From a new discovery in the Danish North Sea to a project final investment decision, below is a compilation of the latest headlines in the E&P space within the past week.

Activity headlines

NOK 10 billion upgrade plan for Oseberg approved

The Norwegian Ministry of Petroleum and Energy approved a 10 billion Norwegian Krone plan to upgrade the Equinor-operated Oseberg Field in the North Sea.

The upgraded plan calls for the installation of two new compressors on the Oseberg Field Centre to lower the process pressure on the platform. The upgrade is expected to generate a 54% increase in the remaining recoverable gas and oil reserves from Oseberg after 2025. Emissions from Oseberg's production will be cut through a partial electrification of the Oseberg Field Centre and Oseberg South platform.

"The production of highly sought-after gas from Oseberg can be maintained at the current high level for several years since we'll be recovering more of the gas. At the same time, we'll be reducing CO2 emissions by about 320,000 tonnes per year," said Trond Bokn, Equinor's senior vice president for project management control.

Oseberg is the third largest oil field in Norway, and gas exports from Oseberg have increased significantly in recent years, from annual gas exports of 3 Bcm leading up to 2018, to about 8 Bcm in 2022. The upgrades will make Oseberg Norway’s third largest gas field, after Troll and Snøhvit, measured in remaining reserves.

Oseberg is expected to produce 100 Bcm of gas between 2022 and 2040. Start-up is scheduled for 2026.

Aker BP to submit PDOs for four Norwegian developments

Aker BP is expected to submit the plans for development and operation (PDO) for the NOAKA field development project, the Valhall PWP-Fenris project, the Skarv Satellite project and the Utsira High projects during the first half of December, after which the PDOs will be submitted to Norwegian authorities.

Noreco greenlights two Halfdan infill wells

Norwegian Energy Company ASA (Noreco) announced reaching final investment decision (FID) on two infill wells for the Halfdan field in the Danish North Sea.

Jackup Shelf Drilling Winner is expected to drill the first well in the early spring of 2023.

The two wells will be drilled at the Tor reservoir in the Halfdan North East area, located in the central part of the Danish North Sea. Both the wells are expected to increase gas production from the Halfdan Field, with plateau production expected during autumn 2023.

Noreco is a partner in the field, operated by Total E&P Denmark.

Construction on Sangomar FPSO completed

Construction of the FPSO destined for Woodside Energy’s Sangomar Field is complete.

In 2020, MODEC won the contract from Woodside to supply the FPSO, which is a Very Large Crude Carrier conversion.

COSCO Shipping Heavy Industry handled hull and marine works, external turret and topsides module installation and conversion work on the vessel. COSCO Shipping Heavy Industry and BOMESC Offshore Engineering Co. Ltd. fabricated the topsides modules, while Penglai Jutal Offshore Engineering Heavy Industries Co., Ltd (PJOE) fabricated the external turret mooring system.

Sangomar Field Development Phase 1 is Senegal’s first offshore oil project, and the FPSO serving it will be able to produce 100,000 bbl/d of oil.

Meg O’Neill, CEO of Woodside Energy, acknowledged the companies’ “excellent safety performance throughout this phase of construction, logging more than 16 million hours of complex construction work without a lost-time injury event.”

Following departure from COSCO, the vessel was relocating to Keppel Offshore & Marine Ltd.’s Tuas Shipyard in Singapore, where Keppel will complete topsides integration and support pre-commissioning and commissioning activities for the FPSO.

The development is about 70% complete and is expected to be online in 2023. When finished, it will include the FPSO, 23 wells and supporting subsea infrastructure, designed to allow the tie-in of subsequent phases.

Woodside is operator and has an 82% participating interest in the project, with PETROSEN holding the remaining 18%.

Neptune Energy confirms new discovery in the Norwegian Sea

Neptune Energy announced a new discovery at the Calypso exploration well in production license 938 in the Norwegian Sea.

Preliminary estimates are between 6 MMboe and 22 MMboe of recoverable reserves.

The Calypso discovery, located 14 km northwest of the Draugen Field and 22 km northeast of the Njord A platform, is Neptune Energy’s third discovery in six months on the Norwegian Continental Shelf.

