Presented by:

This article appears in the E&P newsletter. Subscribe to the E&P newsletter here.

When it comes to capturing and storing CO2, going directly to the source of emissions and utilizing existing resources could prove beneficial in saving both time and money.

That’s one of the approaches Houston-based Talos Energy is taking with point source carbon capture as it expands its E&P technical expertise deeper into carbon, capture and storage (CCS).

Speaking during the NAPE Business Conference recently, Talos Energy’s Chief Sustainability Officer Robin Fielder talked about the company’s efforts to help slash global greenhouse-gas (GHG) emissions.

CCS will be needed to decarbonize between 5% and 20% of such emissions, according to the Global CCS Institute. Estimates show global GHG emissions are at about 55 gigatons per annum, she said. Capturing just 5% of that means there is much work to do.

“[Today] we’re at 40 million tonnes per year, which is great. That can do a lot of good things,” Fielder said, “but we really are going to have to scale this up if we’re going to make a dent into our climate goals and needs.”

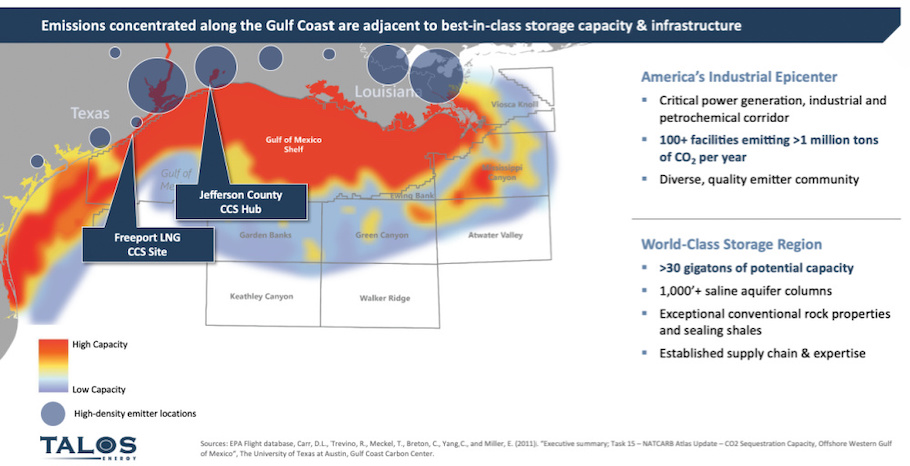

Having already announced plans to capture and store carbon adjacent to Freeport LNG and landed the winning bid for a Texas General Land Office (GLO) carbon storage project in Jefferson County, Texas, Talos has its sights set on forming more partnerships and tapping more sites to store carbon.

RELATED CONTENT:

Talos Aims to Operate First Active Carbon Sequestration Project on US Gulf Coast

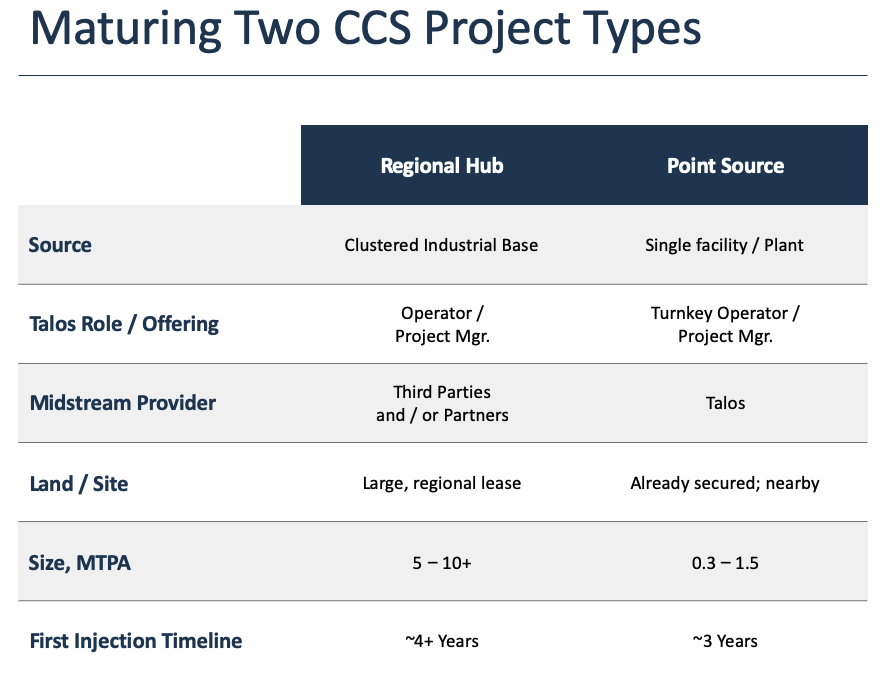

Capturing CO2 from point sources, however, could help move companies toward net-zero goals quicker and at less cost compared to regional hubs. Key is availability of acreage with conditions suitable for CO2 injection and storage, according to Fielder.

“We may not need to have a regional hub,” Fielder said, referring to potential customers with available space.

