In the week since our last edition of What’s Affecting Oil Prices, Brent prices averaged $65.16/bbl last week, up $0.21/bbl from the week before.

Following the standard pattern of late, prices were weak at the start of the week before gaining strength through Friday. This week prices will again be fairly range-bound, averaging $65.50/bbl with the Brent-WTI differential about $4/bbl.

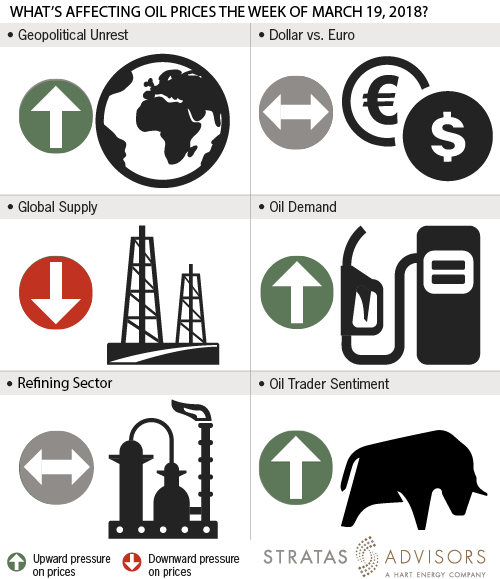

Geopolitical: Positive

Saudi Arabia’s Crown Prince Mohammed bin Salman will be in the U.S. this week with stops in New York, Boston, San Francisco, Seattle and Houston. His meeting at the White House and any high-profile statements could induce price volatility, but are unlikely to have a lasting effect.

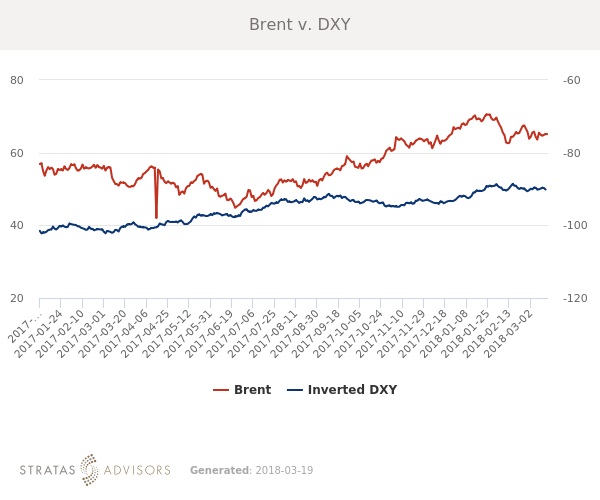

Dollar: Neutral

Fundamental and sentiment-related drivers continue to have more impact on crude oil prices. The dollar and crude oil both rose slightly last week. Crude oil will likely remain only marginally influenced by DXY in the week ahead.

Trader Sentiment: Positive

Nymex WTI managed money net positioning fell slightly last week as ICE Brent was slightly up. Overall market sentiment remains supportive but positioning has been moderating on a lack of new bullish indicators.

