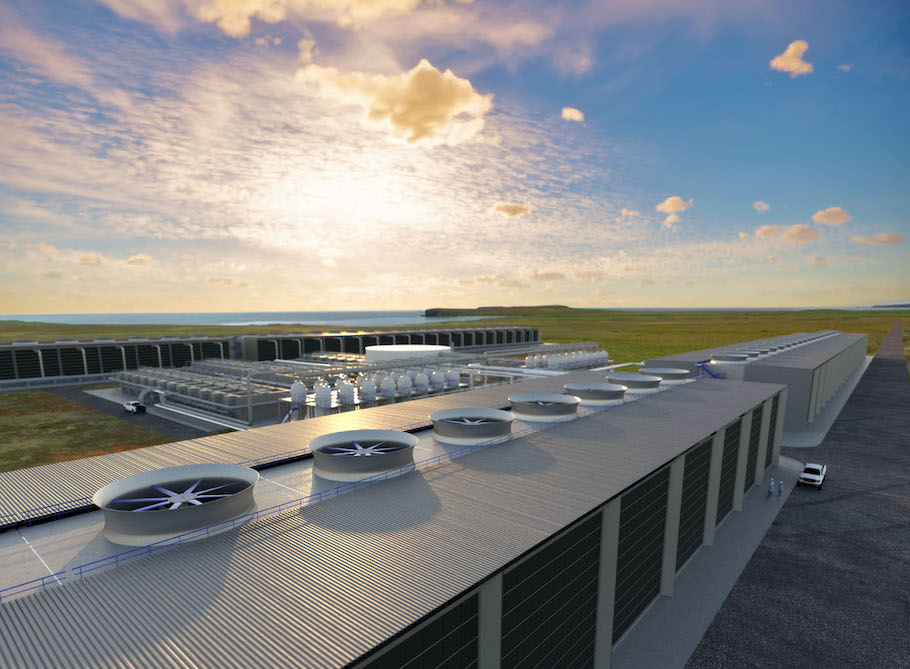

In the Midland Basin, Occidental’s Oxy Low Carbon Ventures and Rusheen Capital Management are working with Squamish, B.C.-based Canada-based Carbon Engineering to build the world’s largest direct air capture facility, capable of removing 1 million tons of CO2 from the air each year when it is fully operational. Construction will probably take about four years, Carbon Engineering CEO Steve Oldham told E&P, because of the extensive design work required to build the first large-scale plant. He expects to break ground in 2022. Construction time for subsequent facilities will probably be about 24 to 30 months, he said.

Hollub has long been a champion of carbon capture, and Occidental is an industry leader in utilizing it in EOR. But she cited another reason why it bodes well for the future of oil and gas: it helps employee retention.

“Especially our earlier career employees who may have had some concerns about getting into the oil and gas industry, staying in the oil gas industry,” she said. “As long as they can be a part of a company that’s committed to doing the things that will make a difference in our world, they’re all excited about that and ready to stay.”

How it works

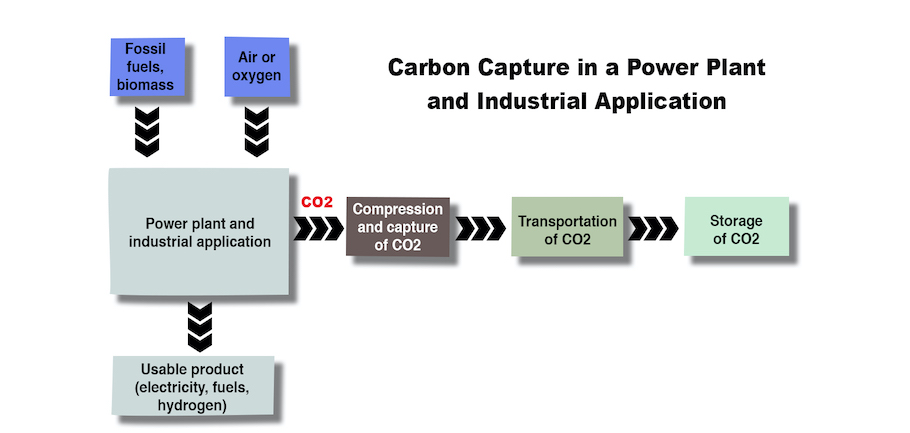

The term carbon capture is not restricted to the capture process. It’s more of a system label.

