From farm-ins to a host of new contracts, below is a compilation of the latest headlines in the E&P space within the past week.

Activity headlines

Baodao 21-1 gas field reserves pass review

CNOOC Ltd. announced Oct. 19 that the proved gas in-place of Baodao 21-1 Gas Field has passed Chinese governmental review.

Chinese governmental bodies reviewed the discovery and certified the proven in-place of natural gas and condensate oil at over 50 Bcm and 3 MMcm, respectively.

The Baodao 21-1 gas field is in the Qiongdongnan Basin in the western South China Sea in water depths from 660 m to 1,570 m. The main gas-bearing layer is the Paleogene Lingshui formation and the discovery is condensate gas reservoirs.

The Baodao 21-1-1 discovery well was completed at hole depth of 5,188 m and encountered 113 m of pay zone. The well is tested at an average of 587,000 cubic meters of natural gas per day.

Baodao 21-1 gas-bearing structure will host the first deep-water deep-stratum large gas field in the South China Sea, realizing the biggest discovery in more than half a century in Songnan-Baodao Sag, CNOOC said.

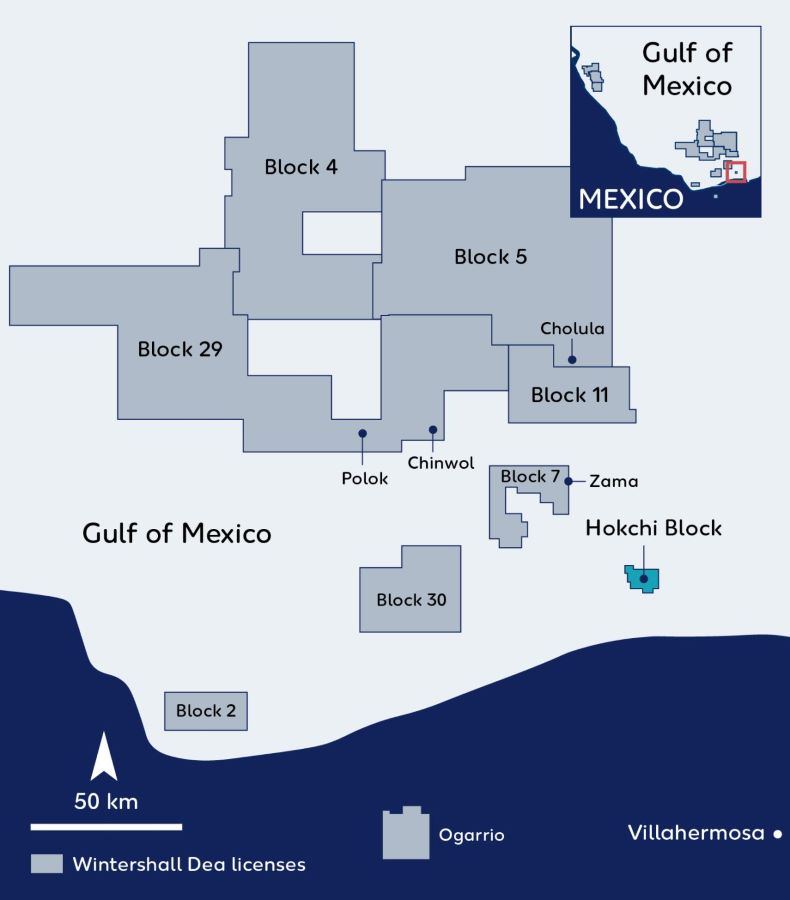

Wintershall farms into Hokchi field

Wintershall Dea announced it has signed an agreement with Hokchi Energy, the Mexican subsidiary of Pan American Energy, to acquire a 37% non-operated participating interest in the Hokchi Block.

“The Hokchi Block is located in the Sureste Basin, where we already have a strong portfolio of promising licenses and which is therefore familiar to us. It’s near our Zama, Polok and Chinwol discoveries as well as our own operated exploration Block 30,” Martin Jungbluth, managing director of Wintershall Dea in Mexico, said.

