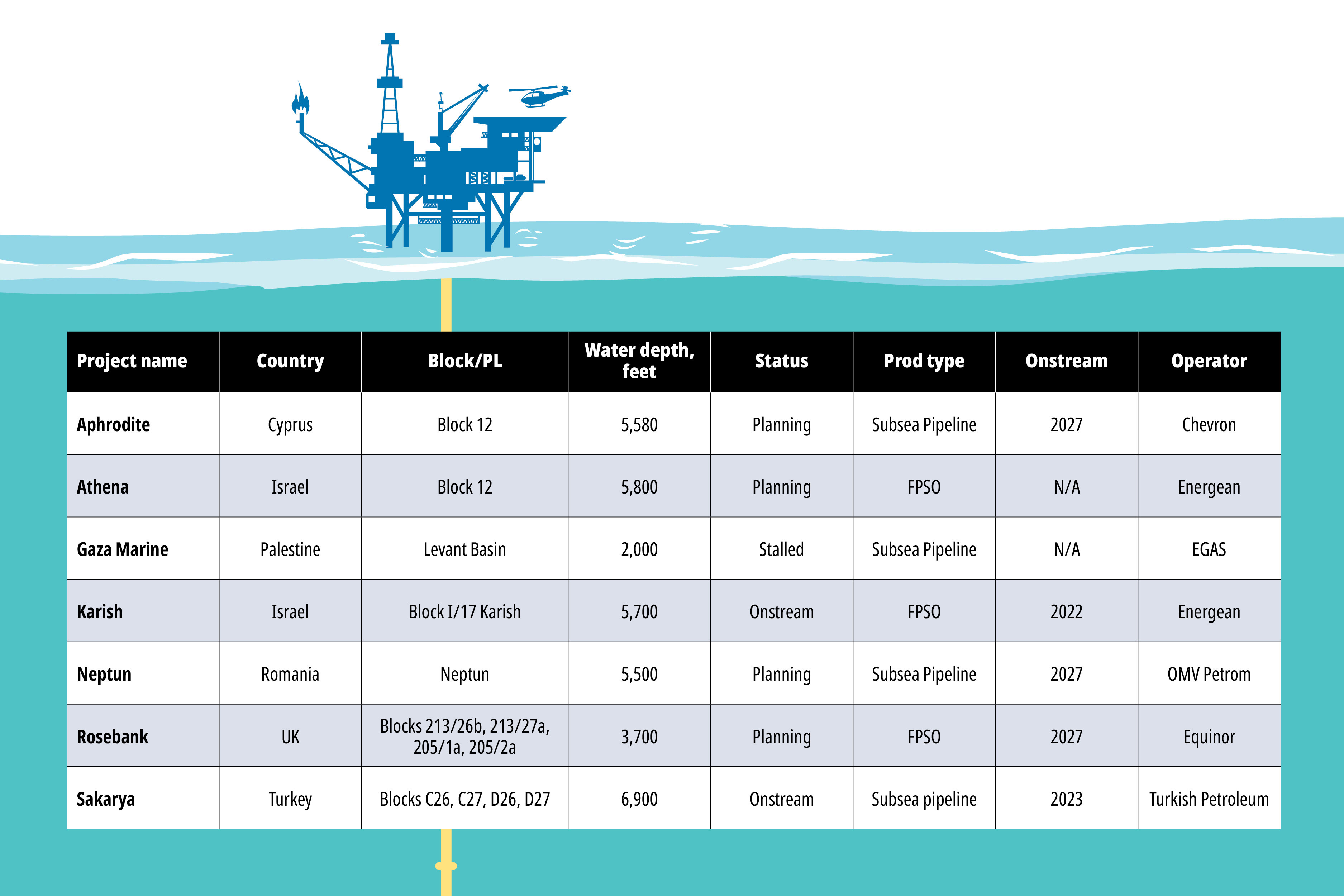

This list looks at six projects in the Middle East and Europe, with onstream dates ranging from 2022 to 2027 and one stalled. (Source: Shutterstock)

Deepwater projects are a key source for global energy, and the fourth and final part of E&P’s Deepwater Roundup summary highlights some of the latest deepwater developments located in Europe and the Middle East, based on publicly available information and analysis.

