Editor's note: This article first appeared in the 2021 Hydraulic Fracturing Techbook. View the full PDF of this techbook here.

Oil and gas developers are learning the power of persuasion. Since the initial commercial success of unconventional development, the sophisticated subtlety of seismic data interpretation and fine control of directional drilling have been in sharp contrast to the brute force of breaking rocks: heavy horsepower driving huge volumes of water carrying massive loads of proppant.

Recently, prompted by the needs of profitability, efficiency and stewardship, producers and the drillers they hire are rediscovering that pounding proppant into the pay zone is not a goal in itself, but merely a means to the end of getting hydrocarbons to the surface. Basic and applied research in academia and in the field are establishing that in many cases coaxing the resource out of the rock can be faster, easier and less expensive than crashing it out.

University research

There has been extensive work done on fracture propagation, proppant transport and lodgment, and fluid recipes. The swing to some subtlety even extents to new generations of wellhead power.

“The main purpose of our work is to understand how to maximize the surface area in the fracture so there is more contact with the wellbore,” said Chandra S. Rai, Miller Chair and professor of petroleum and geological engineering with University of Oklahoma Mewbourne College of Earth and Energy. “That means studying things from the hydraulic fracturing process itself to proppant behavior. We take rock recovered from drilling or from outcrops and put it into the stressed condition as it would undergo during fracturing.”

—Chandra S. Rai, University of Oklahoma Mewbourne College of Earth and Energy

Those experiments last for several months. Over the course of the research, some intriguing findings have already been made. Notably, some of the decline curve for a well is not just a matter of tapping out the pressure.

“There are a lot of things happening that are reflected in the decline curve,” Rai said. “The type of proppant, size and quality are part of the curve. The better we understand the other factors, the better we can address productivity of the well.”

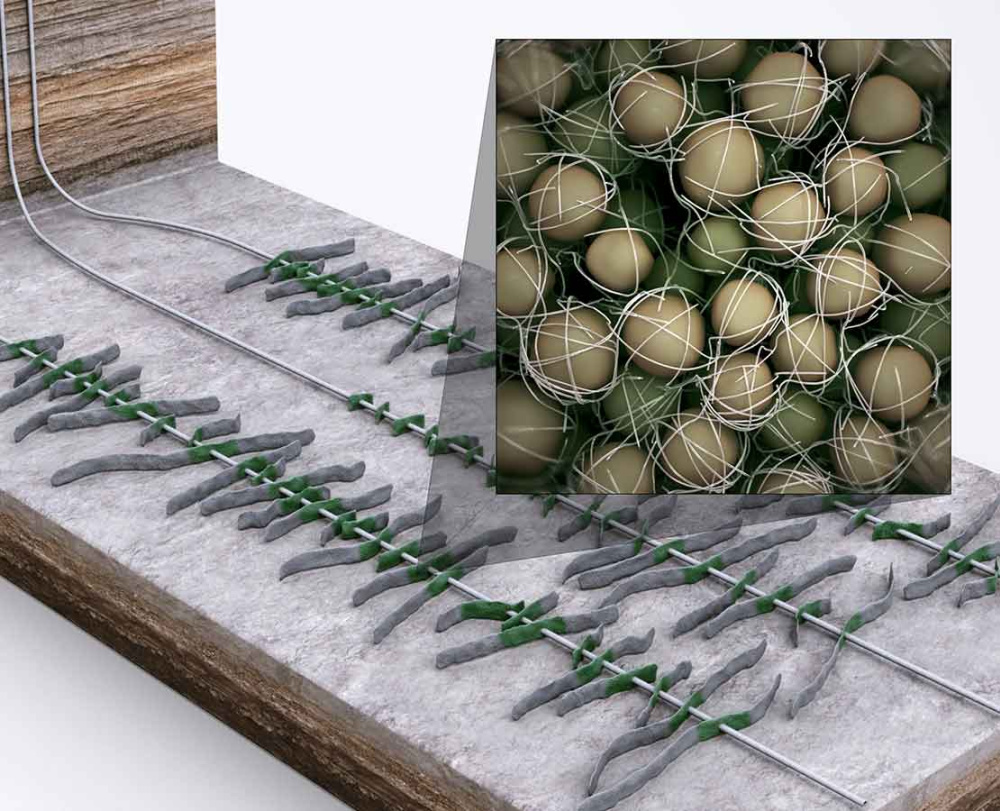

As one example of the multiple variables involved, “even ceramic spheres have their downside as proppants,” he said. “They are very strong, no doubt, they won’t break. But they are subject to embedment and to chemical degradation.”

