(Source: Hart Energy / Shutterstock.com)

From CNOOC’s plan to bring 9 fields onstream in 2023 to drilling rig updates, below is a compilation of the latest headlines in the E&P space in the past week.

Activity headlines

Wintershall Dea finds gas at E. Damanhour

Wintershall Dea reported finding gas at its operated East Damanhour exploration block in the onshore Nile Delta.

The partners, which include Cheiron Energy, INA and the Egyptian Gas Holding Co. (EGAS), will assess the discovery as a possible tieback development to the nearby infrastructure at Disouq gas project operated by DISOUCO, a joint venture between Wintershall Dea and EGAS.

Wintershall Dea started exploration at East Damanhour in November 2021. The discovery was made as the second exploration well in this license. The ED-2X well is located around 3 km north of the existing Disouq Field. The well encountered a 43-m thick gas-bearing reservoir with a gas-water contact at 2,627 m. The discovery has been tested at peak production of 15 MMcf/d.

Wintershall Dea operates the East Damanhour block with 40% on behalf of partners Cheiron with 40%, INA with 20% and EGAS.

Gas found at Pensacola prospect

Deltic Energy Plc reported the Shell-operated Pensacola prospect exploration well 41/05a-2 on License P2252 in the Central North Sea has encountered gas and that a well test program has been recommended and accepted by the license partners.

Shell operates the license with 65% interest on behalf of Deltic with 30% and ONE-Dyas with 5%.

Trillion plans SASB side-tracks in Black Sea

Trillion Energy International Inc. reported plans to increase production at the South Akçakoca Sub-Basin (SASB) gas field in the Black Sea in 2023 by adding three side-track wells to its development program.

The program brings the total number of wells contemplated in the SASB development program to 20. Eleven are anticipated in 2023.

Trillion attributed the additional three side-track wells to experience gained from the successful recompletion of initial wells drilled during 2022 and other geological works. Production volume, log evaluations, perforation intervals and gas production behavior have now been evaluated to calculate the estimated remaining gas reserves in the East Ayazli Gas Field and Akkaya Gas Field.

Hibiscus production well spudded

BW Energy announced it spudded the production well on the Hibiscus/Ruche Phase 1 development in the Dussafu Block offshore Gabon.

The Borr Norve jackup spudded the well in early January. Production well DHIBM-3H targets the Gamba sandstone reservoir on the Hibiscus field and is expected to take just over two months to drill and complete. Installation of flexible pipelines and risers completing the 20-km connection between the BW MaBoMo production facility and the FPSO BW Adolo was also finalized in early January.

“We are on track for first oil towards the end of the first quarter,” said BW Energy CEO Carl Krogh Arnet. “This will be the first step of many on a path for successive production growth as we complete the drilling Hibiscus/Ruche Phase 1 program and asset upgrades through 2023 and into early 2024.”

The initial Hibiscus/Ruche Phase 1 drilling campaign targets the Hibiscus and Ruche fields, which are expected to add 30,000 bbl/d of total oil production when all wells are completed in early 2024.

In December, the new gas lift compressor to support production for the six existing Tortue wells was lifted onboard the BW Adolo, and installation work is ongoing. Commissioning and start-up of the compressor is expected to follow first oil from Hibiscus/Ruche.

White Rose recoverable reserves updated

The Canada-Newfoundland and Labrador Offshore Petroleum Board (C-NLOPB) has updated its estimation of recoverable reserves at White Rose.

Cenovus Energy’s decision to construct a wellhead platform and proceed with the White Rose Extension Project has extended the life of the White Rose Field from 2032 to 2038.

The C-NLOPB estimates Proven and Probable (2P) at the field is 436 MMbbl of oil, up from the 404 MMbbl estimate from 2015. The board attributes that increase to the extended life of the field.

On the other hand, 2P contingent gas and NGL estimates have both decreased from 2015 estimates.

C-NLOPB dropped the 2P contingent gas estimate for the White Rose Field to 1,497 Bcf (1.5 Tcf), from the previous estimate of 2,716 Bcf (2.7 Tcf) based on a change in methodology for assessing gas resources.

C-NLOPB said a decrease in gas volume is responsible for dropping the field’s 2P NGL estimate to 45 MMbbl from the 2015 estimate of 82 MMbbl. The decrease results directly from the decrease in gas volume.

Gannet well nears production to Triton FPSO

Tailwind announced the Gannet E development well, 21/30c-29 (GE-04), has been drilled and completed on the U.K. Continental Shelf.