The recent European energy crisis has forced Europe and the Middle East to diversify their sources for energy. Small nations such as Cyprus have begun to dip their toes in the deepwater.

In the two regions, this list looks at six projects with onstream dates ranging from 2022 to 2027 and one stalled project.

Aphrodite

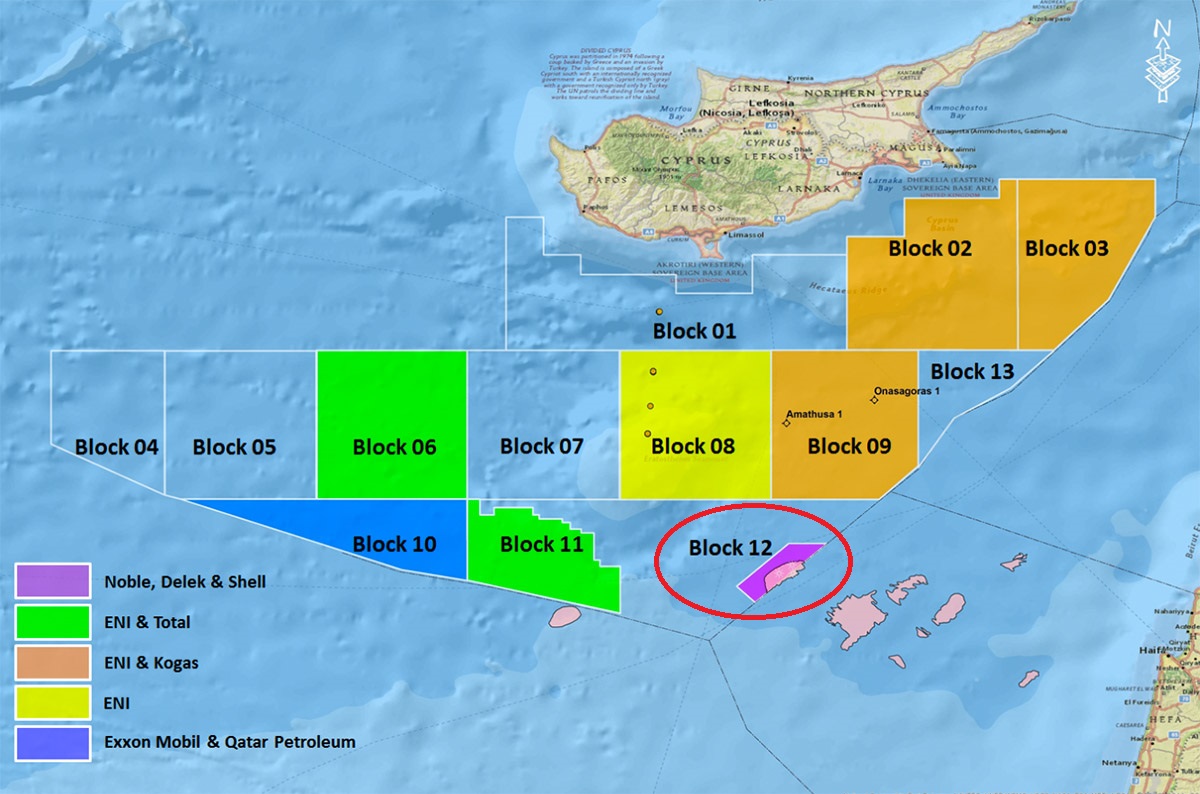

Drilling for the Aphrodite gas field offshore Cyprus is expected to begin in the first half of 2023. Discovered in 2011, the field is located in Block 12 of the Cypriot Exclusive Economic Zone in 5,580 ft of water.

