From discoveries to product launches to new and extended contracts, below is a compilation of the latest headlines in the E&P space within the past week.

Activity headlines

Energean planning Olympus area project

Energean reported a commercial discovery of 13.3 Bcm recoverable gas with its Zeus-01 discovery in Block 12 offshore Israel.

Based on the Zeus results and a resources upgrade at the nearby Athena area, Energean is progressing with a field development plan for the Olympus area.

“We are evaluating a number of potential commercialization options for the Olympus area that leverage both new and our existing, unique Med-based infrastructure, and we expect to commit to a development concept in 1H 2023,” Energean CEO Mathios Rigas said.

Pre-drill estimates for Zeus-01 were between 10 Bcm and 12 Bcm. Energean is analyzing data collected during drilling.

The Stena IceMax rig drilled the Zeus-01 well and has now moved to drill a well in the Hercules structure in Block 23 offshore Israel. The Hercules well is the final well in Energean’s 2022 drilling campaign.

The company also announced an upgrade in its resources at Athena in Block 12. Reserve auditor DeGolyer & MacNaughton has certified contingent resources of 11.75 Bcm in the Athena discovery, an increase of 3.75 Bcm on Energean’s preliminary estimate of 8 Bcm. This increase follows post-well studies on data collected during the drilling process, the company said.

OMV considering follow-up after discovery

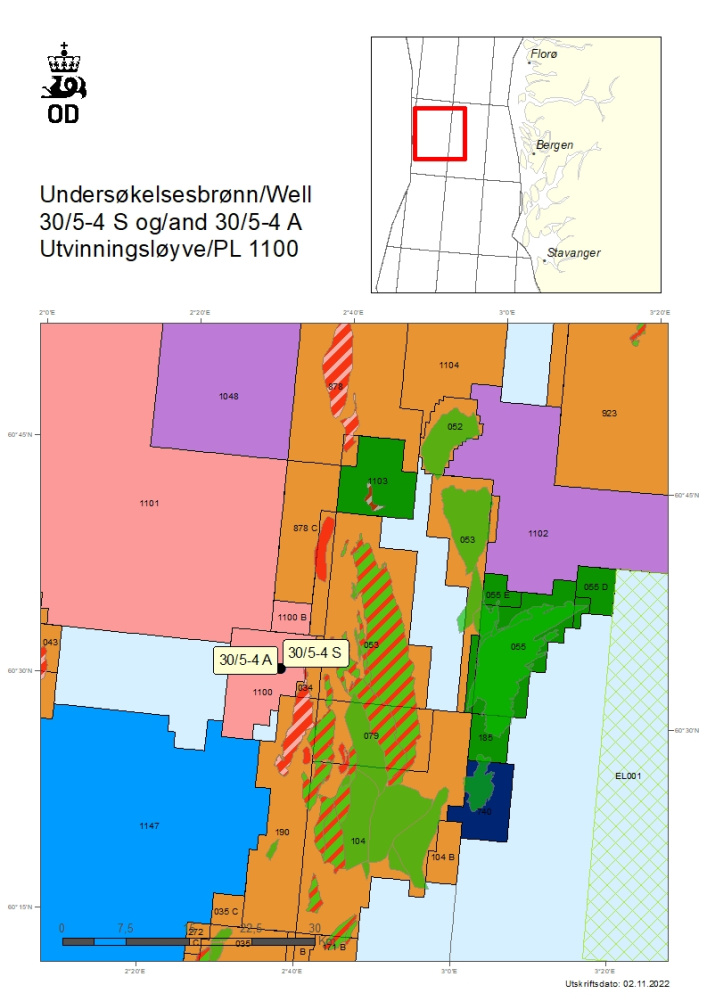

OMV reported finding gas/condensate but poor reservoir quality in two wells at its operated Production License 1100, which is 10 km northwest of the Oseberg Field in the Norwegian North Sea.