Petrofac managed and operated the well, which was drilled with the Stena Don.

According to Tailwind, the well results exceed pre-drill expectations.

The well will be tied into the Dana-operated Triton FPSO in February 2023 and with production of 8,000 boe/d. There are two more wells in the Triton joint venture committed plan scheduled for drilling and production in 2024, each capable of averaging in excess of 5,000 boe/d, along with some smaller impact well interventions planned for 2023, Tailwind said.

Tailwind operates the Gannet Field with 100% interest.

Contracts and company news

CNOOC aims to bring 9 fields online in 2023

CNOOC Ltd. is targeting net production of 650 MMboe to 660 MMboe in 2023, with the expectation the operator will reach net output of around 700 MMboe in 2024 and up to 740 MMboe in 2025.

In support of those targets, the operator has budgeted the 2023 capex of $14.9 billion to $16.4 billion.

The capex includes 18% for exploration, 59% for development and 21% for production.

The operator bases its production targets on expectations of bringing nine new projects onstream, including the Bozhong 19-6 Condensate Gas Field Phase I Development Project, Lufeng 12-3 Oilfield Development Project and Enping 18-6 Oilfield Development Project in China, the Payara Project in Guyana, Buzios 5 Project and the Mero 2 Project in Brazil.

Perenco puts Fololo on Mibalé Field

Perenco DRC subsidiary Perenco Rep announced it installed a self-elevating platform system on the Mibalé Field, offshore the Democratic Republic of Congo (DRC).

The Fololo system is the eleventh of its type that Perenco Group has installed. Perenco developed the Fololo design for operations in the DRC. It uses lightweight floating pontoons and legs that can be self elevated to the required height.

Initially designed for workover support, the Fololo was conceived as an alternative to the conventional options available for operations in water depths of 30 m or less, which were jacket based and required a heavy lift barge for installation. The concept was to create a 20 m by 20 m self-elevating mini platform, with a crane and sufficient space for the necessary equipment and materials for well intervention work.

The Fololo allows workover teams to install electric submerged pumps (ESPs) without external assistance to boost production.

Perenco is working to deploy the concept with additional capabilities in waters of 40 m to 60 m to support the redevelopment of more fields.

Trendsetter for Shenandoah intervention package

Trendsetter Engineering Inc. announced it won a multi-year rental and servicing agreement to provide a 20,000 psi subsea well intervention package for Beacon Offshore Energy LLC’s Shenandoah project in the Gulf of Mexico.

Trendsetter anticipates delivery of the system in the third quarter of 2023. The award follows previously awarded scopes for the initial design and qualification of the system.

Trendsetter’s TRIDENT intervention system is suitable for offshore mobilization to a vessel of opportunity and capable of rapid re-configuration to facilitate hydraulic, riserless light-well and risered medium-well subsea intervention operations.

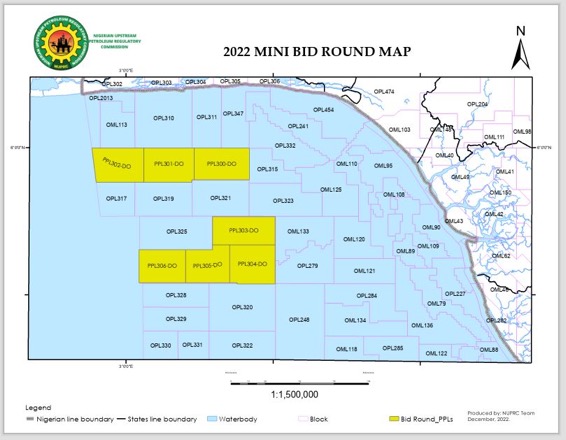

Nigeria sets pre-bid conference for bid round

The Nigerian Upstream Petroleum Regulatory Commission (NUPRC) is holding a pre-bid conference for its Mini Bid Round 2022, which is offering seven deepwater exploration blocks.

NUPRC said this is the first in a series of planned bid rounds aimed at encouraging deepwater oil and gas exploration.

The seven blocks on offer —PPL 300, 301, 302, 303, 304, 305 and 306— are in water depths ranging from 1,150 m to 3,100 m.

Interested companies should submit pre-qualification applications by the end of January. Bids are due by April 7 and bid winners will be announced on April 19.

NUPRC maintains a portal dedicated to the bid round.