Development of the field, which holds up to 4.5 Tcf of recoverable gas reserves, was complicated due to a dispute between Cyprus and Israel that delayed the project for nearly a decade. While most of the discovery lies within Cyprus’ territorial waters, a small portion of the field lies in Israeli waters, which led to a dispute. As of this writing, the dispute has not been officially settled, but operators are being allowed to make development plans for the field.

Operator Chevron Corp. – and partners Shell and NewMed Energy – plan to drill a third well at Aphrodite during the first half of 2023. Chevron has contracted the Stena Forth drillship to drill this second appraisal well that could also serve as the field’s first production well. However, if drilling is unsuccessful Chevron has indicated it may walk away from the project.

In 2018, Cyprus and Egypt signed an agreement for a subsea pipeline connecting production from the Aphrodite field to Egypt. Final Investment Decision (FID) on the field is expected later this year, with first gas in 2027.

Chevron and Shell each hold 35% interest in the field and Israel’s NewMed Energy has a 30% interest.

Athena

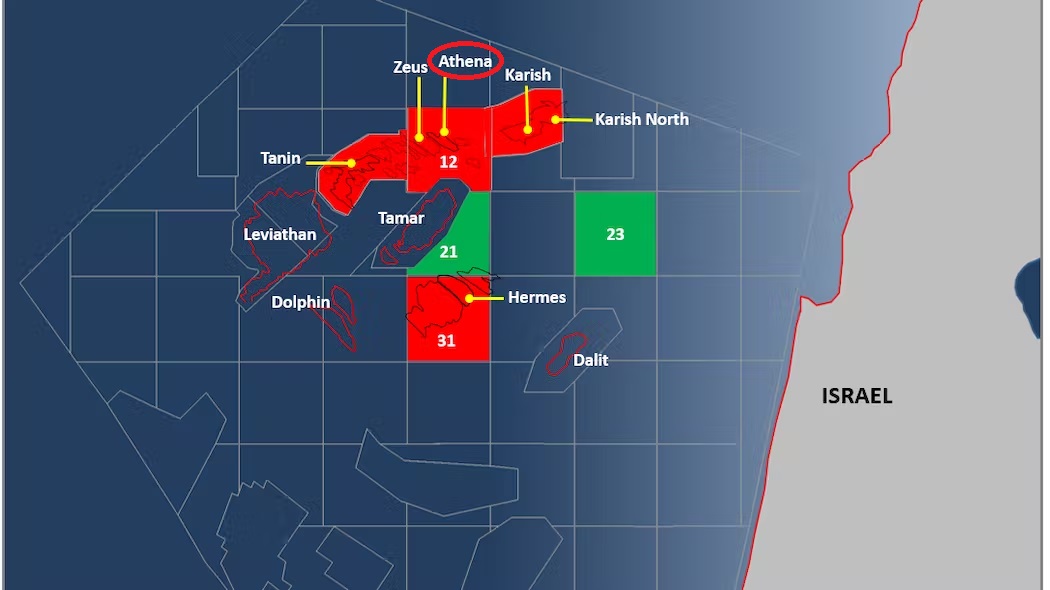

Discovered in May 2022, the Athena gas field was initially believed to hold 283 Bcf of gas, but further discovery later that year revealed reserves of 415 Bcf.

The Energean Plc-operated field is located in Block 12 of the Olympus Area offshore Israel in 5,800 ft of water. The field is about 12 miles from the Karish Field and Tanin A development.

Energean, the sole owner of the field, is exploring multiple options for the development of the discovery. One option is to develop the discovery as its own project in the Olympus Area development.

The other option is to develop the field as a tie-back to the Energean Power FPSO, which arrived at the Karish gas field location in June. The tie-back would help commercialize the discovery in the near-term, while also increasing the value of the Karish development.

Gaza Marine

Discovered in 2000, the Gaza Marine gas field could finally be on its way to development after decades of controversy and disputes.

