In the week since our last edition of What’s Affecting Oil Prices, Brent prices fell $0.55/bb and WTI fell $1.61/bbl. Barring a geopolitical surprise, we expect that Brent will average around $75/bbl this week, with highs seen early in the week before leveling off after the Singapore summit.

All eyes are on Singapore this week where U.S. President Donald Trump and North Korean leader Kim Jong-Un are meeting. Given the unpredictability of both leaders almost every possible outcome is possible. Many observers expect that the meeting will end in détente with neither side agreeing to the other’s terms. If the meeting ends without an agreement but without an escalation in hostilities that will likely be interpreted as a positive outcome.

Prices will be choppy heading into the meeting on rising geopolitical risks but then should fall off fairly quickly, assuming the meeting concludes with no escalation in tensions. Also on the radar, Venezuela has threatened to call a force majeure on exports if customers will not accept ship-to-ship transfers to load cargos and European buyers of Iranian crude oil are reportedly already having trouble shipping cargos due to concerns about upcoming U.S. sanctions. While these supply constraints should be positive for prices, concerns that OPEC will end its deal early will still weigh on prices.

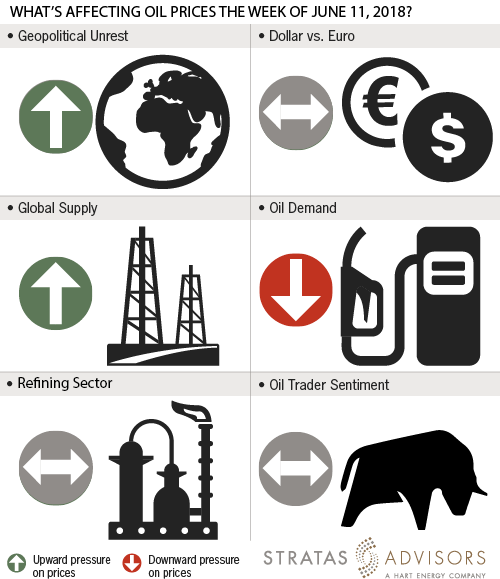

Geopolitical: Positive

Geopolitics will be a positive factor in the week ahead as markets watch and interpret the outcome of U.S. President Donald Trump and North Korean leader Kim Jong Un’s meeting in Singapore.

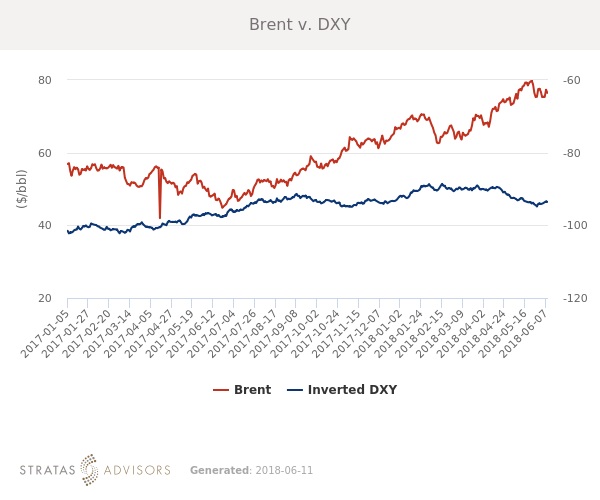

Dollar: Neutral

The dollar will be a neutral factor in the week ahead as fundamental and sentiment-related drivers continue to have more impact on crude oil prices.

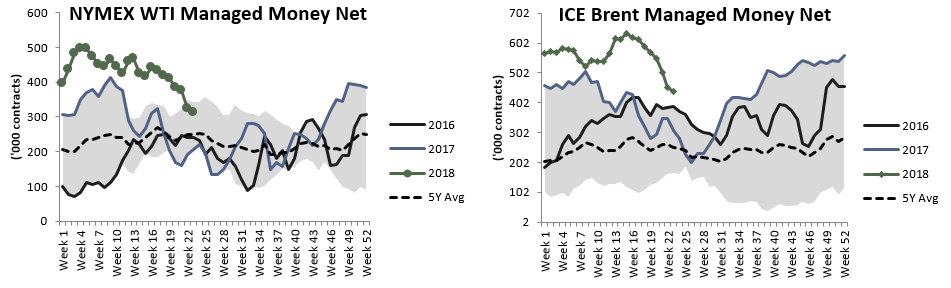

Trader Sentiment: Neutral

Trader sentiment will be a neutral factor in the week ahead, possibly even weighing on prices as the recent bull run comes to a close.