Thilo Wieland, a member of Wintershall Dea’s management board responsible for Latin America, said, “With Hokchi, we are gaining a producing asset that fully meets our strategic requirements, also in terms of efficiency and emissions.”

The shallow-water Hokchi Block is developed as a subsea tie-back to the Satellite and Central offshore platforms and was brought on-stream in May 2020 following an appraisal campaign.

The well stream is piped 24 km from the two offshore platforms to an onshore processing facility where oil and gas is separated and treated for further sale to the Mexican state company Pemex. The block produces around 26,000 boe/d with a planned ramp-up to a gross production of 37,000 boe/d by 2023.

The deal, subject to government approval, will make Wintershall Dea the second-largest interest holder in the Hokchi Block after operator Hokchi Energy.

Under the deal, Wintershall DEA has a conditional option to increase its participation up to 40% at a later stage.

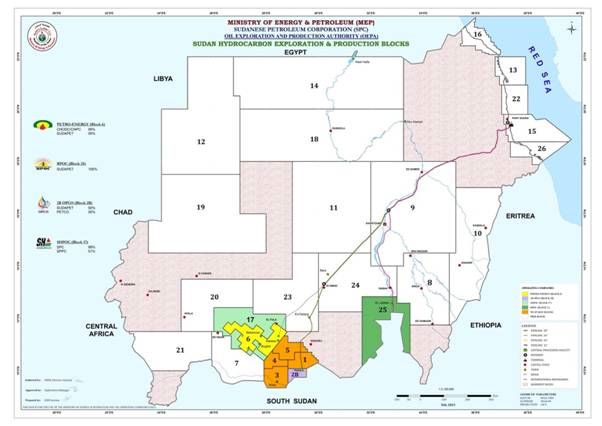

Wildcat, Sudan Oil Ministry sign MoU

Wildcat Petroleum plc announced it has signed a memorandum of understanding with the Sudanese Oil Ministry aimed at increasing oil production in Sudan by 100,000 bbl/d. Under the deal, which initially runs through the end of 2022 but can be extended, Wildcat will focus on increasing production from the already producing Blocks 1, 3, 4 and 5.

The blocks are already connected to petroleum transport infrastructure and other facilities, and there is spare capacity to handle and transport increased oil production, according to Wildcat.

"It is the company's intention in 2023 to be up and running across multiple fields, across multiple blocks and funded via multiple third parties so that the company is producing a significant portion of the 100,000 bbl/d target," Mandhir Singh, Wildcat Petroleum Chairman, said.

Contracts and company news

Sembcorp wins FLNG conversion work

Sembcorp Marine Ltd.’s Sembcorp Marine Rigs & Floaters Pte Ltd. subsidiary will engineer and convert two Sevan cylindrical drilling vessels to Floating LNG (FLNG) liquefaction facilities, including the fabrication and integration of LNG topside modules, for New Fortress Energy Inc. affiliates.

Sembcorp said the hull conversion and fabrication of topsides for the first FLNG liquefaction facility is scheduled for delivery in the first half of 2024. Work on the second FLNG liquefaction facility project is expected to be contracted through work engagement contracts to Sembcorp Marine at a later date.

The two FLNG liquefaction units will host the NFE-designed fast LNG liquefaction production facility with a capacity of 1.4 million tonnes per annum. LNG produced will be stored in a separate LNG tanker moored near the FLNG liquefaction facility. While NFE currently has Fast LNG liquefaction facilities on jackup rigs under construction in the U.S., this marks the first set of two Sevan cylindrical hulls to be re-purposed into FLNG liquefaction facilities, according to Sembcorp.

Saipem wins $4.5B contract from Qatargas

Saipem announced winning a $4.5 billion contract from Qatargas for the North Field Production Sustainability Offshore Compression Complexes Project – EPC 2, located offshore the northeast coast of Qatar.

Under the contract, Saipem will handle the engineering, procurement, fabrication and installation of two offshore natural gas compression complexes aimed at sustaining the production of the North Field, including two of the largest fixed steel jacket compression platforms built, flare platforms, interconnecting bridges, living quarters and interface modules.