“Initial analysis of Calypso indicates commercial potential. Together with our partners in the Calypso license, we will now study options to effectively develop the discovery using nearby infrastructure,” Odin Estensen, managing director for Neptune Energy in Norway and the U.K., said.

The Deepsea Yantai drilled well 6407/8-8S to a vertical depth of 3,496 m and encountered an estimated 8 m thick gas column and 30 m thick oil column in a 131 m thick Garn Formation sandstone reservoir, of good to very good quality.

Neptune, which Eni is looking to acquire, operates the field with 30% interest on behalf of partners OKEA ASA with 30%, Pandion Energy AS with 20% and Vår Energi ASA with 20%.

Duster in the Norwegian Sea

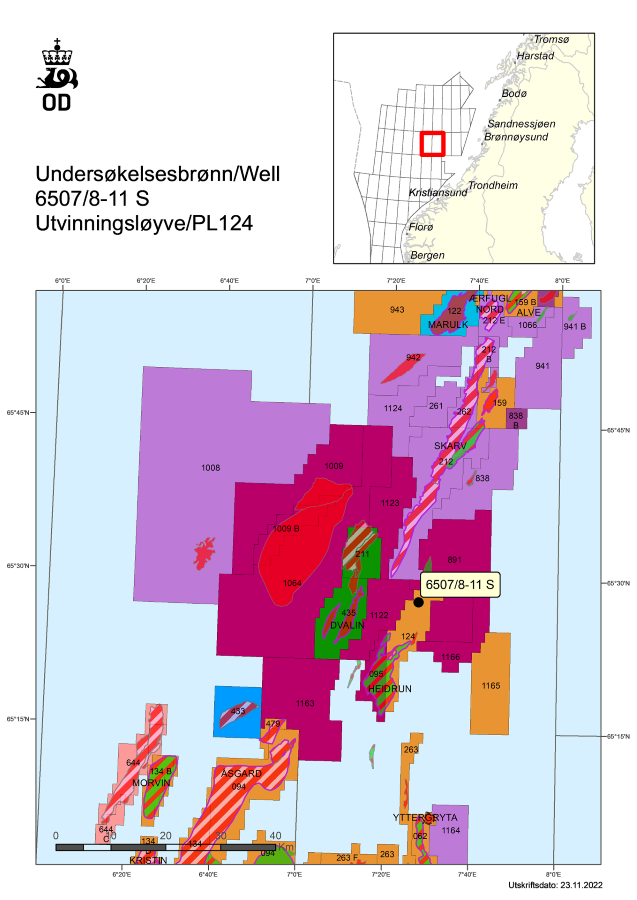

While Equinor Energy AS encountered 206 m of sandstone layers with good reservoir quality, weak traces of petroleum were encountered in a well near the Heidrun Field in the Norwegian Sea, according to the Norwegian Petroleum Directorate.

Exploration well 6507/8-11 S was classified as dry although extensive data acquisition and sampling were conducted in the PL 124 well.

The objective of the well was to prove petroleum in Lower Jurassic and Triassic reservoir rocks in the Åre Formation and Grey Beds. The well encountered reservoir rocks in the Åre Formation and in Grey Beds, of which there were sandstone layers totaling 206 m with good reservoir quality. Weak traces of petroleum were encountered.

Contracts and company news

Saipem permanently adds Santorini to fleet

Saipem announced it had exercised its purchase option for the seventh-generation Santorini drillship, with a price of $230 million to be paid by the end of 2022.

The Santorini drillship is operating within the Saipem fleet under a long-term charter agreement signed with Samsung Heavy Industries in 2021. It is currently working in the U.S. Gulf of Mexico under a contract with Eni that expires in the third quarter of 2023.

The Santorini, whose construction was completed in 2021, is equipped with two seven-cavity blow out preventers (BOPs) and state-of-the-art operations automation systems.

Weatherford, Ardyne partner on P&A offerings

Weatherford International announced a strategic partnership with well decommissioning company Ardyne.

Under the agreement, Weatherford will invest in Ardyne’s specialized single-trip abandonment and slot-recovery technology to pair with Weatherford’s Firma P&A offering. The companies believe the combined offering addresses a niche in late-life well management by allowing operators to tap into additional reserves or sustainability abandon nonproductive wells with an estimated 70% to 80% reduction in rig time in complex well environments.