Most broadly, Rai advocates a holistic approach.

“We can take some [rock] samples from the well, hydraulically fracture them and look at them under the scanning electron microscope and say that if you pump differently you could get better results,” Rai said. “As wells are going deeper and deeper, they are taking larger and larger compressors. But we have come up with some methods where you don’t need so much horsepower.”

This is as much a business revelation as it is a technical one. Since the commercialization of hydraulic fracturing, the basic approach can be captured in the pop culture expression “Hulk smash!”

“These days we are just bulldozing down hole,” Rai said. “People want to use maximum horsepower, maximum amounts of water [and] maximum sand loading. All that takes bigger compressors that cost more money. Maybe for all that you just get one large fracture. But what you really want is a dense network of small fractures that remain open. It’s not about maximum power or load; it’s about maximum surface area of the source reservoir rock exposed to the bore so it can be drained.”

To monitor those experiments, Rai’s program uses acoustic sensing.

“We can map the sound just as can be done for microseismic surveys,” he said. “The focus, as I said, is to learn the effects of lithology, fluid properties and pumping protocol to optimize surface area and productivity of the frac.”

One particular area of focus is proppant behavior.

“Several things can happen,” Rai explained. “That can range from degradation to embedment, all of which can affect conductivity. Proppant is put in place to hold the fracture open, but the proppant itself affects fluid flow. There can also be silica diogenesis or other chemical reactions.”

The decision about what type of proppant often involves balancing how robust the grains or spheres are versus how much they cost. But the toughness of the proppant is only one factor.

“There can be instances where the rock closes around the proppant or the proppant becomes imbedded,” Rai said. “That is just as detrimental as if the proppant gets crushed.”

From crosslink to HVFR

Oilfield services companies are also transferring knowledge. Having sold its onshore hydraulic fracturing business in North America to Liberty Oilfield Services in January, Schlumberger is now focused on taking its expertise to unconventional development in other parts of the world, notably Argentina, Saudi Arabia, the United Arab Emirates (UAE) and China.

“Geologically, the Vaca Muerta Formation in Argentina has some similarities to the Eagle Ford, but under higher tectonic stress,” said Pedro Artola, Schlumberger’s stimulation technology adviser for the Western Hemisphere. “That means that the pressures are higher than in North America. We are pumping at 11,000 to 12,000 psi. That also means that the selection of friction reducer is fundamental. Early jobs used crosslink gel, but that has been replaced with high-viscosity friction reducers [HVFR] for better proppant transport.”

That is effective even at salinity levels of 300,000 ppm, Artola said. Laterals in the Vaca Muerta are often about 8,500 ft, so shorter than is common in the U.S., with 45 to 50 stages, which is a bit denser than in the U.S.

“Proppant selection is a similar story to the U.S.,” Artola added. “Ceramics were considered early, but we have moved away from that. We are now using mostly in-basin sand, mostly 100 mesh and 30/70.”

Some operators are experimenting with high-intensity completions.

“They are placing 2,800 to 3,000 pounds per foot in stages of 180 feet, even 150 feet,” he said. “That means 24 [million] to 25 million pounds per well as compared to the average in North America of 15 [million] to 16 million pounds.”

In the Eastern Hemisphere, “the most action is in the Middle East and China,” said Philippe Enkababian, Schlumberger’s stimulation technology adviser for the Middle East and Africa. “Both regions have capitalized on the work done in North America and Argentina. The tectonic regimes are highly compressive with strike-slip faulting. That makes proppant characteristics and placement very important.”

In the Middle East, the primary targets are Jurassic carbonaceous shales.

“Saudi Arabia is in full development,” Enkababian said. “The UAE wells are still in the appraisal stage. They tend to be deeper and hotter.”

The evolution of chemistry is similar to what took place in the Western Hemisphere.

“By 2017 Saudi Arabia was pumping mostly slickwater,” Enkababian said. “In 2018 and ’19 there was a gradual shift to HVFRs. In the UAE the conversion was just last year.”

Enkababian noted that in Saudi Arabia laterals tend to be only 5,000 ft to 7,000 ft lateral length, while the variability in China is wider at 6,000 ft to 11,000 ft.

“In China it is common to frac 30 to 40 stages, with proppant loads of 2,000 to 2,500 pounds per foot of 100 mesh and 40/70 ceramic,” he said. “Chemistry is a mix of crosslink, slickwater and HVFR.”

He explained that because of the higher compressive forces in the rock, most in-basin sand still needs some ceramics near the wellbore to cope with the closure stress.