The field, valued at $1.4 billion, is 22 miles offshore Gaza, in the Levant Basin in 2,000 ft of water. The gas fields in the Mediterranean do not conform to national borders, causing tensions among countries in the region. The field is officially under the jurisdiction of the Palestinian Authority as a result of the Oslo Accords, however Israeli forces have prevented access to the resources.

Spurred by the global energy crisis and the race to secure alternatives to Russian oil and gas, Palestine, Israel and Egypt have entered into talks around it. Last owned by Shell in 2018, Egypt's state-owned gas company EGAS is aiming to take over development of the field and has been in contact with Palestinian officials.

Karish

In February, Israel exported hydrocarbon liquids from the Karish gas field, which came onstream last October. This marks the first time that Israel has exported oil and gas to global markets. The first cargo was sold as part of a multi-cargo marketing agreement between Energean and Vitol.

Energean made the Karish FID in March 2018. The Karish main field will be the first asset to be developed in the Karish and Tanin blocks by the Rapac Group. Karish was selected as the initial development as it is the largest discovery in the area.

Discovered by Noble Energy in 2013, the Energean-operated project is 60 miles off the coast of Israel in Block I/17 Karish at a water depth of 5,700 ft. The field’s reservoir contains gas and a small quantity of light oil. The Karish Field contains 1.41 Tcf gas 2P reserves and 61 MMbbl of liquid 2P reserves.

Initial production of the Energean Power FPSO, which is being used in the field, is 230 Bcf/year. Energean’s growth projects – the Karish North development, the second oil train and the second export riser – are on track to go online later this year, which will raise production to 282 Bcf/year. Karish North is expected online later this year.

In 2018, TechnipFMC was awarded a $1.36 billion engineering, procurement, construction and

installation (EPCI) contract for the development. The scope of the contract included a subsea system, an FPSO, subsea pipeline system, as well as onshore pipeline and valve station at the receiving station. A year earlier, TechnipFMC won the FEED contract for the field.

Sembcorp Marine was subcontracted by TechnipFMC for the engineering, procurement, and construction (EPC) of the hull and living quarters for the FPSO.

COSCO Shipping Heavy Industry constructed the hull. Stena Drilling’s Stena DrillMAX drillship drilled the three Karish development wells.

Energean is the sole owner of the field.

Neptun Deep

Romanian oil and gas company OMV Petrom, along with SNGN Romgaz, signed a contract with national gas pipeline operator Transgaz to supply natural gas from the Neptun Deep Field to the National Transport System (NTS).

Transgaz is planning to build a 190-mile long, $530 million pipeline to bring natural gas from the Neptun Deep block in the Black Sea to the national grid via the Tuzla entry/exit NTS point.

The Neptun Deep gas field project lies in the Neptun block of the Black Sea in 5,500 ft of water. The field is estimated to hold around 3.53 Tcf of natural gas reserves. Production plateau is expected at 140,000 boe/d.

Production is expected to peak between 350 Bcf/year and 420 Bcf/year. Full scale development of Neptun Deep could trigger investments as high as $4.3 billion. FID is expected later this year, with first production in 2027.

OMV Petrom is the operator of the field with a 50% interest stake. Romgaz holds the remaining 50%, which it acquired from Exxon Mobil.

Rosebank

A group of 40 EU lawmakers have called on U.K. Prime Minister Rishi Sunak to block the development of the Equinor-operated Rosebank oil and gas field.

According to Equinor, Rosebank — located 80 miles West of Shetland Islands in 3,700 ft of water — has been optimized to reduce carbon emissions. However, EU lawmakers believe the burning of its extracted oil and gas would generate CO2 emissions equivalent to those produced annually by the 28 lowest-income nations combined.

The field is believed to hold between 300 MMbbl and 500 MMbbl of recoverable oil. Anticipated average production of 70,000 bbl/d of oil and 21 MMcf/d of gas would make Rosebank one of the largest fields in the U.K. once it goes onstream in 2027.