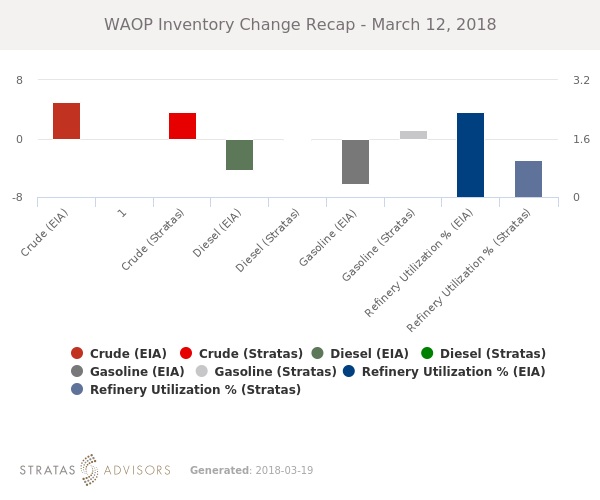

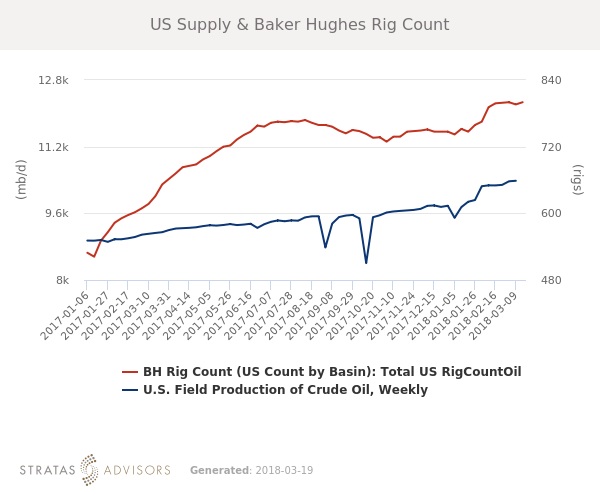

Supply: Negative

According to Baker Hughes, the number of U.S. oil rigs rose by four last week. U.S. oil rigs now stand at 800, compared to 631 a year ago. Evidence of renewed global oversupply continues to pose the greatest threat to prices.

Demand: Positive

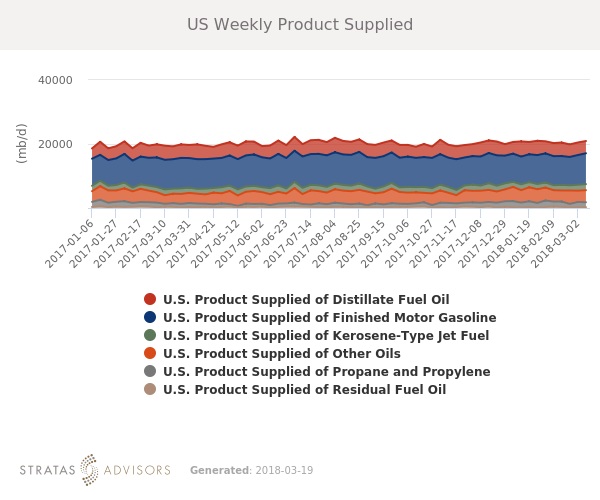

U.S. consumption of petroleum products remains generally at or above seasonal averages in all products except fuel oil.

Refining: Neutral

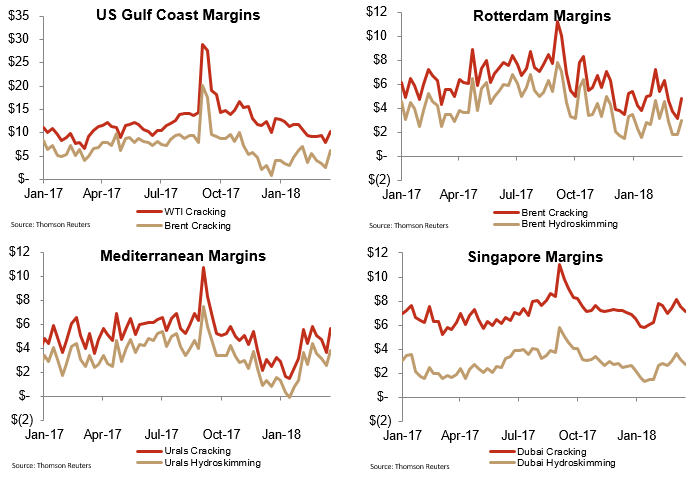

Global refining margins ticked up last week. Declines in margins appear to be slowing, and we could even see some strengthening in margins in the weeks ahead as Asian refinery maintenance is underway. However, in the meantime, margins are not robust enough to incentivize additional runs of a level likely to support crude.

How We Did