“The Carbon Capture Coalition takes a broad view of the definition of the term and applies carbon capture to the entire suite of carbon management tools—carbon capture, removal, transport, utilization and storage,” Jessie Stolark, public policy and member relations manager for the Carbon Capture Coalition, told E&P.

In this system, CO2 is captured, compressed into a dense fluid and transported by pipelines to be injected into underground storage facilities. The actual capture involves either a pre-combustion or post-combustion system, which refers to the point in which the carbon is removed.

“The first major step conducted during the elimination of carbon from fuel is to change the fuel to a form that is quite easy to capture,” wrote Tabbi Wilberforce, et al. in a 2019 research paper.

So in a power plant using the pre-combustion approach, CO2 is removed from fossil fuels before combustion is completed. As explained on the U.S. Department of Energy website, the feedstock is partially oxidized in steam and oxygen/air under high temperature and pressure to form synthesis gas, or syngas. The syngas—a mixture of hydrogen, carbon monoxide, CO2 and other components such as methane—undergoes the water-gas shift reaction to convert carbon monoxide and water (H2O) to hydrogen fuel (H2) and CO2, producing an H2 and CO2-rich gas mixture.

The CO2 content in this mixture can range from 15% to 50%. The CO2 can then be captured and separated, leaving an H2 fuel stream.

The post-combustion carbon capture approach involves absorbing the CO2 produced by the flue gas after the fossil fuels are burned. Flue gas is scrubbed in an absorber vessel, which captures about 85% to 90% of the CO2 produced, said Wilberforce’s team. The CO2 is then injected into the regenerator where highly concentrated CO2 is released after it reacts with steam. That gas is compressed and shipped to a storage location.

“For commercial and industrial power plants, post-combustion carbon dioxide capture is considered the matured type of technology compared to the others,” Wilberforce wrote. The researchers also favor post-combustion as the best choice for existing power plants that are being renovated. A study by the Electric Power Research Institute also found this method to be the most effective and cheapest.

That’s essentially how the technology works. But how is the industry supposed to pay for it? The answer begins with policy.

Americans in Paris (Agreement)

In the realm of greenhouse-gas (GHG) reduction, the touchstone is the Paris Agreement, an international treaty adopted in December 2015 that went into effect in November 2016. Its goal is to limit global warming to less than 2 C above pre-industrial levels. To achieve this, signatories have pledged to limit their GHG emissions, aiming for a climate-neutral world by 2050.

Of course, those aspirations were stated in 2015 and a new sense of urgency has been inserted into the global political equation since then. President Joe Biden has made fighting climate change a central tenet of his administration. On his first day in office, he announced that the U.S. would rejoin the agreement following its formal withdrawal in November 2020 under the Trump administration.

In April 2021, Biden’s team released updated U.S. emissions reduction targets from those set during the Obama administration, nearly doubling them to cuts of 50% to 52% by 2035. Biden also shut down the Keystone XL crude oil pipeline project on the first day of his administration, sending jitters throughout the oil and gas sector.

In a philosophical sense, it could be argued that the industry has no reason to view these policies as an existential threat.

“It is not about fossil fuels,” Mark Finley, fellow in energy and global oil at the Center for Energy Studies in Rice University’s Baker Institute for Public Policy, told Hart Energy in late 2020. “It’s about the level of CO2 in the atmosphere.”

Finley, a former CIA analyst who led production of the BP Statistical Review of World Energy for 12 years as a senior economist for bp Plc, said he opposes any role of government in picking energy technology winners.

“You shouldn’t say 'Our objective is to eliminate fossil fuels,'” he said. “The objective should be, ‘I want to reduce CO2 concentrations in the atmosphere.’ And if the technology game plays out to where carbon capture is cheaper than growing renewables, or efficiency, or switching from coal to gas then, from a policy and an economics perspective, that’s what you should want to happen.”