Saipem said the contract is the single highest value contract won by the company to date.

In 2021, Saipem won a contract related to offshore facilities for extraction and transportation of natural gas for the same field.

Shearwater for GoM OBN survey

Shearwater GeoServices has won a second project through a global agreement with WesternGeco. The newest project is for a large U.S. Gulf of Mexico ocean bottom node (OBN) program, Engagement 3.

The three-month survey is expected to cover a nodal area of about 2,400 km2. Shearwater carried out similar OBN geophysical data acquisition in the Gulf of Mexico in 2020. Sparse node projects use ultralong-offset OBN data to resolve subsurface imaging challenges by integrating new data with existing wide and full azimuth data to provide new geological insight.

Shearwater will deploy the high-end seismic vessels SW Gallien and SW Mikkelsen as source vessels for the project, working in combination with ROV node deployment. Both vessels are expected to continue to execute projects in the OBN market.

WesternGeco will combine new OBN data with existing Wide Azimuth and Revolution data, through proprietary Enhanced Template Matching Full Waveform Inversion (ETM FWI), which the company said delivers a step change in subsurface imaging resolution to accelerate near field development with reduced uncertainty.

P-71 sails toward Itapu

Sembcorp Marine Ltd. announced the newbuild P-71 FPSO sailed away from the shipyard of its Estaleiro Jurong Aracruz subsidiary in mid-October, bound for ultra deepwaters in the Santos Basin offshore Brazil.

The EJA yard fabricated six modules, pipe-racks and a flare and integrated them on the vessel along with other modules and items supplied by the customer. EJA also made modifications on the FPSO’s topsides and hull to meet Itapu field requirements.

Once operational for Tupi B.V., the FPSO will produce up to 150,000 bbl/d and have capacity to store 1.6 MMbbl of oil.

Woodside, Lanza to collaborate

Woodside Energy and U.S.-based LanzaTech NZ have signed a strategic framework agreement under which Woodside can collaborate with LanzaTech to design, construct, own, maintain and operate pilot facilities relating to LanzaTech’s technologies.

The strategic framework agreement also allows Woodside and LanzaTech to explore opportunities for the potential commercial scale-up of LanzaTech’s technology, which seeks to convert greenhouse gas emissions into new products. The companies expect to further collaborate to explore and develop additional products from greenhouse gas emissions.

Port Arthur LNG EPC contract amended

Sempra subsidiary Sempra Infrastructure announced Port Arthur LNG and Bechtel Energy have amended the fixed-price engineering, procurement and construction (EPC) contract for the proposed Phase 1 liquefaction project under development in Jefferson County, Texas, and updating the price to $10.5 billion.

"The execution of the final contract is a critical step in advancing Phase 1 of Port Arthur LNG toward a final investment decision," said Justin Bird, CEO of Sempra Infrastructure.

Under the EPC contract, Bechtel will perform the detailed engineering, procurement, construction, commissioning, startup, performance testing and operator training activities for Phase 1 of the project.

The Port Arthur LNG Phase 1 project is permitted and expected to include two natural gas liquefaction trains, LNG storage tanks and associated facilities capable of producing up to 13.5 million tonnes per annum of LNG. A similarly sized Port Arthur LNG Phase 2 project is under active marketing and development.

According to Sempra Infrastructure, development of Phase 1 and Phase 2 of the Port Arthur LNG project is contingent upon completing the required commercial agreements, securing all necessary permits, obtaining financing and reaching an affirmative final investment decision, among other factors.

PGS to acquire 3D seismic off Namibia

PGS announced it had won a 3D exploration acquisition contract offshore Namibia from an unnamed major energy company.

Ramform Titan will mobilize for this survey, with acquisition expected to complete mid-February 2023.

Offshore fabrication yards planned for Saudi Arabia

Saudi Aramco announced it will establish two offshore fabrication yards aimed at delivering a more than 200% increase in Saudi Arabia’s offshore fabrication capacity.