“In the early days, it was common to use full ceramic, and in the basins under appraisal, and most jobs still use approximately 80% ceramic,” he said. “There is a gradual reduction in the use of ceramic proppant in the Eastern Hemisphere. The shift to in-basin sand in those regions has given improved economics with no meaningful reduction in production.”

Worldwide the shift to in-basin sand and less water is part of an overall effort to reduce cost and environmental impact.

“Water availability and cost are not too much of a challenge in most regions,” Artola said, “but there are some savings and environmental improvement. In Argentina some clients are considering implementing a partial closed-loop reusing produced water blended with fresh. We can use flowback water, produced water, brackish water and, in some cases, even seawater.”

Where to land the laterals

As the industry rethinks the need for ever-greater horsepower, it is also reconsidering the desirability of ever-greater later lengths.

“The state-of-the art is two- to three-mile laterals,” said Jennifer Miskimins, head of the Petroleum Engineering Department at Colorado School of Mines (CSM). “That is driven by land use as well as economics. Long laterals from the same vertical well can save in capital costs. The wine-rack technique for spacing has become standard even though researchers and industry are still trying to determine the balance between optimized drainage and interference in every basin. Some operators are ahead [on spacing optimization]; some operators think they are ahead.”

A more elusive challenge is where to land the laterals within the pay zone.

“Across plays, and especially in the Wolfcamp and Eagle Ford, researchers and industry are trying to understand where and how many laterals to drill,” Miskimins said.

An important part of making those determinations is downhole metrics, notably the diagnostic fracture injection test, which is done at the toe of the bore.

“It helps to determine the stress profile of the entire well,” she said. “That is an important pretreatment diagnostic for permeability—where are the easy molecules to access?”

Another useful diagnostic, Miskimins mentioned, is sealed wellbore pressure monitoring that Devon patented a few years ago. The technique can help determine spacing and clustering.

“It is just a wellbore in the center of the wine rack,” Miskimins explained, “just a piece of pipe being used as a pressure gauge. As the other wells around are fractured, the changes in pressure are recorded and help determine pumping action and how far the fractures are propagating.”

The concept is relatively simple; the patented parts are the processing and analyzing of the data.

More broadly, Miskimins said fiber-optic sensors and data analytics are being used more widely.

“There is just so much data coming out of the well,” she added. “Visualization of what is going on downhole and across the play is growing fast. There is much more sophistication in the stimulation world.”

One of Miskimins’s areas of concentration is proppant transportation using both data from fieldwork and computational fluid dynamics.

“If you are pumping 40/70 sand, we have found that in the bore and in the frac, the sand will segregate itself. Just as you see in a riverbed with high flow rates, there will be differentiated settlement of dust, gravel and boulders. Even if the sand is well sieved, the particles of different size and shape will separate top to bottom.”

In terms of proppant, transportation is very much affected by viscosity. In many formations the preferred weight is a step higher than slickwater, but not quite a gel, Miskimins said.

“Ceramic beads are always better in terms of their durability, but what people are pumping depends as much on economics as on characteristics,” she said.

The same applies to sand. Local sand is usually cheap, and pits have been opened in or near most major basins. Still, “Ottawa [Wisconsin] sand is some of the best,” according to Miskimins.

Miskimins is also studying how the perforations in the pipe are eroded, which can affect well performance.

At present downhole sensing can differentiate gas from liquid, but the Holy Grail remains discerning oil from water.

“At present, there is not enough difference in density for sensors to detect,” Miskimins said.

Drilling and completing successes

Beyond the laboratory bench, CSM collaborates extensively with the industry but also has its own field research facilities. Notably, a former silver mine.

“We have drilled holes through the mine and lined them with instruments and fiber optics,” Miskimins said. “We can measure stress and temperature, among other readings. For temperature we can measure the gradient of 0.1 F every 20 feet for the wellbore length. We can measure strain in the rock.”

For all the advances in frac operations, Miskimins said frac performance has remained steady.

“We can detect stresses out thousands of feet from the bore, but in terms of actual drainage from the rock we are still lucky to get 50 feet of effective wellbore,” she said. “We also know that the fractures grow farther than we drain from.”

So even after decades of successful unconventional development, there is still plenty of progress to be made in simply cracking the rock and getting the hydrocarbons out of the cracks.

“Overall, industry has gotten very good at drilling and completing wells,” she said. “Times that used to be measured in weeks are now measured in days. What we are still trying to improve is efficiency. We can drill fast and frac fast. We are trying to be sure that the fracs are actually doing what we want them to do.”

North America is where unconventional development was invented, and the region remains on the leading edge.

