[Editor's note: This story originally appeared in the January 2020 edition of E&P. Subscribe to the magazine here.]

In the early days of hydraulic fracturing, engineers commonly performed diagnostics and modeled fracture dimensions on every treatment stage. As the industry moved from vertical wells with a few stages to long, horizontal wells with treatment stages spaced every approximately 150 ft, engineers had neither the time nor the resources for diagnostics or fracture geometry understanding. Compared to completions, recent drilling operations have progressed more rapidly toward data-driven automation.

To produce economic unconventional wells, operators have focused on factory-style operations in the past few years. In this quest for optimization, lateral wells are being drilled and completed quicker and longer with 40 to 70 stages per well, requiring more proppant placed at higher rates.

To meet the demands of efficiency, completion engineers typically spend more time using spreadsheets than fracture simulation software, where formulaic outputs dictate treatment stage spacing, perforation cluster depth and the pump schedule. This is confounded by the fact that completion engineers often orchestrate simultaneous fracturing and zipper fracturing operations with multiple horizontal wells. These complex operations leave no time to review data or perform diagnostic tests between stages.

This is in contrast to the origins of hydraulic fracturing, where a slower pace of operations meant engineers commonly had diagnostics, fracture models and onsite design changes on each stage. However, as well and stage spacing become tighter and rock quality diminishes, even with time to make decisions, novel diagnostics are needed to sufficiently explain the subsurface. In relatively high-permeability rock, pump-in tests gave past completion engineers quick, meaningful information on fluid leak-off. Today’s completions target much lower permeability formations, thus requiring a new approach.

Finally, the predictive capability of fracture models differs from those of the past. In more conventional reservoirs, calibrated models could relatively accurately predict fracture dimensions in a vertical well’s treatment. Models are generally uncalibrated because of sparse data, aggravated by complex multistage treatments with multiple perforation clusters per stage, creating interstage and intercluster stress effects that are difficult to model.

The paradox of today’s completions designs is that while completions are more complex, traditional measurements are poorly suited for most drilling targets, and the drive for efficiency requires real-time solutions. This article will focus on recent technological advances enabling completions engineers to move beyond factory-style completions and make real-time data-driven decisions.

A paradigm shift

After several years of factory-style development, the unconventional industry is experiencing a paradigm shift. Operators and investors realize the growth model (i.e., continuously increasing drilled feet and proppant pumped per day) is neither sustainable nor realistic.

Especially in today’s low-price environment, most realize the need to focus on capital efficiency. Doing so requires a continuous improvement program to move toward optimized reservoir development. Important variables to tweak and test include well spacing, lateral target zones, drilling parameters, completion designs and flowback strategies. Compared to a trial-and-error method, cost-effective data acquisition and processing can accelerate the continuous improvement process.

In several ways, drilling departments are further along this path than their completion counterparts. Compared to the relatively standard set of measurements in real-time drilling data streams, completions data currently lack such standardization. For example, each pumping service company has its own name for the same chemical additive. Although there is still room for improvement, direct downhole measurements are also more common during drilling than during completions. Gamma ray measurements, for example, provide a direct measure of the subsurface and are commonly used to steer the well in the correct target formation.

On the other hand, completion engineers primarily rely on data calculated from surface measurements to interpret downhole conditions. As a result, large drilling departments have control rooms with a few engineers and geoscientists remotely drilling and steering multiple wells. For completions, an equivalent remote decision-making process, informed by real-time data streams, is uncommon. One of the main challenges of a data-driven, remotely controlled process is that current modeling capabilities are not enough to accurately predict the results of real time changes. Because completion engineers cannot rely on models, the processing and interpretation of data are critical.

Real-time fracture monitoring empowers completion engineers to make decisions during fracturing and immediately see the results of those decisions. This feedback accelerates the learning curve and provides a continuous improvement platform.

Fluid tracking and cloud computing

Real-time completions monitoring options range from low-cost, scalable measurements to high-resolution methods that provide vast data but are often cost-prohibitive. For instance, wellhead pressure gauges are inexpensive and easily installed on every wellhead, but their information is limited to pressure communication at specific times. In contrast, permanently installed fiber-optic cables can provide data from well construction, stimulation and production. However, budgets often preclude multiwell fiber deployment.