But what is actually happening is a significant change from previous energy policies.

“In this shift, the Biden administration has quietly retired the notion of an ‘all of the above’ strategy, a (largely rhetorical) commitment to favor all fuels,” wrote Nikos Tsafos, interim director and senior fellow in the energy security and climate change program at the Center for Strategic & International Studies, in an assessment of the first 100 days of the administration. “The administration wants to support some energy sources and shrink others—there is no other way to succeed. It has also brought back industrial policy. The term is rarely used, but the administration sees the federal government as a primary engine for change, as a way to channel the creative dynamism of private markets. The energy transition needs this.”

The administration’s American Jobs Plan, unveiled in March, would fund 10 demonstration facilities for carbon capture retrofits in the steel, cement and chemical production sectors. It would also leverage the SCALE Act (Storing CO2 And Lowering Emissions Act) to support large-scale sequestration efforts and expands Section 45Q to encourage hard-to-decarbonize industrial applications, direct air capture and retrofits of power plants.

45Q is a section of the tax code that provides tax credits to encourage companies to invest in carbon capture and storage (CCS) solutions. A requirement is that captured CO2 must be stored underground, used for EOR or utilized in other projects that permanently sequester CO2.

There are two levels of tax credits in 45Q: $35 per metric ton of CO2 used for EOR; and $50 per metric ton of CO2 put into geologic storage. Construction must begin before Jan. 1, 2026, to qualify for the credit. The credit is in place for 12 years after the equipment is placed in service.

“We do a lot of tax credit finance in the renewable sector and a lot of what 45Q is focused on is trying to bring some of the understood structures from the renewable areas, particularly in the wind space, to help accelerate understanding and comfort with investing in this new sector from a finance perspective,” said Ellen Friedman, partner at Nixon Peabody, during the Columbia webinar. “There’s so much opportunity and the policy drivers and the legislative initiatives just keep popping up every single day.”

But carbon capture can also entice private investors. Estimates of CCS by 2060 and 2070 range from 140 billion tonnes to 220 billion tons. To date, only about 260 million tonnes have been stored. That means growth potential.

“Reaching just 50% of the capture and storage goals implies a CAGR of 13% to 15% for CO2,” Roger D. Read and Lauren Hendrix with Wells Fargo Securities LLC wrote in an April research report. “Thus, CCUS [carbon capture, utilization and sequestration] appears poised to be a high growth opportunity through 2040.”

Assuming $80/tonne opex and 12% to 15% after-tax return by 2030, Wells Fargo calculates an industry value of $110 billion to $160 billion with annual revenue of $80 billion to $120 billion.

“Assuming more aggressive multiples in line with other renewable/decarbonization ventures, the CCUS market could exceed $500 billion by 2030,” the analysts wrote. “Whichever valuation approach is best, the future market size dwarfs our current estimate of CCUS market value of $10 billion to $15 billion.”

To be sure, Wells Fargo identifies risks as well. Capex and opex cutting into investor returns could dampen enthusiasm. Policy support needs to be consistent so operators can count on tax credits and zero-carbon mandates remaining in place. Permanent sequestration sites must be secure against leaks to allay investor concerns over liability. Finally, government support must continue for technological advancement.

Out of thick air

Reducing emissions is insufficient in terms of long-term climate goals. Even if the sweeping agenda of clean fuels and carbon capture technology were to succeed in reducing human activity-based GHG emissions to zero tomorrow, the problem would not go away. Yesterday’s CO2 would remain in the atmosphere.

Enter direct air capture, a technology designed to yank CO2 out of ambient air, process it and store it.

“Effectively, you can not just decarbonize anything on the planet today, but you can also decarbonize yesterday and the day before, and the day before that,” Carbon Engineering's Oldham said. “So as we look at the energy transition, we say, ‘How do we balance the need to decarbonize with the ongoing need for energy across the planet?’ Having the capability that allows you to decarbonize in parallel with continuing to use fossil fuels while we develop alternatives is very powerful.”