Well 30/5-4 S encountered a gas/condensate column of about 100 m in the Tarbert Formation, which has a total thickness of 200 m, and sandstone layers totaling 96 m, with poor reservoir quality. The gas/water contact was not encountered.

The primary exploration target for well 30/5-4 S was to prove petroleum in Middle Jurassic reservoir rocks in the Tarbert Formation (the Brent Group). The secondary exploration target for the well was to prove petroleum in Middle Jurassic reservoir rocks in the Ness Formation (the Brent Group), but that formation was dry with only traces of petroleum.

The objective of appraisal well 30/5-4 A was to conduct a formation test in the Tarbert Formation.

Well 30/5-4 A encountered a gas/condensate column of about 90 m in the Tarbert Formation. A total of 150 m of the formation was drilled, with sandstone layers totaling 90 m with poor reservoir quality. The gas/water contact was not encountered.

Preliminary estimates place the size of the discovery between 1.5 and 6.5 MMcm of recoverable oil equivalent. The licensees will assess the discovery with a view toward further follow-up.

These are the first two exploration wells in production license 1100, which was awarded in APA 2020. The Nobel Intrepid drilled them in 95 m of water.

Contracts and company news

Aker Solutions lands Petrobras frame agreement

Aker Solutions announced it won a frame agreement from Petrobras and partners for subsea production systems and subsea lifecycle services for Petrobras-operated oil and gas fields offshore Brazil.

The frame agreement has a fixed period of five years, from the fourth quarter of 2022 to the fourth quarter of 2027, and will be managed from Aker Solutions' locations in Brazil.

The scope of the agreement covers the delivery of complete subsea production systems, including equipment such as subsea trees, Vectus subsea controls, subsea distribution units and spare parts.

The scope also covers the full range of subsea lifecycle services for Petrobras-operated fields offshore Brazil. This will include intervention, preservation, and maintenance, as well as installation services. The service work will be managed from Aker Solutions' service base in Rio das Ostras in Rio de Janeiro, Brazil.

Subsea resident robot picked for Johan Sverdrup field

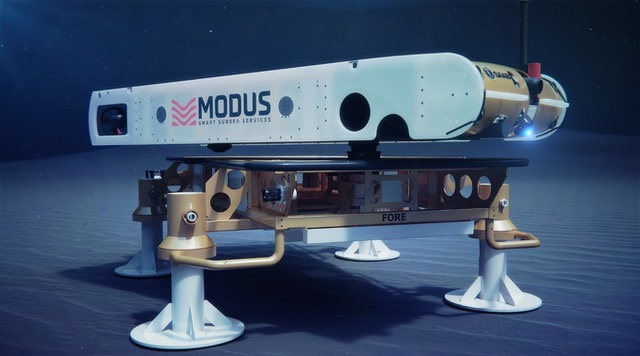

Saab Seaeye announced Modus had won an award from Equinor Energy for the autonomous deployment of a Saab Sabertooth underwater robot, which will remain docked on the seabed between tasks.

The Saab Sabertooth will remain at a subsea docking station for charging and data transfer between underwater intervention missions at the Johan Sverdrup oil field, Norway. According to Modus, the contract runs from 2023 to mid-2024.

Over-the-horizon mission management will come from Modus’ command and control center at their U.K. head office.

Modus was one of Saab’s first commercial customers for the Sabertooth system.

Modus chose Sabertooth because of its roaming and hovering multi-role, 360-degree maneuverable system that enables flexible dual autonomous and intervention operations from a single platform, fitted with cameras, sonars and tooling, according to Saab Seaeye.

Libongos drillship extended

Seadrill announced Sonadrill Holding, a 50:50 joint venture with Sonangol E.P., has won a 12-well extension in Angola. The extension is for the Libongos drillship at $402,500 per day.

Total contract value for the firm portion of the contract is approximately $327 million, inclusive of additional services. Commencement is expected in fourth-quarter 2022, with a firm-term of approximately 25 months, in direct continuation to the existing contract.