New wet-mate connector for electric completions

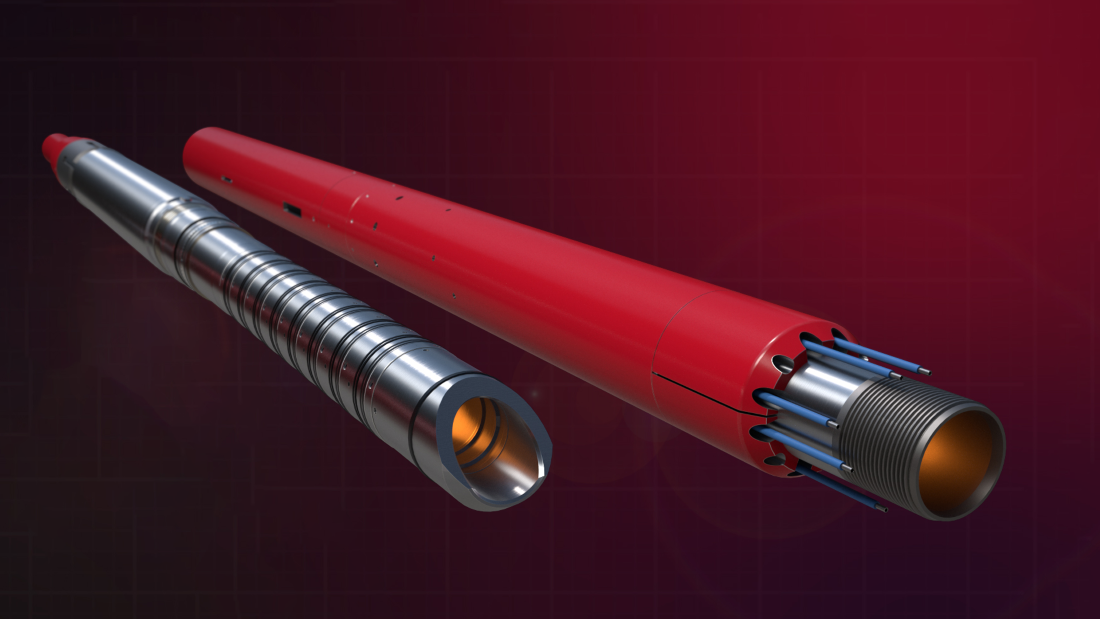

Halliburton announced the installation of the first single trip, electro-hydraulic wet connect in deepwater for Petrobras in Brazil.

The service company called the Fuzion EH electro-hydraulic downhole wet-mate connector a significant achievement in downhole electric completion technology.

Halliburton said the Fuzion EH helps increase well recovery factors by maintaining integrity of Halliburton’s SmartWell completion systems throughout the well’s lifecycle. Halliburton said it plans a future version of a dual trip system Fuzion-EH connector for qualification and implementation by Petrobras in 2023. This system will provide additional benefits in SmartWell system installations while maintaining the benefits of the single trip system.

ABS selling technical inspection services line

American Bureau of Shipping subsidiary ABSG Consulting Inc. has agreed to sell its technical inspection service line to Apave Group.

“The sale of our global inspection service line will enable us to concentrate on our core risk and reliability consulting business,” said Ryan Moody, CEO of ABS Consulting.

The acquisition of ABS Consulting’s technical inspection service line will allow the Apave Group, which operates in more than 45 countries, to strengthen and expand its geographical position in strategic markets, such as the Middle East, the Asia-Pacific region, as well as the U.S. and UK. Apave will be acquiring the entire inspection service line of ABS Consulting. The deal is expected to close by the first quarter of 2023.

Petrofac to work for Shell in Oman

Shell has awarded Petrofac new engineering and procurement services (EPS) scopes in Oman.

The first is a five-year EPS contract for Shell’s Block-10 Mabrouk Phase-2 Project, located in the Al Wusta Governate of Oman. The contract scope includes well-pads for multiple wells, remote manifold stations and connecting pipelines, including water infrastructure for well development and a field operations base.