Supply: Positive

Supply will likely be a marginally positive factor in the week ahead with Venezuelan and Iranian volumes both constrained. However, any hopes of supply constraints will be moderated by concerns that OPEC’s supply deal will soon dissolve.

Demand: Negative

Demand will be a negative factor in the week ahead as rising prices cause greater concern from local governments about demand destruction.

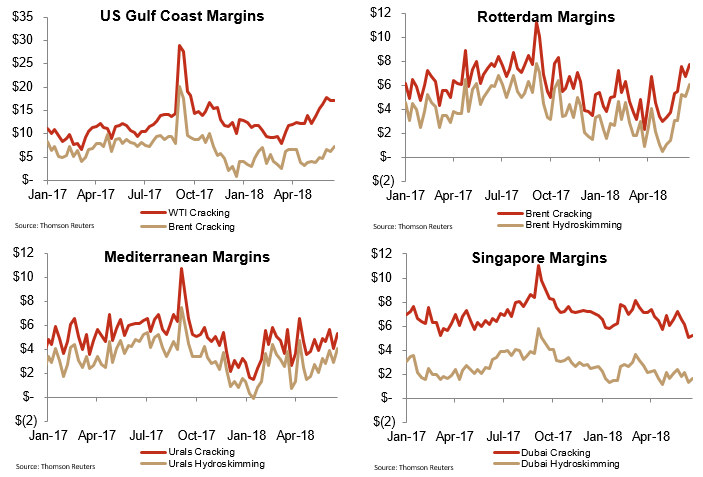

Refining: Neutral

Refining will be a neutral factor in the week ahead although margins have improved slightly in some enclaves as crude prices have fallen.

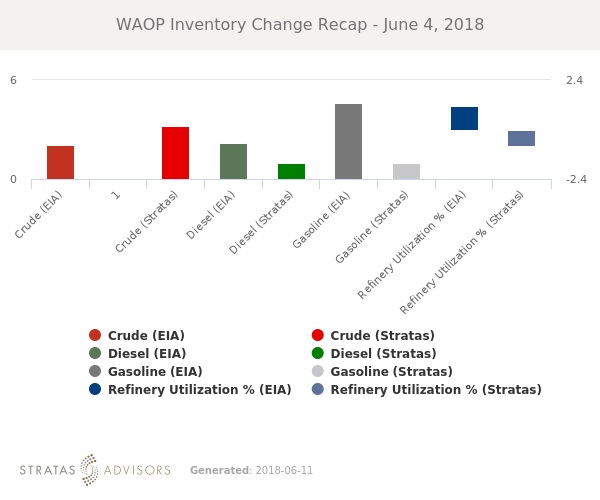

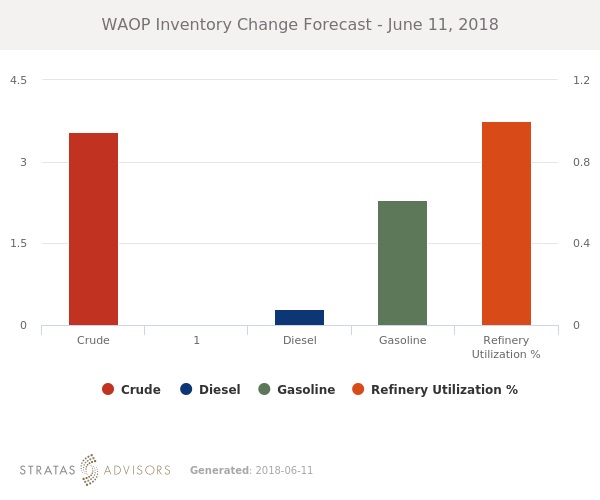

How We Did