The increase in brownfield activity, involving activities such as stimulation, re-entry, infill activities, inspection and maintenance, plays an important role in prolonging the lifetime of a project. (Source: Shutterstock)

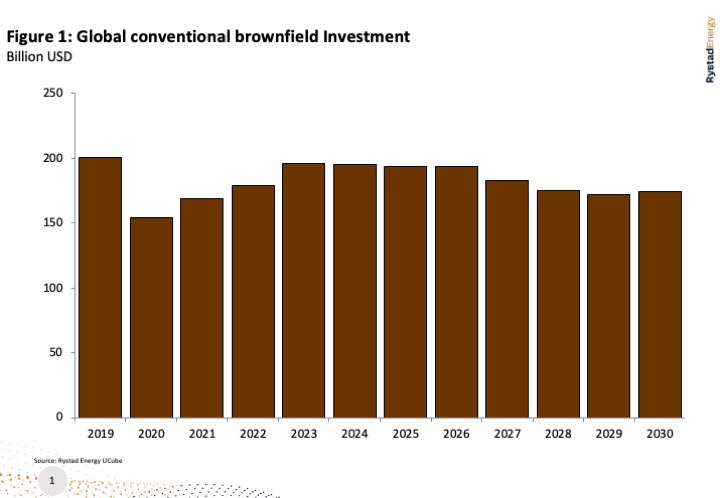

Brownfield investment in the conventional upstream sector looks on course to hit nearly $200 billion this year as the oil and gas industry and global economy recovers from the pandemic-induced slump in demand.

The Middle East is set to lead the way with spending levels, with markets in Asia and South America also attracting significant investment in the years ahead. In this commentary, Rystad Energy examines where brownfield investment is set to be deployed in conventional developments this year and for the remainder of the decade.

Global market vulnerabilities combined with the pandemic led to a steep drop in oil and gas industry spending, with E&P companies slashing upstream conventional investment. With an average Brent crude price of around $42/bbl, the upstream industry recorded a drop of around 19% in capital expenditure in 2020, excluding exploration spending, compared to 2019. The industry has, however, started to recover following the normalization of market conditions and soaring energy prices.

Last year saw an uptick of around 10% in global upstream spending compared to 2021, primarily driven by a rise in greenfield investment, which recorded a 14% rise compared to 5% for brownfield. This highlights the revival of sanctioning activity, comprising some key delayed projects that can significantly impact global supply. The jump in brownfield spending, however, highlights the relevance of existing mature fields and the importance of continuous supply from and maintenance of these fields.

The increase in brownfield activity – which primarily involves activities such as stimulation, re-entry, infill activities, inspection and maintenance – plays an important role in prolonging the lifetime of a project by increasing ultimate recoverable volumes and enhancing operational efficiency by maximizing cash flow toward the tail end of production life, while providing an opportunity for regional players to farm into assets that could otherwise be less profitable, marginal or fall into the category of non-core assets for large global players.

Mature fields dominate brownfield investment

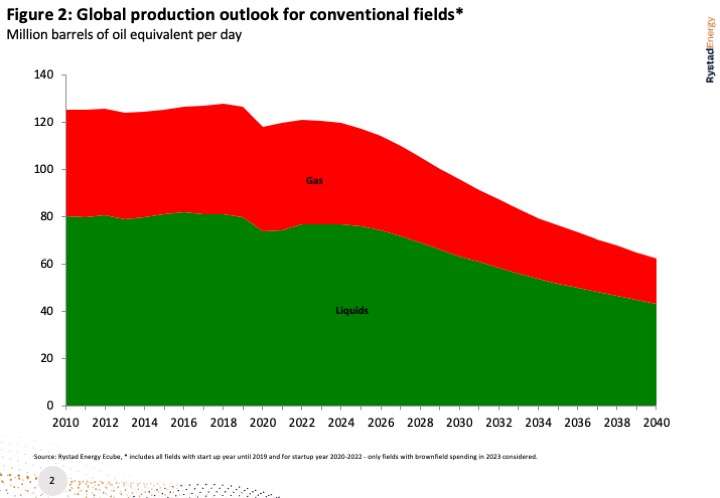

Global conventional production continues to be dominated by mature fields, which contributed over 60% of cumulative conventional output in 2022 and will continue to produce the lion’s share going forward. These mature fields, which produced more than 50% of cumulative recoverable volumes last year, therefore continue to be highly relevant in terms of global supply.

