Like most countries that attempt energy reform, Mexico has felt some bumps in the road. Its first two licensing rounds received only tepid industry response, and the Comisión Nacional de Hidrocarburos (CNH) has had to revisit some of its contract terms to make future rounds more enticing.

But it’s not just operators that need enticement. The service companies that provide the geophysical prospecting technology are investing millions of dollars to learn more about the prospectivity of the blocks being licensed. There are murmurs that the agency and the country could do more to encourage continued investment.

Valente Ricoy, EMGS’ country manager for Mexico, would like to see more emphasis put on nonseismic techniques such as controlled-source electromagnetics (CSEM), airborne surveys, seafl oor coring, geochemical sampling and oil seep mapping, among many others. EMGS provides CSEM surveys and has worked with PEMEX for almost a decade in both deep and shallow water.

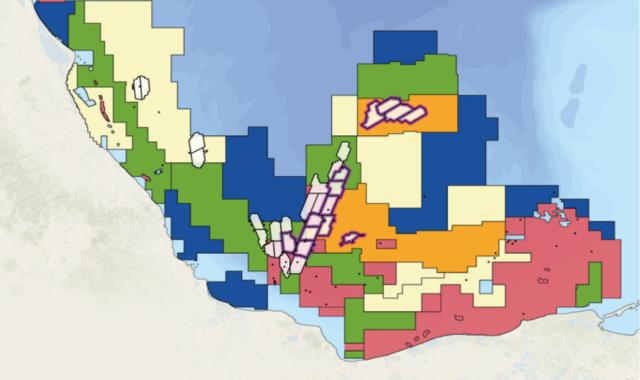

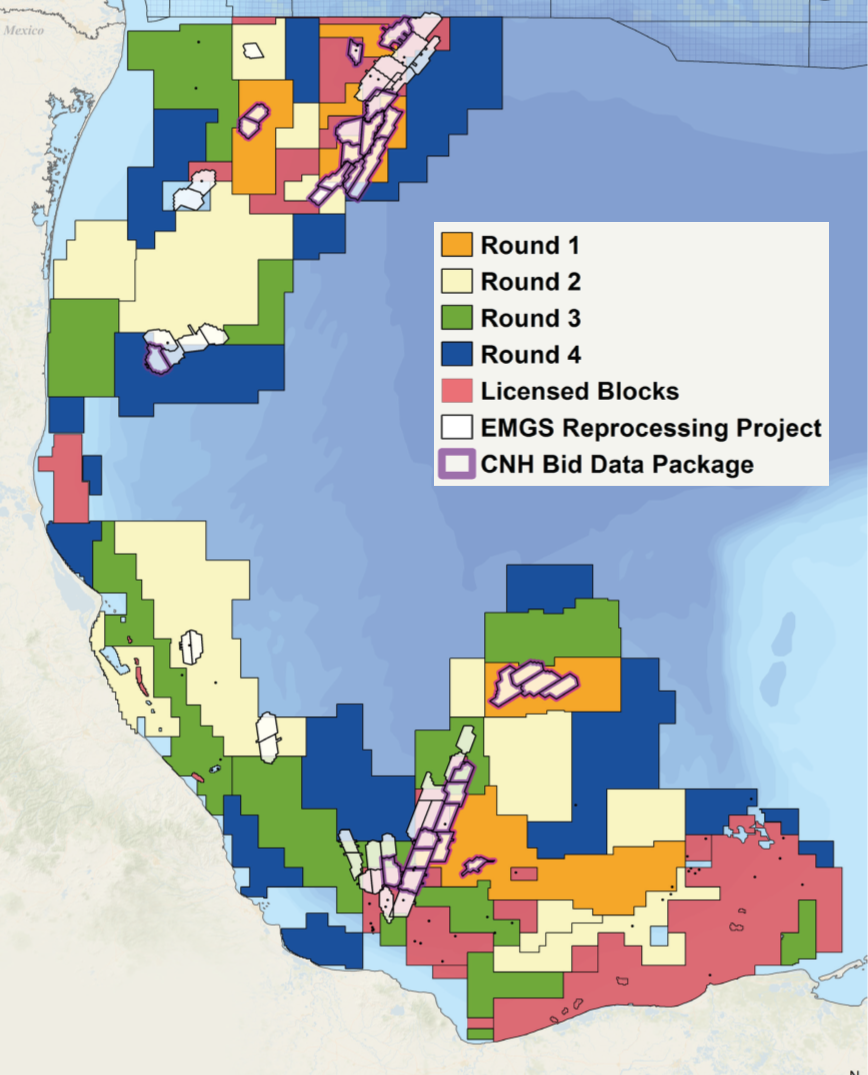

“In recent years PEMEX has contracted EMGS to acquire more than 16,000 sq km [6,178 sq miles] of 3-D CSEM over more than 40 identified prospects in deep waters, data which are now accessible under the new energy reform,” Ricoy said. “For a long time the focus was solely on deep waters because this is where drilling wells is most expensive. However, the technology also works well in shallow water. PEMEX recently conducted a survey in shallow water imaging targets below 3,000 m [9,843 ft] burial depth, and according to a statement by Marco Vázquez, PEMEX’s deputy of geophysical solutions, who spoke at the recent Mexico Oil & Gas Summit, it was a success.”

The goal of a CSEM survey is to measure the Earth’s resistivity since hydrocarbons have a much more resistive signature than water. The technology is useful as an adjunct to seismic both in exploration settings and in reservoir monitoring.

But in the current terms there is no mention of CSEM in the work commitments that operators are agreeing to. Ricoy said that his clients have mentioned this when considering CSEM surveys.

He’s hoping that Mexico can look to other countries for examples. Canada, for instance, has included CSEM as part of its work commitments, and in Brazil CSEM counts as about 86.4% of a seismic working unit.

Ideally, the country will encourage the use of all technology that can increase the exploration success and reduce the exploration cycle to shorten the gap of new finds and developments.

“The use of these technologies can significantly increase the chance of a sustainable and successful exploration program,” he said.

Overall, Ricoy is optimistic that the regulators will eventually provide more clarity. “CNH was very specific in saying that they understand that the initial phase of exploration, of data acquisition, is supported by service companies,” he said. “It’s important that they support that, and embrace any kind of technology that will help achieve exploration success in the region.”

Contact the author, Rhonda Duey, at rduey@hartenergy.com.

Recommended Reading

Some Payne, But Mostly Gain for H&P in Q4 2023

2024-01-31 - Helmerich & Payne’s revenue grew internationally and in North America but declined in the Gulf of Mexico compared to the previous quarter.

Patterson-UTI Braces for Activity ‘Pause’ After E&P Consolidations

2024-02-19 - Patterson-UTI saw net income rebound from 2022 and CEO Andy Hendricks says the company is well positioned following a wave of E&P consolidations that may slow activity.

Jerry Jones Invests Another $100MM in Comstock Resources

2024-03-20 - Dallas Cowboys owner and Comstock Resources majority shareholder Jerry Jones is investing another $100 million in the company.

E&P Earnings Season Proves Up Stronger Efficiencies, Profits

2024-04-04 - The 2024 outlook for E&Ps largely surprises to the upside with conservative budgets and steady volumes.

Chesapeake Slashing Drilling Activity, Output Amid Low NatGas Prices

2024-02-20 - With natural gas markets still oversupplied and commodity prices low, gas producer Chesapeake Energy plans to start cutting rigs and frac crews in March.