With leasing on federal lands restricted, drilling costs escalating and new shale wells producing less oil and declining faster, producers are looking for ways to revive existing basins.

Conventional wells typically leave 60%-70% of their oil behind, while shales leave behind 90- 95%. Two companies have developed ESG-friendly EOR methods geared toward releasing more oil without the traditional use of chemicals.

Salinity and wettability discovery

The founding of Engineered Salinity (ESal) in 2013 was almost an accident.

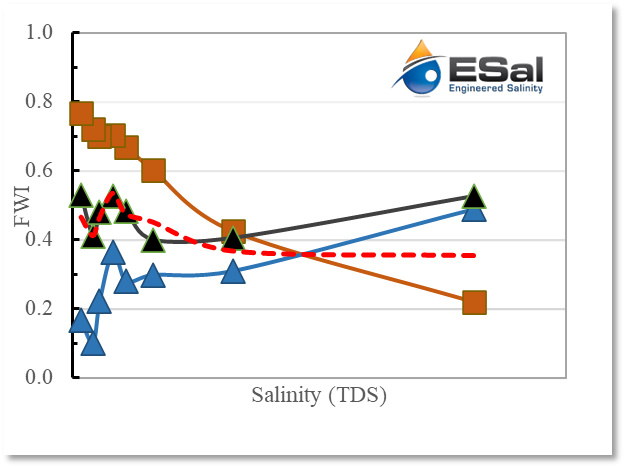

Geoffrey Thyne, now the company’s CTO, was working for the Enhanced Oil Recovery Institute at the University of Wyoming in 2012 researching using water chemistry to recover more oil. There, he discovered that wettability (preferably oil, water or neutral) was a key factor in releasing more oil, and that the salinity of water could change that, both in frac water for completions and in EOR waterfloods. It was, he said, basically the opposite of what he was being paid to discover.

After this finding, Thyne assembled a group that founded ESal, first to deepen the salinity and wettability research, then to offer the finely-tuned product to the marketplace. By 2020 the company had successful field data. In one test, their EOR water salinity adjustments improved a field’s decline curve from 15.91% to 10.22%, increasing the EUR by more than 5 million barrels. The expected return on investment (ROI) was projected at 2,750%.

The pre-treatment evaluation included testing three basic components of the process—rock, water and oil–for wettability. With that knowledge, the company could tailor injection water salinity to maximize the release of trapped oil.

Through years of research and in-field testing, ESal amassed a database of information from basins across the U.S. and elsewhere. In the process, they realized the extensive lab tests of earlier days were not necessary, but that only four or five variables affected the salinity adjustment.

Earlier this year, they pivoted, leveraging the database for use by production engineers everywhere instead of doing individual jobs. It will use artificial intelligence (AI) and machine learning algorithms to leverage the data for decisions regarding proper injection water treatments—company agnostic—and to compare expected results and costs to arrive at the suggested solution, the company said.

Thyne said this will be as accurate as the lab test and that the amount of accuracy is still likely to improve production. Further, he said, the client can input actual data so AI can further boost accuracy.

Biosurfactants: another option

Texas-based Locus Bio-Energy Solutions provides biosurfactants produced from natural and biodegradable substances to penetrate deeper into the geology of existing fields, breaking up the surface tension of the oil and other substances to boost production.

One pair of biosurfactant treatments, known as AssurEOR FLOW and AssurEOR STIM, has shown effectiveness in EOR fields, while being environmentally friendly and ESG compliant, said Megan Pearl, the company’s director of technology.

“We formulate all of our biosurfactant-based products so that they are multifunctional, in the sense that they offer all of the traditional surfactant functionalities like IFT (interfacial tension) reduction, surface tension reduction, wettability alteration and non-emulsification. But they also have added abilities directly related to the biosurfactant that dissolve organic depositions,” Pearl said.

She added that when wells have been producing for a long time, a lot of organic buildup can happen on the reservoir surface and block the release of the formation’s oil.

To remedy that, AssurEOR FLOW and AssurEOR STIM are used in tandem. In what Pearl called a “low-pressure surfactant squeeze,” a pump truck injects about 200 barrels of the first, mixed with water, at a pressure below the frac gradient.

“We’re not increasing the pore network or fracturing at all, we’re just pushing liquid into the reservoir,” she said.

This breaks up the organic buildup, removing the main barrier to additional oil recovery.

“Then the traditional surfactant functionalities can mobilize the oil from the pore space on the rock surface and maintain that mobilization through the water,” stimulating production, Pearl said.

This is the goal of AssurEOR STIM.

The ideal scenario is to repeat the process in sync with the well’s regular maintenance schedule, she added.

Combined with an acidizing schedule, Pearl said the two products can extend the interval between treatments by three or four times.

Over the course of about 300 case studies, Pearl said they see about 40% increases in production after such treatments, with higher numbers lasting as long as 12-18 months. When scale or paraffin deposits are greater, maximum production is reached after the wellbore cleanout.

Pearl sees this regimen as a cost-effective replacement for refracs or an alternative to new fracs, and certainly a way to boost production without spending millions on drilling and completing new wells.

Recommended Reading

Canadian Natural Resources Boosting Production in Oil Sands

2024-03-04 - Canadian Natural Resources will increase its quarterly dividend following record production volumes in the quarter.

After Megamerger, Canadian Pacific Kansas City Rail Ends 2023 on High

2024-02-02 - After the historic merger of two railways in April, revenues reached CA$3.8B for fourth-quarter 2023.

Kissler: OPEC+ Likely to Buoy Crude Prices—At Least Somewhat

2024-03-18 - By keeping its voluntary production cuts, OPEC+ is sending a clear signal that oil prices need to be sustainable for both producers and consumers.

Uinta Basin: 50% More Oil for Twice the Proppant

2024-03-06 - The higher-intensity completions are costing an average of 35% fewer dollars spent per barrel of oil equivalent of output, Crescent Energy told investors and analysts on March 5.

Marathon Chasing 20%+ IRRs with Los Angeles, Galveston Refinery Upgrades

2024-02-01 - Marathon Petroleum Corp. is pursuing improvements at its Los Angeles refinery and a hydrotreater project at its Galveston Bay refinery that are each boasting internal rate returns (IRRs) of 20% or more.