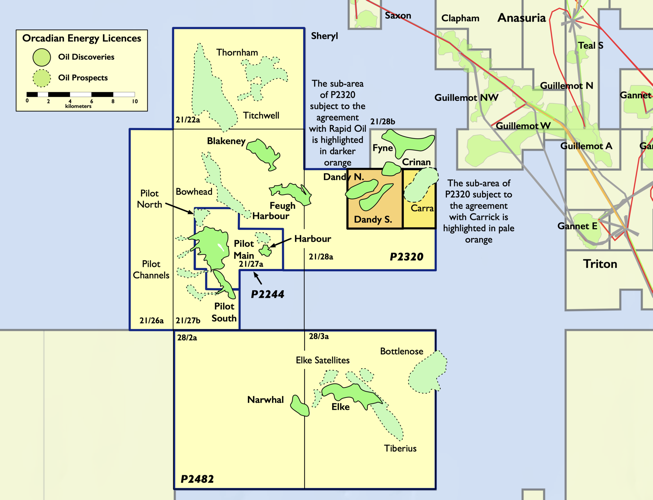

Orcadian farming out of Crinan, Dandy fields

Orcadian announced it will sell its interest in the Crinan and Dandy discoveries in the U.K. North Sea to Rapid Oil Production Ltd.

Rapid is developing the Fyne Field near the discoveries and is aiming for development approval this year. Rapid could bring Crinan into production as part of the Fyne cluster in phase two or three of the field development, possibly followed by a Dandy tieback via Fyne, the company said.

DNV qualifying hydrogen conversion system

Ocyan has engaged DNV as an independent third party in the qualification process of a system injecting hydrogen as an additive in the internal combustion engines of drilling rigs.

DNV’s technology qualification process will verify that the technology achieves the expected degree of maturity, following provisions in DNV-RP-A203 – which provides the industry with a systematic approach to technology qualification, ensuring that new technologies function reliably within specified limits.

Ocyan is working with a technology partner, LZ Energia, which develops technological solutions to reduce operations fuel consumption and air pollution. The project is supported by Shell Brasil, through the RD&I investment clause of the National Petroleum Agency (ANP).

TechnipFMC wins Dvalin North EPCI work

Wintershall DEA awarded TechnipFMC an engineering, procurement, construction and installation (EPCI) contract for the Dvalin North project on the Norwegian Continental Shelf.

The contract covers the design, engineering, manufacture and installation of pipe for the

Dvalin North Field, which will be tied back to the Heidrun Platform via the existing Dvalin Field.

TechnipFMC previously installed subsea umbilicals, risers and flowlines in the Dvalin Field.

Strohm’s Jumpers on Demand planned for Uaru

Strohm won a second “Jumper on Demand” contract from ExxonMobil to supply more than 24 jumpers and associated pipe handling equipment for the Uara Field offshore Guyana.

The thermoplastic composite pipe (TCP) jumpers, made of carbon fiber and PA12 polymer, will be installed in depths of 1,700 m and used for water and gas injection.

The award, subject to government approval and final investment decision, follows a similar award about a year before from ExxonMobil for jumpers for the Yellowtail project, also offshore Guyana.

Strohm will produce the TCP for Uaru at its Netherlands manufacturing facility. The TCP will be delivered in a single continuous length to allow the individual 24-plus jumpers to be cut to the desired length, terminated and tested onsite in Guyana.

Valaris announces rig contracts

TotalEnergies EP Brasil has exercised an option for the VALARIS DS-15 drillship for operations offshore Brazil, Valaris announced in its most recent fleet status report. After exercising the option, the rig is expected to be under contract through December 2023. One priced option remains with an estimated duration of 100 days.

Harbour Energy has exercised two one-year options for heavy duty harsh environment jackup VALARIS 120 for work in the U.K. North Sea. The first option period is expected to begin in July 2023 in direct continuation of an existing contract.

Petrofac has signed a one-well contract for work in the U.K. North Sea for heavy duty harsh environment jackup VALARIS 121. The contract is expected to begin early in third-quarter 2023 and with an estimated duration of 70 days to 100 days.

Talos Energy exercised a one-well option for the standard duty modern jackup VALARIS 144 for work in the U.S. Gulf of Mexico. The option is in direct continuation of the existing program with an estimated duration of 30 days. The operating day rate is $86,900.

North Sea Natural Resources signed a one-well contract in the U.K. North Sea for heavy duty ultra-harsh environment jackup VALARIS Norway at an operating day rate of $105,000.