Proppants and produced water

“The two basins in Canada where the industry is pushing the edge of frac design are the Duvernay and the Montney,” said Dustin Domres, leader of fracture optimization for the Canadian division of Calfrac. “Typical pressures are 60 to 70 megapascals, with 80 MPa as an upper limit. Proppant loads have been tested up to 6.5 metric tonnes per meter. Fluid volumes vary greatly from region to region. In Canada and in the U.S., most jobs have been pumping slickwater, with a huge uptake of HVFRs.”

Robert Sharpless, manager of divisional engineers for the U.S. division of Calfrac added that in the U.S., across the major basins, pressures run from 8,000 psi to 12,000 psi, with proppant loads of 1,000 to 2,000 lbs/ft of completed interval.

—Dustin Domres, Calfrac

One important factor in frac design, Sharpless added, is the degree to which an operator decides to use produced water.

“The chemistry can be a challenge. In the Permian and the Marcellus, many operators use produced water, but the ratio varies greatly, from 100% to zero,” he said. “That can mean total dissolved solids of anything up to 250,000 ppm.”

He noted that the relatively high use of produced water in the northeastern U.S. means that cationic friction reducers are commonly used. Operators provide expected water characteristics at the time of a bid, but before the job is pumped, samples of actual field water are taken to qualify the planned chemistry. By applying tailored chemistry, the choice of an optimal friction reducer can provide the opportunity for increased placement efficiencies, job design modifications and improved operational execution resulting in a reduced environmental footprint.

As much as possible, Calfrac uses dry friction reducers with emulsions or slurried friction reducers. Most of their completion programs in Canada and a few in Argentina have moved in that direction. By transporting bulk dry friction reducers, they have reduced their round trips by almost 60%. The company expects dry friction reducers to possibly become more common for them in the U.S. soon.

Moving into the jet age

Not all of the reconsiderations in fracturing technology are completely new. Over the decades, drillers have experimented with topside power, including turbines and electric motors. There has been a consolidation around conventional diesels with some gains recently in electric power, but that too is being reevaluated. It is all part of a longer-term view to efficiency and effectiveness over the life of the well, including refracs, not just big IP rates.

“We have had over 15,000 unconventional wells drilled in the state,” said Vamegh Raouli, department chair and Continental Resources Distinguished Professor of petroleum engineering at the University of North Dakota (UND). “The technology is very much advanced. In the longer laterals 30 stages is common, and in some cases we have seen as many as 60 stages.”

As producers and drillers have pushed downspacing, communication or interference between wells, what Raouli calls “frac hits,” is a growing problem.

“The goal is not necessarily to increase stages but to maximize efficiency and minimize effort and expense,” he explained. “There is also a challenge to determine whether to refrac or not, and if so, when and where. That is a focus of our effort. We have a few Ph.D. students working on refrac research, especially on the potential benefits of refracturing. There are lots of theories on that, but we want to know what is actually going on.”

In particular, the research is digging into the direction of the refrac.

“Ideally, you want to go different from the original frac,” Raouli said. “The questions are whether the rock is capable of being fracked that way, and if so, how to do it.”

The research is being supported by state funding.

“In North Dakota, we have the unique property of having shale oil with its challenges as compared to shale gas to study,” he said. “The North Dakota Industrial Commission supports our program, which has close to 80 Ph.D. students. That may be the largest in the country, at least in the top three. The Energy and Environmental Research Center at UND is another great benefit to our students and our program.”

E-frac fleets and turbine-driven pumps

To achieve optimal fracturing treatments, one of the main inputs is horsepower at the wellhead, which is where BJ Energy Solutions is leading a renaissance in natural gas fired turbines. While turbine engines have inherent operational benefits, the company made a virtue of necessity when it replaced its fleet.

“We have a rich legacy dating to 1872,” said Warren Zemlak, BJ’s president and CEO. “When we reemerged as an independent company in 2017, we faced a large, aging diesel-powered fleet. There was a lot of talk at the time about electric frac fleets. We did a lot of work studying cost, operational simplicity, emissions, energy balance, fluid handling, reliability and settled on direct-drive turbines.”

The emphasis, Zemlak said, is on the mobility and modular design, maximizing efficiency, and minimizing cost and environmental impact. There is also an acknowledgement that in some formations a subtler approach to fracturing may be more productive than simply hammering horsepower into the well.

—Warren Zemlak, BJ Energy Solutions

“With diesel-powered fleets, you are often limited to the relationship between an engine and transmission,” Zemlak said. “Electric- and turbine-driven pumps have a linear relationship, so you can optimize the power efficiency between the available power and number of pumps resulting in a smaller footprint. We have also incorporated proprietary digital controls.”