With Brent crude prices expected to hover between $80/bbl and $90/bbl over the next couple of years, Rystad Energy estimates global conventional brownfield spending will continue to rise in 2023, potentially nearing $200 billion and remaining stable toward the end of the decade.

The interconnectivity between the spending and the maturity of projects is highlighted by the fact that around 60% of estimated brownfield spending will be utilized to optimize production at fields that came online in the 1980s or 1990s. The remainder will serve fields currently in the early stage of production or that have passed peak output levels.

Considering that brownfield spending typically starts two or three years after field start-up, depending on resource potential, we see that the fields with brownfield investment contributed around 121 MMboe of oil and gas in 2022, 63% of which was liquids and the remainder gas. Supply from these fields is expected to decline to about 62,000 boe/d by 2040. Nonetheless, these fields will have an important role to play in meeting global oil and gas demand.

If we consider only liquids, according to Rystad Energy analysis, global liquids demand under our mean assumption corresponding to a scenario of a 1.9 C global temperature rise above pre-industrial levels is estimated to be around 103 MMbbl/d, dropping to around 85 MMbbl/d by 2040. The majority of this demand will be fulfilled by fields with current brownfield activity, representing 60% of global liquids demand in 2030 and 50% in 2040. This illustrates the relevance of brownfield capital expenditure along with the continued importance of conventional projects, despite the expected growth of production from unconventional projects.