The company, she said, has found that CO2- emitting facilities often have acreage near their operating facilities that serve as buffer zones or for potential expansions.

“In many cases, what we found is there may be enough storage space on site where we can actually, depending on the emission volumes, inject right on the site,” she said.

The Freeport LNG project will do just that.

The two announced in November plans to develop the CCS project on the Texas Gulf Coast adjacent to Freeport LNG’s natural gas pretreatment facilities. The project will utilize a Freeport LNG-owned geological sequestration site less than half a mile from point of capture to permanently sequester CO2. Talos expects first injection by year-end 2024.

The company has said the site is within 25 miles of up to another 15 million metric tonnes per annum of incremental CO2 emissions from major industrial sources, providing opportunities for future expansion.

“While it’s not a regional hub, it’s a very bespoke solution. … The nice thing about that is it’s a much shorter timeline,” said Fielder, who also serves as Talos’ executive vice president of low carbon strategy.

Point source projects like the one at Freeport LNG could reach first injection within about three years, compared to four years or more for regional hub projects. While the time needed for stratigraphic well tests for both are similar, regional hubs call for midstream partnerships and more time for construction and wells.

With the regional hub, it’s really about how long it will take for emitters to make firm commitments to CCS projects and pursue 45Q tax incentives, she said.

The advantage with regional hubs is scale.

“The thought was you gather some of these industrial bases in a cluster of emissions, pull them in together into a transportation solution and find a large hub site where you’ve got the column, you’ve got the aerial extent and you’ve got limited liabilities that you can inject into and monitor for decades,” Fielder said. “So, it’s great for scale. … But it’s going to be a little bit longer on the timeline because you’re going to need to get enough emissions to underwrite the project.”

Permitting time, however, is lengthy regardless of whether the project is a hub or point source.

Point source projects appear to have advantage when it comes to infrastructure, particularly the presence of existing facilities.

“This saves a lot on the transportation costs, which besides the capture cost in some cases can be the most expensive piece,” Fielder said. “If you’re trying to make commercial projects, you’ve got to think about how is that transportation going to work. This also allows for a much shorter cycle time, so it enhances the economics.”

RELATED CONENT:

Talos Taps E&P Skills for Carbon Storage Buildout along Gulf Coast

Talos Energy Jumps into Carbon Capture Storage with JV

Talos hopes to do more point-source projects as it talks to its general customer base, she said.

The company envisions micro-hubs, something comparable to how subsea oil and gas players utilize tiebacks to existing infrastructure.

“In this case, it would be tying back to a much larger storage hub over time,” Fielder said. “So again, trying to be a little creative on how we approach this and adapt with it. And as a small independent, that’s certainly in our wheelhouse to be very agile and adjust over time.”

In addition to teaming up with Freeport LNG and with Carbonvert Inc. for the carbon storage site in Jefferson County, Texas, near Beaumont and Port Arthur, Talos also has CCS partnerships with Storegga and TechnipFMC. Fielder said the company continues to seek partners, including a midstream partner for the Jefferson County project, as well as anchors to get key emissions signed up to help underwrite projects.

The Gulf Coast project with Storegga targets more than 30 gigatons of potential carbon storage, while the specific GLO project with Carbonvert has the potential to sequester up to 275 million metric tons of CO2 over the project’s lifetime.

Citing figures from the National Petroleum Council, Fielder said investments of about $680 billion will be required through 2050 to capture about 20% of U.S. emissions. She added that more than 2.6 times more CO2 capture capacity will be needed to meet net zero targets. Figures from Credit Suisse stated only projects totaling 220 MT CO2 have been announced, leaving a gap of 580 MT CO2 needed based on the International Energy Agency’s Sustainable Development Scenario.

“It’s going to have to be a joint effort. We’ve got some huge climate goals out there to tackle,” Fielder said. “If we’re going to get anywhere close to that, it’s going to take a lot of innovation and partnerships. Our sector has a lot of that.”

Recommended Reading

US Gulf Coast Heavy Crude Oil Prices Firm as Supplies Tighten

2024-04-10 - Pushing up heavy crude prices are falling oil exports from Mexico, the potential for resumption of sanctions on Venezuelan crude, the imminent startup of a Canadian pipeline and continued output cuts by OPEC+.

Oil Dips as Demand Outlook Remains Uncertain

2024-02-20 - Oil prices fell on Feb. 20 with an uncertain outlook for global demand knocking value off crude futures contracts.

US Oil Stockpiles Surge as Prices Dip, Production Remains Elevated

2024-02-14 - EIA reported crude oil stocks increased by 12.8 MMbbl as February began, far outstripping expectations.

Oil Settles at Highest in Nearly 8 Weeks on Strong Economic Growth

2024-01-26 - Oil prices settled at their highest in nearly two months on Jan. 26 as positive U.S. economic growth and signs of Chinese stimulus boosted demand expectations.

Oil Broadly Steady After Surprise US Crude Stock Drop

2024-03-21 - Stockpiles unexpectedly declined by 2 MMbbl to 445 MMbbl in the week ended March 15, as exports rose and refiners continued to increase activity.