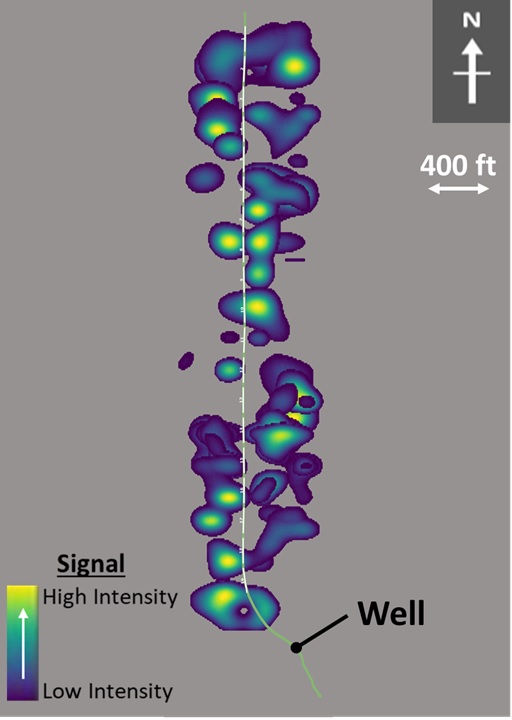

Electromagnetic (EM) fluid tracking is one of the recent options for cost-effective completions monitoring. Deep Imaging uses controlled-source EM technology to measure the changes in subsurface resistivity caused by treatment fluid injection. Injection of the hydraulic fracture fluid into the source rock perturbs a generated electrical field causing measurable EM field differences on the surface. As a result, the technology creates a map of fluid movement in each treatment stage or during flowback. It has a relatively small footprint with no impact to operations because it requires neither well intervention nor additives to the fluid or proppant. The technique involves a transmitter and grounded electrodes spaced out over the horizontal portion of the well, not on the well pad.

One operator used the technology to monitor its first horizontal well in the area (Figure 1). The results illustrated the east and west extents of the stages’ fluid, which were used to optimize subsequent well spacing. These data also indicated that lithologic changes along the toe-up well affected fluid movement, which suggests the landing zone target impacts fracture geometry. Surface treating pressure alone did not show such variations in stages with different lithology. Thus, the processing and interpretation of far-field fracture monitoring data provide greater insights than traditional measurements and are effective in guiding field development.

In some cases, particularly for smaller operators that only drill a few wells per year, reviewing data after completing the fracture treatments is enough. Alternatively, larger operators that drill multiple wells per month often plan the next well’s completion before finishing that of the prior well. In these cases, real-time processing and interpretation add significantly more value. Because fluid-tracking processing requires neither an inversion nor a calibrated model, it involves little interpretation and is easily automated in the cloud.

Deep Imaging has collaborated with Amazon Web Services (AWS) for its demonstration of real-time processing and interpretation capabilities. The scalability of a cloud-based infrastructure allows rapid deployment of computational power scaled to meet each project, while allowing Deep Imaging to be agile and design for the ideal solution, not the existing infrastructure. Detailed fluid tracking creates extremely large datasets, and without a cloud-native approach, data-intensive analysis of these data would be limited to existing capabilities. Instead, by leveraging AWS’ technology infrastructure platform, Deep Imaging will be able to focus on its primary goal of delivering results to customers in real time.

Recommended Reading

Hess Corp. Boosts Bakken Output, Drilling Ahead of Chevron Merger

2024-01-31 - Hess Corp. increased its drilling activity and output from the Bakken play of North Dakota during the fourth quarter, the E&P reported in its latest earnings.

California Resources Corp. Nominates Christian Kendall to Board of Directors

2024-03-21 - California Resources Corp. has nominated Christian Kendall, former president and CEO of Denbury, to serve on its board.

CEO: Coterra ‘Deeply Curious’ on M&A Amid E&P Consolidation Wave

2024-02-26 - Coterra Energy has yet to get in on the large-scale M&A wave sweeping across the Lower 48—but CEO Tom Jorden said Coterra is keeping an eye on acquisition opportunities.

W&T Offshore Adds John D. Buchanan to Board

2024-04-12 - W&T Offshore’s appointment of John D. Buchanan brings the number of company directors to six.

Exxon, Chevron Tapping Permian for Output Growth in ‘24

2024-02-02 - Exxon Mobil and Chevron plan to tap West Texas and New Mexico for oil and gas production growth in 2024, the U.S. majors reported in their latest earnings.