The Rosebank oil and gas development plan calls for two phases. The first phase will involve drilling up to four production wells and three injection wells. Phase II calls for up to three additional production wells and two injection wells.

In February 2022, Equinor entered into an agreement to use the Altera Infrastructure-owned Petrojarl Knarr FPSO. The FPSO was previously used at the Knarr Field in Norway and will be redeployed for the Rosebank project. Equinor expects to recover about 300 MMbbl of oil via subsea wells tied back to the FPSO for processing and offloading at the Rosebank Field.

The FPSO will also be modified for electrification, allowing it to be powered from shore — giving it the potential to reduce emissions by more than 70%. Initially, Rosebank will produce 12 kg CO2 per barrel and after electrification emissions well be reduced to 3 kg CO2.

Earlier this year, Aker Solutions was contracted to perform upgrades on the FPSO under a joint venture with Drydocks World. The EPC contract scope, due to start before mid-2023 and finish by year-end 2025, covers newbuild, demolition and life extension services to the hull, marine systems and topsides. The refurbishment will allow the FPSO to remain on the field for 25 years without the need for drydocking.

In 2022, Aker Solutions also won the contract for Rosebank Subsea Production System and Umbilicals FEED.

Equinor plans FID on the project before the end of June, with first oil expected in 2027.

Equinor operates the field with an 80% interest. Ithaca SP E&P Ltd. holds the remaining 20%.

Sakarya

State-owned Turkish Petroleum (TPAO) has brought its Sakarya gas field in the Black Sea onstream. Discovered in 2020, the Sakarya Field is located in blocks C26, C27, D26 and D27 in 6,900 ft of water.

Development of the field involved the installation of a subsea gas production system, construction of a gas processing terminal in Filyos, Turkey, and laying a 105-mile long subsea pipeline to export gas from the field to the gas terminal.

The field, which is believed to hold about 25 Tcf of recoverable reserves will average 353 MMcf/d per day initially. A second state will raise average production to 1.4 Bcf/d by 2028. Gas from Sakarya is delivered to land via the subsea pipeline and then through various compression plants.

The first phase includes ten appraisal wells. The drilling was carried out by the TPAO-owned Fatih drillship, while the well completion operations and borehole testing will be performed by their Kanuni drillship. TPAO will drill up to 30 production wells during the second phase of the Sakarya project.

A consortium of SLB and Subsea 7 received the EPCI contract for the Sakarya Field development in 2021. The scope included the installation of subsea production systems, subsea umbilicals, risers and flowlines and tie-in connections. Also included was the laying of the gas export pipeline, a monoethylene glycol injection pipeline and the development of an onshore early production facility.

Saipem installed the pipelines. Tenaris supplied 68,000 tons of steel pipes for the project.

TPAO is the 100% owner of the field.

Recommended Reading

Defeating the ‘Four Horsemen’ of Flow Assurance

2024-04-18 - Service companies combine processes and techniques to mitigate the impact of paraffin, asphaltenes, hydrates and scale on production—and keep the cash flowing.

Tech Trends: AI Increasing Data Center Demand for Energy

2024-04-16 - In this month’s Tech Trends, new technologies equipped with artificial intelligence take the forefront, as they assist with safety and seismic fault detection. Also, independent contractor Stena Drilling begins upgrades for their Evolution drillship.

AVEVA: Immersive Tech, Augmented Reality and What’s New in the Cloud

2024-04-15 - Rob McGreevy, AVEVA’s chief product officer, talks about technology advancements that give employees on the job training without any of the risks.

Lift-off: How AI is Boosting Field and Employee Productivity

2024-04-12 - From data extraction to well optimization, the oil and gas industry embraces AI.

AI Poised to Break Out of its Oilfield Niche

2024-04-11 - At the AI in Oil & Gas Conference in Houston, experts talked up the benefits artificial intelligence can provide to the downstream, midstream and upstream sectors, while assuring the audience humans will still run the show.