Direct air capture is not novel. Capturing CO2 from ambient air was commercialized in the 1950s as a pretreatment for cryogenic air separation. The possibility of large-scale capture as a tool to manage climate risk did not come about until the 2000s.

Carbon Engineering Founder David W. Keith calculated the costs of CO2 capture in a 2018 peer-reviewed study. Prior to that, 2011 estimates had capture costs of $550 per ton ($780/ton when considering emissions from an electricity supply outside the plant). Keith and his fellow researchers detailed a cost analysis in a range of $94-232/ton for Carbon Engineering’s large-scale direct air capture technology. The discrepancy can be attributed to a divergence in the design of Carbon Engineering’s plants with that used by the Society in its study.

A direct air capture system pulls in atmospheric air, works it through a series of chemical reactions to extract the CO2, then returns the cleaned air to the environment. The CO2 is compressed for storage underground or, in the case of Occidental’s future facility, for use in EOR. Carbon Engineering’s plants are designed to be fueled by renewables and natural gas, though the site in the Permian Basin likely will use a combination of wind and solar, Oldham said. When natural gas is the feedstock at a given facility, the system captures the CO2 produced by the gas and processes it for storage.

Oldham emphasized he is a fan of carbon capture that takes CO2 from flue stacks but stressed that direct air capture has particular advantages. They don’t have to be located at the point of combustion because they capture carbon from the ambient air. That creates a great deal of optionality when it comes to siting them.

“What it means you can do is you can build these plants on top of sequestration sites,” he said. "So, for example, Texas has huge sequestration capacity—the ability to put CO2 back underground—so you build that plant right on top of that and now you can capture CO2 from the air and bury it permanently back underground without the need for pipelines.”

And sequestration sites are plentiful. In onshore storage, Texas has more than anywhere else, with capacity of between 661 million and 2.4 billion tons.

There are plenty of places on the planet to store CO2, but not every place is suitable, said Susan Hovorka, senior research scientist with the University of Texas at Austin’s Bureau of Economic Geology.

“You have to have the right rocks that will accept large volumes of CO2 and retain them permanently,” she said during the Columbia webinar. “When we first started, I looked at this map and said, ‘Oh my God, the place to go is in Texas.’ It’s a global hotspot of places to put CO2 in the ground.”

That means the market, not storage limitations, will drive scalability of direct air capture.

“How quickly do people want to decarbonize?” Oldham asked. “I think of the economics of this very, very simply. If we have to get to net-zero and we have to eliminate emissions, the cost of eliminating an emission is very, very different in different places and with different types of emission. And if direct air capture is cheaper than trying to stop an emission, then the economics work.”

He cited aviation as an example. Worldwide, the sector accounts for about 1 billion tons of CO2 pumped into the air each year. Decarbonizing aviation is difficult, however. Electric planes will not be an option anytime soon, and sustainable aviation fuel from biological sources cannot provide the necessary volume.

But direct air capture can attack the problem from a different angle.

“So maybe the solution is,” Oldham said, “instead, you pull CO2 out of the air to match the amount of CO2 that aviation produces.”

‘We have to do all things’

So, back to the very essence of climate change as stated by the Baker Institute’s Finley—there’s too much CO2 in the atmosphere. It’s a big problem.

The current level is the highest in human history—about 418 parts per million (ppm), or about 49% higher than pre-industrial levels. In 2019 U.S. energy consumption accounted for 5.13 billion metric tons of CO2 emissions, the U.S. Energy Information Administration (EIA) reported. That’s a 2.8% decline from the 5.28 billion metric tons emitted in 2018, which can be credited to natural gas taking some of coal’s share as fuel for electricity generation plants. Global emissions from energy consumption in 2019 totaled about 33 billion metric tons.

Complicating the issue is a huge and growing global demand for energy that cannot be met by renewables alone. At the moment, fossil fuels are a must-have to satisfy the demand, which means solving these problems requires the use of technologies that reduce and eliminate CO2 emissions.