The new yards are being constructed in Ras Al Khair in collaboration with National Petroleum Construction Company (NPCC) and McDermott International. They are expected to fabricate and assemble offshore platforms, jackets and structures for subsea pipelines.

The yards are intended to serve the kingdom, GCC and broader markets. Start-up of the facilities is planned for the third quarter of 2023, with the initial combined production capacity estimated at roughly 70,000 metric tons per year.

Huisman wins Carbfix pilot work

Huisman announced Carbfix has awarded it a contract to deliver and install Huisman Composite Tubulars. The pipe system will be installed in the pilot well of the Coda Terminal, a large carbon transport and storage hub in Iceland.

At full scale, the terminal near Straumsvík, Iceland, will have the capacity to inject 3 million tonnes of CO2per year for permanent mineral storage.

Carbfix, based in Kópavogur, Iceland, has developed a process that turns CO2 into stone. CO2 is dissolved in seawater before it is pumped into a basaltic bedrock formation through a network of injections wells. Once in the subsurface, the injected CO2 reacts with the rock, forming stable carbonate minerals and providing for safe, long-term storage, according to the company.

SLB teams up with RTI on carbon capture

SLB, previously known as Schlumberger, announced it has agreed with the nonprofit research institute RTI International to accelerate the industrialization and scale-up of its proprietary non-aqueous solvent (NAS) technology, which enhances the efficiency of absorption-based carbon capture.

According to the service company, the NAS technology will be applicable to capture CO2 across a variety of industrial emissions and will enhance the overall economics of carbon capture, utilization and storage projects.

As part of an engineering-scale carbon capture demonstration funded by the U.S. Department of Energy, NAS technology was able to remove more than 99% of the CO2 from natural gas combustion exhaust streams.

RTI and Schlumberger will collaborate to develop models that enable fast design and process customization to achieve a step-change in CO2 capture operations while leveraging Schlumberger’s global footprint to expand market opportunities for the technology.

Weatherford for drilling services for PDO

Weatherford International Plc announced receiving a five-year contract for more than $500 million from Petroleum Development Oman to deliver integrated drilling services in the Marmul and Grater Saqar fields.

Operations are expected to begin in the fourth quarter of 2022.

NPD evaluating new file format for seismic

The Norwegian Petroleum Directorate announced that Troika International will study what needs to be done to implement an updated reporting format for seismic data.

As part of that study, awarded by Biskos and the NPD, Troika will contact a number of companies on the Norwegian Continental Shelf, including oil companies, software suppliers and seismic companies regarding updating the Segy format for seismic data.

The Segy format currently in use is from the 1970s, but the format has limitations that make it difficult to store today's vast volumes of seismic data, and the format's machine readability is not optimal. Norway is one of the first countries to use Segy rev. 2.

"The Segy rev. 2 format will make it possible to automate seismic reporting to a far greater extent. It will also be easier for users to convert the format to their desired use format," said Petter Dischington, who is responsible for the project in the NPD.

The project will be completed in the first quarter of 2023. According to NPD, the project will form the basis for further updates to the reporting regulations for seismic data.

Recommended Reading

Energy Transition in Motion (Week of Jan. 26, 2024)

2024-01-26 - Here is a look at some of this week’s renewable energy news, including NextEra Energy’s growing renewable energy backlog.

Element3 Extracts Lithium from Permian’s Double Eagle Wastewater

2024-01-30 - The field test was conducted with wastewater from a subsidiary of Double Eagle Energy Holdings’ produced water recycling facility.

Energy Transition in Motion (Week of Feb. 9, 2024)

2024-02-09 - Here is a look at some of this week’s renewable energy news, including the latest on a direct lithium extraction technology test involving one of the world’s biggest lithium producers and the company behind the technology.

Occidental’s Lithium Technology ‘Ready for Prime Time’

2024-03-20 - Occidental is leaning towards a ‘build, own and operate’ approach to growing its direct lithium extraction business.

Energy Transition in Motion (Week of Feb. 16, 2024)

2024-02-16 - Here is a look at some of this week’s renewable energy news, including the outlook for solar and battery storage in the U.S.