LoA for Blackford Dolphin

Dolphin Drilling AS announced it has signed a letter of award (LOA) for the Blackford Dolphin for between 120 days and 485 days of work in Nigeria at a day rate of $325,000 for the minimum firm period. The work would be in direct continuation with the previously announced contract with General Hydrocarbon Ltd.

Nigerian Agip extends Abo FPSO

BW Offshore announced it has signed a short-term extension for Abo FPSO with Nigerian Agip Exploration Ltd., a subsidiary of Eni S.p.A.

The extension runs through March 31, 2023.

Helix Robotics charters Glomar Wave

Helix Energy Solutions Group’s robotics division, Helix Robotics Solutions, has entered into a three-year charter agreement with two years of options for the DP2 offshore support vessel Glomar Wave for work in both the offshore oil and gas and renewables sectors.

The Glomar Wave, a multi-role vessel, can be configured with one or two remotely operated vehicles (ROV) and Helix’s new custom-built IROV boulder and debris clearance tool.

Rockwell wins ICSS for Búzios FPSO

Sensia, a joint venture between Rockwell Automation and SLB, will supply automation and integrated control and safety systems (ICSS) for the P-79 FPSO destined for the Petrobras-operated Búzios pre-salt field in the Santos Basin offshore Brazil.

Previously, Rockwell supplied the ICSS for the P-78 FPSO, also for the Búzios Field.

Petrobel extends Trident 16 jackup contract

Shelf Drilling Ltd. reported it has secured a one-year contract extension for the Trident 16 jack-up rig in direct continuation of its current term with Belayim Petroleum Co. (Petrobel) for operations in the Gulf of Suez offshore Egypt.

The contract includes a one-year option period. The Trident 16 has been working with Petrobel in Belayim fields since 2015. Following this extension, the expected availability of the rig is February 2024.

FET delivers ROVs to OceanPact

Forum Energy Technologies (FET) has delivered three of its 200 hp Perry XLX-C work-class remotely operated vehicles (ROV) to Brazil-based OceanPact to support inspection, repair and maintenance services for Petrobras’ oilfields.

As part of the scope, FET has also supplied a VMAX ROV Simulator configured with a complete XLX-C Console. The simulator is provided with training exercises designed to train and evaluate pilot competence in skills such as tether management, manipulator control and operation of tooling.

Odfjell re-ups Aker BP-Halliburton alliance deal

Odfjell Drilling Ltd. has extended its “one for all, all for one” collaborative alliance agreement with Aker BP ASA and Halliburton AS for a further five years.

The alliance aims to execute drilling and well projects with close cooperation with alliance members and ensure greater value for all parties through common incentives.

Odfjell Drilling has two semi-submersibles contracted by Aker BP. The Deepsea Nordkapp is currently operating with Aker BP, and the Deepsea Stavanger is due to begin operations with Aker BP in early 2025. It is expected that both units will operate under the renewed Alliance model subject to approval from the respective licenses.

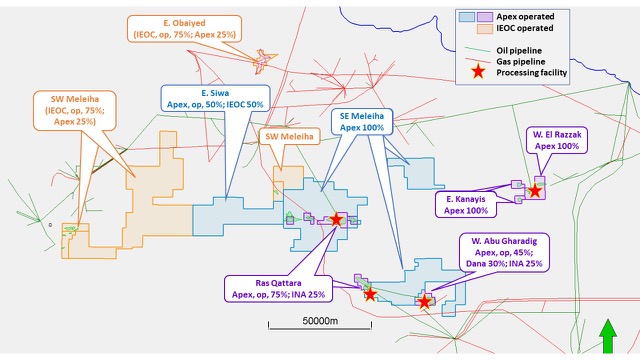

Apex adds Egypt leases to portfolio

Apex International Energy has acquired interests in four concessions in the Western Desert oil producing region of Egypt from IEOC Production B.V., a unit of Eni S.p.A. The company said it will acquire two additional concessions after parliamentary approval of extensions, which the company expects in first-quarter 2023.

In addition, Apex and IEOC were recently awarded the East Siwa exploration concession in the Western Desert, each with Apex holding 50% operator interest. The East Siwa concession agreement,approved by the Egyptian General Petroleum Co., is expected to be approved by parliament and signed into law in second-quarter 2023.

Apex has discovered four new fields in its existing South East Meleiha (SEM) concession since January 2021 and plans additional exploratory drilling in SEM in 2023.