Beyond the turbine engine itself, “all the remaining mechanical components are similar to traditional equipment,” he said. “You don’t have to retool the pumps or retrain the workforce. Turbine reliability allows the team in the field to focus on job execution.”

Noting that the concept of direct-drive turbines is not new and acknowledging that the history of the system is checkered, Zemlak stressed that the new generation of turbine power has more than 10,000 hours of operation in the Haynesville, “one of the harshest environments.”

He added, “These are proven engines with very long lives. They will outlast the pumps.

Realistic physics

More advanced power at the wellhead is being matched with more powerful analysis of what is happening in the bore.

“Our focus has been on drilling and completions data as well as pressure monitoring and fuel usage,” said Jessica Iriarte, manager of the data science team with Well Data Labs. “But there is so much data available, we have been expanding into tying those to emissions tracking as well. We also have a partnership with Devon Energy for analyzing well interactions by monitoring sealed wellbores.”

Having structured industry data from different sources allows Well Data Labs to compare many aspects of well performance against industry trends or against design parameters. Not surprisingly, a great deal of analysis and modeling is directed to maximizing production while preventing communication between wells. That ranges from cluster efficiency to fracture treatment design including fuel efficiencies.

“One of our models can predict communication between wells in real time,” Iriarte said. “We can notify a client when there is a frac in one well that causes a pressure response in another. We are working on understanding what causes those. It’s not so much about getting as much fluid and proppant as possible into the well but doing it in a cost-effective, environmentally friendly and safe way.” Big Data can also yield insights above ground.

—Jessica Iriarte, Well Data Labs

“We can analyze rig states, activity and events and focus on efficiencies,” Iriarte said. “Then we can compare crew to crew, rig to rig, and generate real-time diagnostics alerts. That way the operator can make changes to improve and sustain their operational efficiency.”

Modeling and simulation analysis

Ahmad Ghassemi, professor of rock mechanics and McCasland Chair in the Mewbourne School of Petroleum and Geological Engineering at the University of Oklahoma, leads a program on experimental work as well as modeling and simulation analysis.

“The emphasis is on effective stimulation mechanisms,” he said. “More connected cracks in the formation means more surface area exposed to the wellbore. We want to know how they form, when and where. That will allow for design optimization and pumping protocols.”

The recent attention to interference among proximate wells is one particular area of emphasis and a reminder of the adage that the model is only as good as the premise.

“Most people believe in a single frac, and most models take that route,” Ghassemi explained. “But core and communication among wells indicates more complex modeling is necessary. A lot of models take a lot of short cuts. They are heavily tied to the original conceptual thrust. The physics need to be realistic.”

Another area of emphasis is micro-seismicity in stimulation, in contrast to induced seismicity from reinjection of produced water. Ghassemi’s program is examining how microseismicity relates to increasing the permeability of formations.

The output of all the research is a better understanding of well spacing, infill drilling, and the timing and approach to refracs.

“Modeling is very useful, especially for timing of refracs, not just on spacing,” he said.

And giving a nod to a less carbon-intensive future, Ghassemi’s program extends its expertise into geothermal development.

“That is getting a lot of traction lately,” he said. “It’s really many of the same issues as oil and gas drilling, just deeper and at much higher temperatures.”

Recommended Reading

Exclusive: Dan Romito Urges Methane Mitigation Game Plan

2024-04-08 - Dan Romito, the consulting partner at Pickering Energy Partners, says evading mitigation responsibility is "naive" as methane detection technology and regulation are focusing on oil and gas companies, in this Hart Energy Exclusive interview.

Wanted: National Gas Strategy for Utilities, LNG

2024-02-07 - Chesapeake CEO Nick Dell’Osso and Mercator Energy President John Harpole, speaking at NAPE, said some government decision-makers have yet to catch on to changes spreading across the natural gas market.

Venture Global Seeks FERC Actions on LNG Projects with Sense of Urgency

2024-02-21 - Venture Global files requests with the Federal Energy Regulatory Commission for Calcasieu Pass 1 and 2 before a potential vacancy on the commission brings approvals to a standstill.

GOP’s Reaction to White House LNG Pause Takes Shape

2024-01-31 - The U.S. House Energy, Climate and Grid Security subcommittee set the date for a hearing on the Biden administration’s recent pause on LNG export approvals for Feb. 6; Republican Louisiana Sen. John Kennedy pledges to block Biden nominees.

The Jones Act: An Old Law on a Voyage to Nowhere

2024-04-12 - Keeping up with the Jones Act is a burden for the energy industry, but efforts to repeal the 104-year-old law may be dead in the water.