Many game-changing fields were discovered back when baby boomers were kids and the younger generation of today didn’t exist. But most people in the industry today remember the gradual evolution (“discovery” is not the right word here) of the Barnett Shale. And it revolutionized the industry, particularly in North America, like no other play in recent memory.

The story is well-known by now and has been retold in shale plays across the continent. Shales were considered a pain in the neck for many years because of the vast amounts of natural gas that were locked in their tiny pores. Drillers had to exercise extreme caution while drilling through them because of the possibility of a severe kick. “If you reported that you’d drilled into shale when I was growing up, you got fired,” said Scott Tinker, director of the Bureau of Economic Geology at the University of Texas. The fact that they contained hydrocarbons was never in doubt. But the odds of getting those hydrocarbons out of the ground seemed slim to none.

Like many of its shale counterparts, the Barnett was useful to early explorationists as a source and sealing caprock for conventional reservoirs in the area. E&P in these reservoirs has taken place since the early 1900s, according to an American Association of Petroleum Geologists (AAPG) report in 2007. These reservoirs range in age from Ordovician to Permian. The Texas Railroad Commission (RRC) website added, “It was thought that only a few of the thicker sections [of the Barnett] close to Fort Worth would support economic drilling.”

George Mitchell decided to take a risk. His North Texas holdings were in decline, and the company was in trouble. Dan Steward helped in the development of the play and told the New York Times in Mitchell’s obituary, “This was survival. This was need.”

Mitchell began his quest to exploit the shale in 1981. Hydraulic fracturing was already a tried-and-true technology, but horizontal drilling was in its infancy.

“During the 1980s and early 1990s, Mitchell Energy drilled well after well, many of whose sites were determined personally by Mitchell, an expert geologist who dropped by his company’s engineering department to check for good news,” the obituary noted. “For 15 years the company struggled to show that its fracking could produce reliable and economic gas.”

The proof in the pudding came in 1997, when the company used a water, sand and chemical mixture in its fracturing activities. By 2012 shale gas represented 35% of U.S. natural gas output, and Barnett reserve estimates for the Newark East Field alone were placed at between 70 Bcm and 84 Bcm (2.5 Tcf and 3 Tcf). The U.S. Geological Survey determined a total mean volume of undiscovered, technically recoverable gas at about 736 Bcm (26 Tcf).

The Barnett extent

The play covers parts of more than 15 counties, according to Geology.com, many of which are densely populated. This has led to some unique compromises to tap the play without upsetting the locals.

For instance, now-defunct Ascend Geo used the reliable timing of freight trains as a seismic source for its cableless system rather than bringing vibroseis trucks into populated areas while shooting a seismic survey in the area.

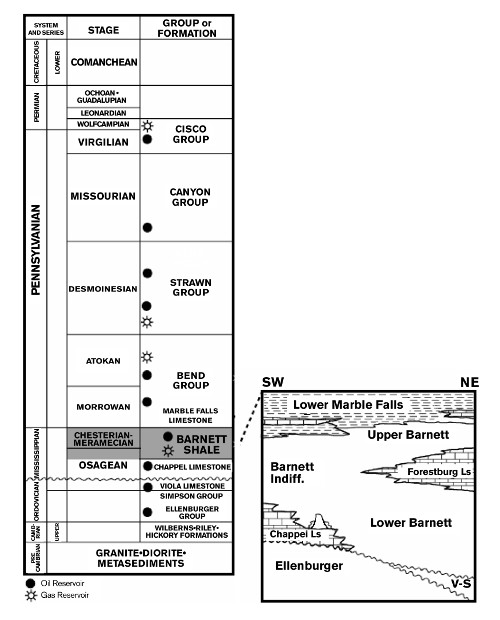

According to information on the RRC website, the Barnett stretches from the Dallas area to the southwest, covering about 13,000 sq km (5,000 sq miles or 34 million acres). According to the AAPG report, it is organic-rich and thermally mature for hydrocarbon generation. In the northeastern section it is more than 305 m (1,000 ft) thick and interbedded with limestone (Figure 1).