Archer closes on Romar-Abrado deal

Archer Ltd. has closed the acquisition of Romar-Abrado, which offers advanced milling and SWARF handling services in the plug and abandonment (P&A) market.

Archer CEO Dag Skindlo said the acquisition expands Archer’s capabilities within workover operations and well abandonment.

“Romar-Abrado fits well with our strategy for brownfield and P&A,” he said. “We expect [the] activity to increase within these markets going forward as fundamentals and outlook remain strong. In addition, the transaction will contribute to the acceleration of our international expansion within the well services segment.”

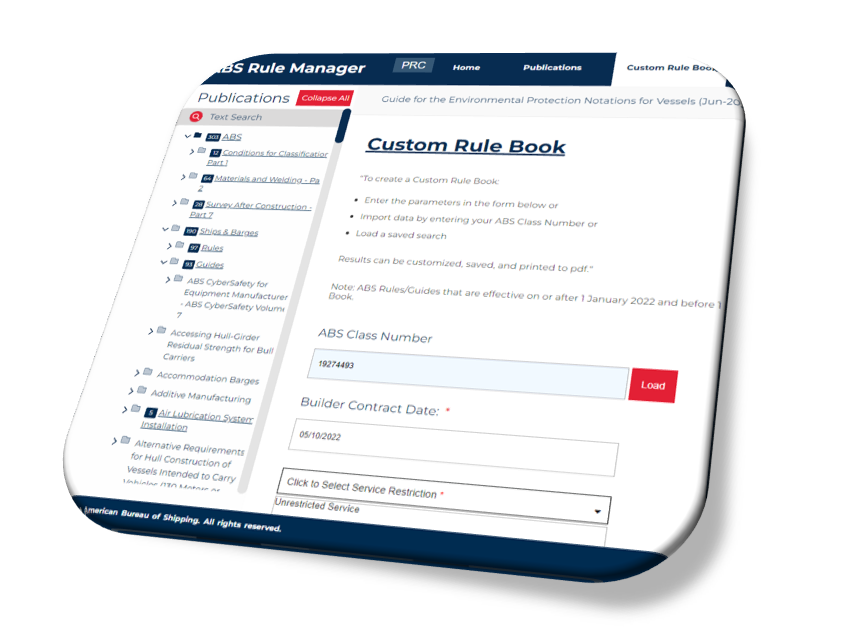

ABS launches Custom Rule Book

ABS launched the Custom Rule Book tool, which allows users to create tailored ABS rule sets in moments, saving significant time.

ABS MyFreedom users can now quickly filter 140 rules and guides, 28,000 pages and 600 notations to generate a Custom Rule Book for their vessel or project. Inputting a vessel’s ABS class number or selecting six attributes produces a custom collection of rules, according to the classification society.

Zenith negotiating for Block 1 offshore Benin

Zenith Energy Ltd. said the Republic of Benin’s Ministry of Water and Mines has awarded Zenith Energy three months of exclusivity to negotiate the terms of a Block 1 production sharing contract.

The block holds the Sèmè oilfield offshore Benin. The shallow-water field has produced 22 MMbbl to date, although the last commercial production ended in 1998 when oil prices were low.

Sèmè North was discovered in 2015 with recoverable reserves of 16 MMbbl.

Ace rebrands itself

Ace Oil Tools, the company behind the Ace Rachet Collar (ARC), has changed its name to Ace Well Technology to reflect the company’s ability to support hydrocarbons as well as geothermal and carbon capture and storage (CCS).

In 2023, the company will focus on its core and expanding markets.

Recommended Reading

BP Restructures, Reduces Executive Team to 10

2024-04-18 - BP said the organizational changes will reduce duplication and reporting line complexity.

Matador Resources Announces Quarterly Cash Dividend

2024-04-18 - Matador Resources’ dividend is payable on June 7 to shareholders of record by May 17.

EQT Declares Quarterly Dividend

2024-04-18 - EQT Corp.’s dividend is payable June 1 to shareholders of record by May 8.

Daniel Berenbaum Joins Bloom Energy as CFO

2024-04-17 - Berenbaum succeeds CFO Greg Cameron, who is staying with Bloom until mid-May to facilitate the transition.

Equinor Releases Overview of Share Buyback Program

2024-04-17 - Equinor said the maximum shares to be repurchased is 16.8 million, of which up to 7.4 million shares can be acquired until May 15 and up to 9.4 million shares until Jan. 15, 2025 — the program’s end date.