Onshore brownfield development dominates

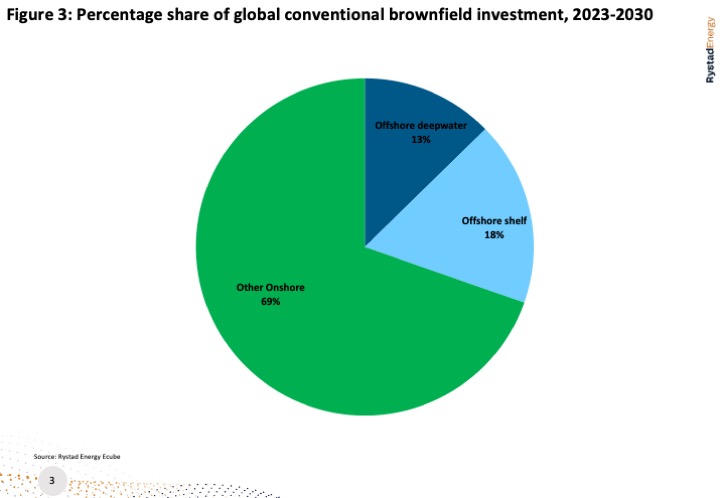

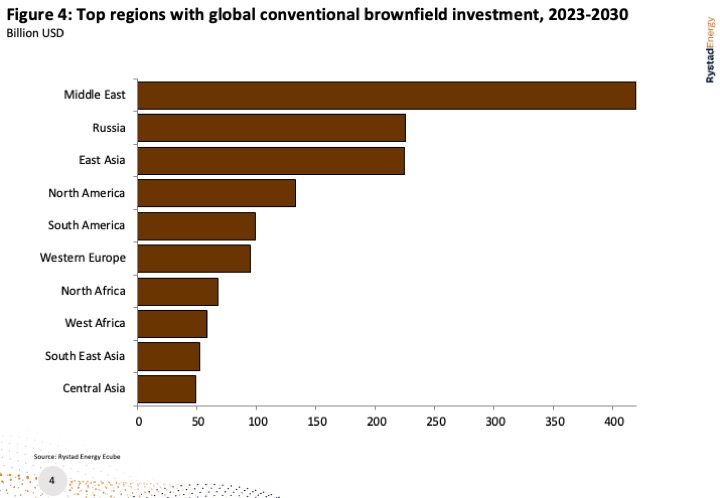

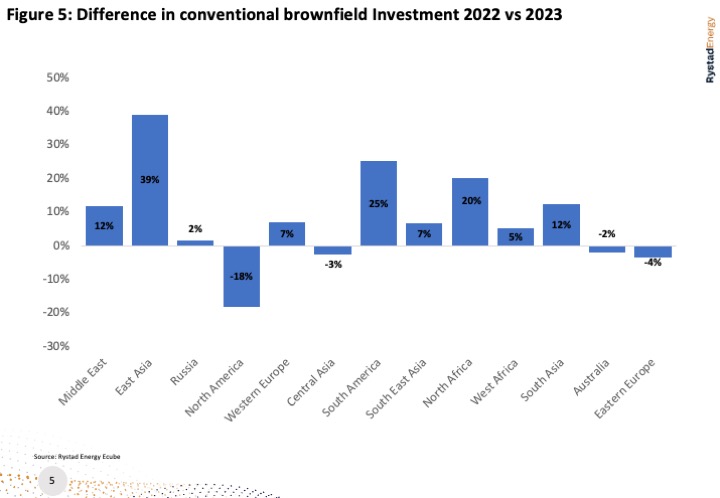

The onshore segment will continue to dominate, representing around 69% of estimated annual global conventional brownfield spending between 2023 and 2030. This is followed by offshore shelf projects with 18%, while the remainder will be spent on enhancement or maintenance of offshore deepwater fields. The Middle East’s cumulative conventional brownfield spending of over $400 billion significantly dominates amongst regions with the highest brownfield spending between now and 2030. This highlights the region’s drive to enhance and prolong production from its prolific legacy fields. East Asia and Russia occupy the two other top-three spots on the podium and are each estimated to spend around $225 billion on brownfield project development.

Narrowing down to global conventional brownfield investment for 2023 and 2024, mainland China dominates the list of countries with the highest estimated spending, followed by Russia and Saudi Arabia in the top three. These three countries are heavily dominated by domestic oil and gas giants that control the majority of hydrocarbon projects within each nation, indicating that national oil companies will play a key role in the increase in investments in the coming years. PetroChina, Sinopec and CNOOC will lead China’s brownfield investments, with Saudi Aramco doing likewise in Saudi Arabia and Rosneft, Gazprom and Lukoil leading the way in Russia. Additionally, Russian players will have to elevate their investment and technical skills following the exit of majors holding participating interests in some of the country’s key assets following Russia’s invasion of Ukraine last year and the subsequent sanctions and ongoing war.

South America, North Africa to see ‘significant recovery’

Apart from East Asia, South America and North Africa are the two regions where annual brownfield investments will see a significant recovery in 2023 compared to last year, following a dull 2020. Cumulative investment of over $21 billion in these regions this year is set to surpass the 2019 cumulative total by about $2 billion. Some 54% of the projected investment this year will be contributed by South America, and the remainder by North Africa. In South America, more than half of the expenditure is lined up for Brazil and Argentina, dominated by offshore projects such as Tupi, Sapinhoa and Marlim in Brazil.

Similarly, Libya and Algeria will see an injection of around 70% of the region’s brownfield expenditure for 2023. The increment in investment in Libya, combined with the lifting of the force majeure on oil and gas exploration in the country by the Tripoli-based government of Abdul Hamid Dbeibeh, could help the country towards its oil production target of 2 MMbbl/d, which for now appears somewhat ambitious. The improved operational environment in Libya following years of civil war has led key upstream players such as Shell, Eni, BP and Sonatrach to include the OPEC member nation in their investment plans.

As fields continue to mature globally, more and more projects will be exposed to brownfield activity to sustain and prolong production. This will not only elevate overall productivity and resource potential, but will also open a plethora of contract opportunities for the service industry in sectors such as maintenance and operations, as well as well services and commodities.

Recommended Reading

ProPetro Ups Share Repurchases by $100MM

2024-04-25 - ProPetro Holding Corp. is increasing its share repurchase program to a total of $200 million of common shares.

Baker Hughes Hikes Quarterly Dividend

2024-04-25 - Baker Hughes Co. increased its quarterly dividend by 11% year-over-year.

Weatherford M&A Efforts Focused on Integration, Not Scale

2024-04-25 - Services company Weatherford International executives are focused on making deals that, regardless of size or scale, can be integrated into the business, President and CEO Girish Saligram said.

Range Resources Holds Production Steady in 1Q 2024

2024-04-24 - NGLs are providing a boost for Range Resources as the company waits for natural gas demand to rebound.

Hess Midstream Increases Class A Distribution

2024-04-24 - Hess Midstream has increased its quarterly distribution per Class A share by approximately 45% since the first quarter of 2021.