FIGURE 1. This figure shows the stratigraphy of the Barnett and nearby sections. (Source: AAPG)

Devon Energy, which acquired Mitchell Energy in 2002, is one of the leading operators in the region. Since the acquisition, the company has drilled more than 5,000 wells in the Barnett, according to its website, and produces about 33 Mcm/d (1.2 MMcf/d) of natural gas. With 600,000 acres, the company expects to spend about $150 million on the play in 2015 to drill 10 gross wells.

Declining production

This is the sad part about the Barnett. When natural gas prices deteriorated due to active shale drilling in other plays, the Barnett fell on hard times. Without much oil or liquids content, the dry gas play dropped to less than 141 MMcm/d (5 Bcf/d) as of last June, according to the Fort Worth Star-Telegram.

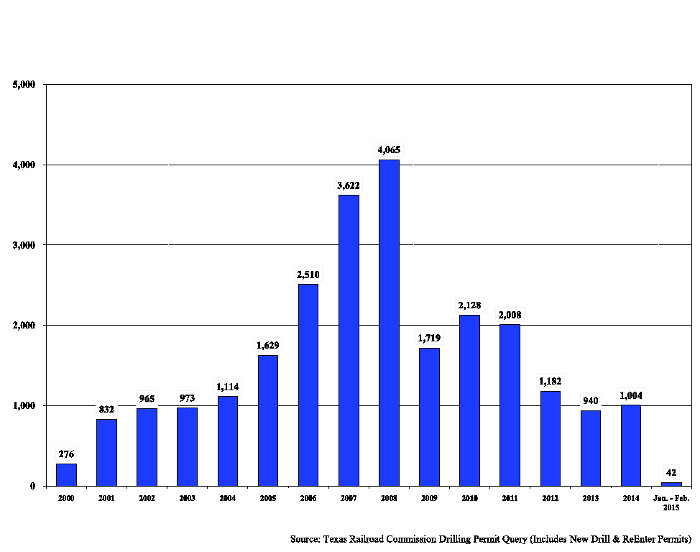

The stats tell the story. Figure 2 shows a dramatic drop-off in drilling permits issued in the first couple of months of 2015. Production figures also continue to slide, with natural gas falling from 161 Mcm/d (5.7 MMcf/d) at its peak to 127 Mcm/d (4.5 MMcf/d) in January 2015, oil drastically declining from 19.8 Mbbl/d at its peak in 2011 to 2.2 Mbbl/d in the same month and condensate dropping from 21.3 Mbbl/d in 2012 to about 11 Mbbl/d in early 2015.

FIGURE 2. Drilling permits in the Barnett have fallen off sharply. (Source: Texas RRC)

The Star-Telegram reported in March 2015 that only one rig remained in the Barnett, drilling on a site just off the Loop. “While three additional rigs were brought in this week, the fact you can count the number of area rigs on one hand is a sign of how things have changed in the once highflying Barnett, the 5,000-acre laboratory for shale exploration that ignited a domestic energy revolution,” the paper reported. “Plummeting oil and gas prices, along with the seductive lure of bigger payouts in other parts of Texas and across the country, have brought exploration in North Texas nearly to a halt.”

What will it take to bring rigs back to the Barnett? “Likely new technology,” said James King, vice president of unconventional multistage completions for Baker Hughes. “A fact of life in all of the shale plays is the low recovery factor. A new EOR technology or a new restimulation/refracturing technology that improves recovery factor would rejuvenate the Barnett and bring the activity back.”

Recommended Reading

BP Restructures, Reduces Executive Team to 10

2024-04-18 - BP said the organizational changes will reduce duplication and reporting line complexity.

Matador Resources Announces Quarterly Cash Dividend

2024-04-18 - Matador Resources’ dividend is payable on June 7 to shareholders of record by May 17.

EQT Declares Quarterly Dividend

2024-04-18 - EQT Corp.’s dividend is payable June 1 to shareholders of record by May 8.

Daniel Berenbaum Joins Bloom Energy as CFO

2024-04-17 - Berenbaum succeeds CFO Greg Cameron, who is staying with Bloom until mid-May to facilitate the transition.

Equinor Releases Overview of Share Buyback Program

2024-04-17 - Equinor said the maximum shares to be repurchased is 16.8 million, of which up to 7.4 million shares can be acquired until May 15 and up to 9.4 million shares until Jan. 15, 2025 — the program’s end date.