Real-time injection, production monitoring for the Middle East

LYTT announced its new sensor analytics application was deployed to interpret point and distributed sensor data collected from a carbonate reservoir in the Middle East.

According to the company, fiber-enabled analytics application for flow profiling enabled greater operational visibility, improving reservoir management and providing early risk identification.

The application was applied to production and injection wells in one of the largest offshore oil fields in the world, LYTT said.

Flow profiling helps with reservoir monitoring in production and injection wells to enable continued oil production.

Traditionally, flow profiling involves collecting data using traditional logging tools that measure flow rate and phase at each point in a well. This is a time-intensive process that comes with a host of challenges, including the erosion of wireline sensors from acid stimulation in injection wells and lengthy lead times to produce actionable data.

LYTT acquired two fiber optic data sets and processed them using its real-time sensor analytics application. After an assessment of its performance, the LYTT application demonstrated accurate injection profiles, and the company’s machine learning model proved reliable for interpreting the point acoustic sensor data obtained from the production well.

Halliburton adds new cement systems to portfolio

Halliburton introduced its NeoCem E+ and EnviraCem cement barrier systems as an expansion of the service company’s portfolio of Portland cement systems.

NeoCem E+ cement contains a 50% or greater reduction of mass cement while EnviraCem cement contains a 70% or greater reduction of mass cement. Portland cement reduction in barrier systems helps lower carbon emission baselines and provides engineered systems with enhanced sheath performance, the company said.

Halliburton successfully pumped the first NeoCem E+ cement system for Aker BP in the North Sea. NeoCem E+ cement contains 50% to 70% less cement than conventional designs and provides operators with high-performance technologies that can help lower carbon emission baselines and improve wellbore integrity.

Halliburton pumped more than 10,000 barrels of EnviraCem cement across numerous wells in the Permian Basin. With 70% or greater reduction of mass cement compared to conventional barriers, the system’s innovative design incorporates more locally sourced, natural and recycled materials. The reduced dependence on cement enables flexibility with industry supply chain challenges and delivers a more sustainable barrier solution.

Mesquite Technologies buys OspreyData

Mesquite Technologies Inc., which provides artificial lift production equipment and services, has acquired OspreyData Inc., an artificial lift production optimization software company.

Mesquite Technologies plans to incorporate OspreyData into the Taproot product line, which combines machine learning with intelligent control equipment intended to improve safety, production output, and profitability for oilfields in artificial lift production.

“Our advanced production optimization software will now have a more comprehensive intelligent control capability integrated with hardware on Mesquite Technologies well site equipment with remote operational capabilities that help producers avoid downtime and manage wells more effectively,” OspreyData CEO Ed Cowsar said.

BW reports Sendje Berge extension

BW Offshore said it has signed an agreement with Addax Petroleum Exploration (Nigeria) Ltd. for a six-month extension for the lease and operation of Sendje Berge. The firm period has been extended to the second quarter of 2023.

Recommended Reading

The OGInterview: Petrie Partners a Big Deal Among Investment Banks

2024-02-01 - In this OGInterview, Hart Energy's Chris Mathews sat down with Petrie Partners—perhaps not the biggest or flashiest investment bank around, but after over two decades, the firm has been around the block more than most.

Petrie Partners: A Small Wonder

2024-02-01 - Petrie Partners may not be the biggest or flashiest investment bank on the block, but after over two decades, its executives have been around the block more than most.

From Restructuring to Reinvention, Weatherford Upbeat on Upcycle

2024-02-11 - Weatherford CEO Girish Saligram charts course for growth as the company looks to enter the third year of what appears to be a long upcycle.

JMR Services, A-Plus P&A to Merge Companies

2024-03-05 - The combined organization will operate under JMR Services and aims to become the largest pure-play plug and abandonment company in the nation.

New Fortress Energy Sells Two Power Plants to Puerto Rico

2024-03-18 - New Fortress Energy sold two power plants to the Puerto Rico Electric Power Authority to provide cleaner and lower cost energy to the island.