“We have to do all things,” Oldham said. “We have to reduce emissions, but there is still going to be a huge need for direct air capture. And what I think a lot of people don’t understand is, we’ve already put so much CO2 into the atmosphere [that] we’ve already baked in a large climate change. The only way to fix that is to remove the CO2 we already put into the atmosphere. So direct air capture can do that for us, which is why I think it’s a really important technology.”

There’s support in Washington for it, too. The bipartisan Carbon Capture, Utilization and Storage Tax Credit Amendments Act led by Sens. Tina Smith (D-Minn.) and Shelley Moore Capito (R-W.Va.) includes the Carbon Capture Coalition’s top two priorities: a direct pay option for the 45Q tax credit for developers of carbon capture, direct air capture and carbon utilization projects; and a multi-year extension of the credit.

The bill also contains higher credit levels for direct air capture, which Stolark said will be essential to seeing greater deployment of the technology, as the current credit structure does not sufficiently incentivize capture from higher-cost, lower concentration sources of CO2.

The recently passed 2020 Energy Act contains historic authorizations for commercial-scale demonstrations, large-scale pilot projects and engineering studies of carbon capture projects, for which direct air capture projects are also eligible.

“Regardless of how infrastructure priorities progress through this administration and Congress, we are confident that the growing and diverse bipartisan support for carbon capture will help to advance policies that close cost gaps for deploying carbon capture in industry, power and direct air capture, as well as ensuring that the infrastructure is in place to safely transport and store captured emissions,” she said.

Staying alive

The energy transition is not on its way; it is here. Carbon capture may be more than just a cost of doing business. It might represent the price of survival.

“Widespread adoption of carbon management is central to the future viability of the oil and gas and refining industry,” Stolark said. “Rapidly evolving investor demands, public policy requirements and societal expectations necessitate fundamental changes to business models and the scaling up of investments in technologies and infrastructure to put the industry clearly on a path to achieving net-zero emissions. Companies that ignore or resist this reality risk accelerating disinvestment and decline.”

The assessment might be blunt, but it is not alone. Listen to the chief economist of KPMG US:

“We’re seeing a renewed interest in carbon capture, probably a very viable solution for the energy industry, rather than facing potential obsolescence by going to completely green energy,” Constance Hunt said during a webinar in March.

Potential obsolescence

The oft-ignored “clean up after yourself, or else!” command from childhood just got real, backed up by the combined might of governments, capitalism and social pressure from billions around the world.

“If you accept, which I personally do, that we cannot instantaneously abandon fossil fuels because they are too integral to our way of life and our standard of living across the planet, and we don’t have alternatives right now, then if you can decarbonize in parallel with this type of technology, that’s a good thing,” Oldham said.

Resolving CO2 is, ironically, a heavy lift. Climate change has been defined by the world’s political systems as the central challenge of our time. Carbon capture may be just the tool needed to repair the atmosphere and the industry’s future viability.

RELATED CONTENT:

Video: Energy ESG Spotlight: Expanding Carbon Capture in Texas

Recommended Reading

Seadrill Awarded $97.5 Million in Drillship Contracts

2024-01-30 - Seadrill will also resume management services for its West Auriga drillship earlier than anticipated.

TotalEnergies Starts Production at Akpo West Offshore Nigeria

2024-02-07 - Subsea tieback expected to add 14,000 bbl/d of condensate by mid-year, and up to 4 MMcm/d of gas by 2028.

Well Logging Could Get a Makeover

2024-02-27 - Aramco’s KASHF robot, expected to deploy in 2025, will be able to operate in both vertical and horizontal segments of wellbores.

Shell Brings Deepwater Rydberg Subsea Tieback Onstream

2024-02-23 - The two-well Gulf of Mexico development will send 16,000 boe/d at peak rates to the Appomattox production semisubmersible.

E&P Highlights: Feb. 26, 2024

2024-02-26 - Here’s a roundup of the latest E&P headlines, including interest in some projects changing hands and new contract awards.