Two further contracts, to provide residual engineering and procurement services to complete Phase-1B of the Block-10 development, were secured under Petrofac’s global enterprise framework agreement with Shell.

Exail drone receives LR Certification

The DriX maritime drone, developed by Exail, has received its first certification for an uncrewed surface vessel (USV) from Lloyd’s Register.

The DriX USV is operated by major hydrographic institutes and energy companies worldwide and had already received Bureau Veritas Approval in Principle (AiP).

This new certification attests that the surface drone meets critical safety requirements to be operated at sea. It included a detailed system level analysis, construction survey, as well as sea trials. The review covered essential design areas, such as structural integrity and stability, as well as command and control in the context of remotely supervised autonomy.

Autonomous chemical injection control with XSPOC

ChampionX has released the latest version of its XSPOC production optimization software. The XSPOC 3.2.2 release expands the software’s core artificial lift capabilities to include wellsite surveillance and autonomous control for chemical injection.

This new capability allows users to proportionally control chemical injection rates based on standard parameters already being tracked in the software, such as production rates, temperature, load, shutdown conditions and more.

Valaris renews Survitec contract

Offshore driller Valaris has renewed a service agreement with Survitec for three years for survival technology solutions.

The master service and supply contract, originally signed in 2016, covers the annual and five-year inspection, servicing and maintenance of LSA, including lifeboats, davits and fast rescue crafts across Valaris’ global fleet of 11 drillships, five semisubmersibles and 36 jackups.

ProFrac acquiring Eagle Ford sand mine

ProFrac Holding said it will acquire the Eagle Ford sand mining operations of Monarch Silica, LLC in a deal expected to close by the end of 2022.

Matt Wilks, ProFrac executive chairman, said the deal provides ProFrac with “access to high-quality, local proppant in the Eagle Ford, where we currently operate eight active fleets. With Monarch's production capacity expected to expand to nearly 4 million tons per year by first-quarter 2023, ProFrac will be well positioned to bundle internally sourced proppant across our active fleets in the region."

Regulatory

BSEE names inspector of the year

The Bureau of Safety and Environmental Enforcement has named Jason Bowens, a member of the Production Operations Inspection Unit for the New Orleans District, as the recipient of the fiscal year 2022 Inspector of the Year award.

The Inspector of the Year program is BSEE’s highest level of recognition program for its inspectors, who travel offshore daily to inspect platforms, rigs, drillships and other offshore energy facilities. The award is presented annually to the inspector who demonstrates the highest level of accomplishment in performing BSEE’s mission. It recognizes an inspector’s extraordinary achievements and performance to ensure the safety and protection of human, marine and coastal environments on the Outer Continental Shelf.

Bowens completed 80 inspection flight days, 20 production complete inspections and 29 “random” inspections. Additionally, his efforts assisted the New Orleans District Office in fulfilling mission goals and fundamentally increased safety operational performance throughout the Gulf of Mexico in FY 2022.

BSEE director Kevin Sligh presented Bowens the award in November.

Recommended Reading

Summit Midstream Launches Double E Pipeline Open Season

2024-04-02 - The Double E pipeline is set to deliver gas to the Waha Hub before the Matterhorn Express pipeline provides sorely needed takeaway capacity, an analyst said.

Kinder Morgan Sees Need for Another Permian NatGas Pipeline

2024-04-18 - Negative prices, tight capacity and upcoming demand are driving natural gas leaders at Kinder Morgan to think about more takeaway capacity.

Post $7.1B Crestwood Deal, Energy Transfer ‘Ready to Roll’ on M&A—CEO

2024-02-15 - Energy Transfer co-CEO Tom Long said the company is continuing to evaluate deal opportunities following the acquisitions of Lotus and Crestwood Equity Partners in 2023.

Summit Midstream Sells Utica Interests to MPLX for $625MM

2024-03-22 - Summit Midstream is selling Utica assets to MPLX, which include a natural gas and condensate pipeline network and storage.

Midstream Operators See Strong NGL Performance in Q4

2024-02-20 - Export demand drives a record fourth quarter as companies including Enterprise Products Partners, MPLX and Williams look to expand in the NGL market.